🔗 News wrap-up - Christmas Eve edition 🎅

In your inbox every Saturday morning, best enjoyed with coffee and brunch ☕. This week we are covering Covid in China, how 2022 was a great year for stablecoins, and developments in crypto regulation

Market update 📉

🌏 Global markets are a little spooked by China’s soaring Covid infections which is keeping people home and causing a slump in travel and economic activity, according to the latest financial data. Following the recent abrupt end to Covid Zero controls, more cities have been hit by an exit wave of infections in the past week, leading to crowded hospitals and queues at funeral parlours. With so many supply chains starting or passing through China, it’s another global blow to economic recovery.

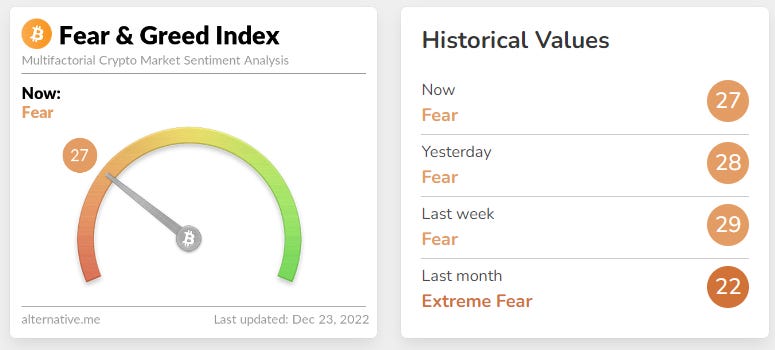

₿ Bitcoin volatility is back baby, and price of BTC has touched both December highs and December lows in the past seven days in a week heavily influenced by macro events. Crypto sentiment still in the Fear zone:

Interesting news from the week 🗞️

💱 Stablecoin Volume Hits Record High of $7.4T in 2022 beating out every major credit card provider except for Visa. Stablecoins are a particular crypto asset that is “pegged” to one USD (for example) enabling the benefits of blockchain with the stability of the fiat currency. They are a foundation of Decentralised Finance (full article coming soon)

Transactions: Stablecoins executed $7.4T worth of transactions in 2022, up from $6T in 2021. The stablecoin sector beat out top credit card companies in 2022 including Mastercard with $2.2T in volume, American Express with $1T volume, and Discover with $200B. Only Visa drove more volume, settling $12T.

Trade Volume - Stablecoins comprise about 18% of the total crypto market cap. Stablecoin volume is up more than 600% in two years, with the asset class driving just $1T worth of transactions in 2020.

💳 Visa Is Exploring Options To Allow Auto Payments Via Ethereum Wallets. Visa’s Head of Central Bank Digital Currencies and Protocols, Catherine Gu, emphasized that the company is focused on growing their “core competencies in Web3 infrastructure layers and blockchain protocols driving crypto development”

Payments giant Visa has been a leader in the crypto space which has really paid off. The company facilitated over $2.5 billion in payments with its crypto-linked cards. All of this only during Visa’s fiscal first quarter 2022 🤯.

⚖️ Elizabeth Warren’s new crypto bill continues to send shockwaves through the industry. Patrick Daugherty, a lawyer who directs the digital assets and Web3 practice at Foley & Lardner, and teaches at Cornell Law School - does a great job of summarising the pros and cons:

➕ Positives: It empowers federal financial regulatory agencies including the Treasury Department, the Securities and Exchange Commission, and the Commodity Futures Trading Commission to audit “money services businesses” for compliance. Given the failure of FTX, Daugherty described this as the “one correct step to make,” just as the Bernie Madoff scandal created a new unit within the SEC to audit investment advisers.

➖ Negatives: Daugherty said that the bill overreaches in its definition of what constitutes a “money service business” and could include miners, validators, and even wallet providers. These entities would have to identify customers and track their transactions. The bill contradicts many of the core tenets of cryptocurrency by reducing the privacy elements of the ecosystem and treating its “decentralized” participants, such as miners and node operators, as centralized figures responsible for a network’s actions.

Thanks everyone, especially my paid subscribers that support this newsletter. Have a wonderful Christmas with loved ones 🎄