Wednesday W.O.W - Bitcoin ETFs 📉₿📈

[5 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Learn how Bitcoin ETFs help bridge the gap between traditional finance and the digital asset ecosystem.

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important to users as well as businesses & brands.

This is week 31 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

🇼 What are Bitcoin ETFs?

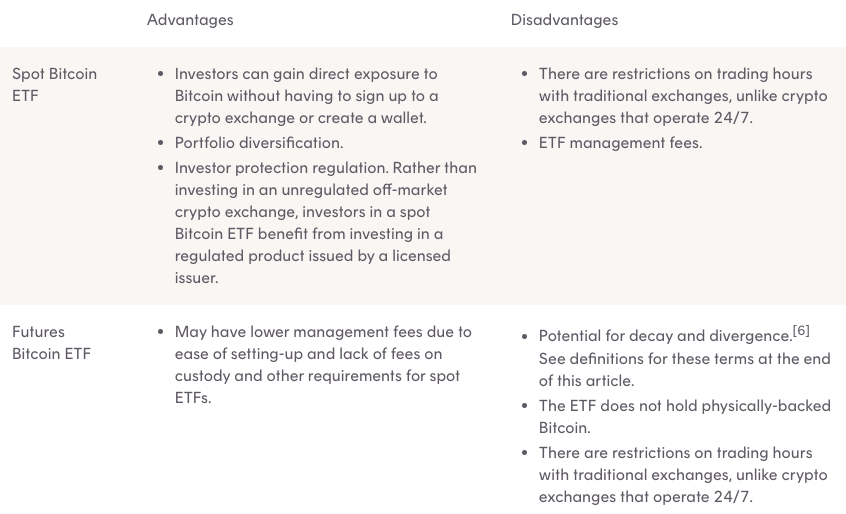

An Exchange-Traded Fund (ETF) is a type of investment fund that trades on stock exchanges. It offers diversified exposure to a basket of assets such as stocks, bonds, or commodities, providing investors with an easy way to gain broad market exposure. Bitcoin ETFs track the price of Bitcoin, providing investors with exposure to the cryptocurrency market. The most common categories are spot ETFs and futures ETFs:

Spot ETFs: These directly track the spot price of Bitcoin, which is the current market price at which the underlying asset can be bought or sold. While there are currently no Bitcoin spot ETFs available, recent developments indicate a growing interest in creating these types of funds. In May 2022, Australia’s first Bitcoin spot ETFs were launched. Neither the US nor NZ has a spot Bitcoin ETF (yet).

Futures ETFs: These do not track the spot price of Bitcoin directly. Instead, they monitor the price of Bitcoin futures contracts. These contracts represent an agreement to buy or sell Bitcoin at a predetermined price and date in the future. Bitcoin futures ETFs offer investors an indirect way to gain exposure to Bitcoin's price movements through these contracts. The US has these, and even a leveraged version.

🇴 What objectives do Bitcoin ETFs strive to achieve?

Bitcoin ETFs serve several objectives:

Portfolio Diversification

By investing in Bitcoin ETFs, investors can diversify their portfolios beyond conventional securities using a familiar and trusted investment vehicle. This allows investors to gain exposure without having to purchase individual cryptocurrencies.

Simplified Investment Process

ETFs saves investors from headaches like setting up a digital wallet and custody, fear of losing wallet keys, etc. ETFs have a flat fee that replaces replaces custody charges and network fees associated with owning and transacting cryptocurrencies directly.

Enhanced Security and Regulatory Oversight

Bitcoin ETFs are issued by regulated companies and traded on well-known exchanges, providing investors with a sense of security. These ETFs are subject to verification and monitoring and offer more safeguards that enhance the safety of investors' funds.

🇼 Why do Bitcoin ETFs play a role in the future of finance?

Mainstream Adoption and Market Legitimacy

The introduction of Bitcoin ETFs, particularly spot ETFs, would bring significant legitimacy to the Bitcoin market. With BlackRock, the world's largest asset manager, filing for a spot Bitcoin ETF in the US, it signifies growing recognition and acceptance of cryptocurrencies as a viable investment option. The availability of regulated and accessible investment products can attract institutional and retail investors, contributing to the mainstream adoption of cryptocurrencies.

Improved Market Efficiency and Price Discovery Bitcoin

ETFs can enhance market efficiency and price discovery by providing a transparent and regulated framework for trading cryptocurrencies. These ETFs enable investors to buy and sell Bitcoin in a familiar exchange-traded format, contributing to fairer and more efficient price discovery. As Bitcoin ETFs are traded on traditional exchanges, they can leverage the existing infrastructure and liquidity of these markets. This increased liquidity can lead to tighter spreads and reduced price volatility, theoretically making it easier for investors to enter and exit positions at fair prices.

Institutional Adoption and Integration

The introduction of Bitcoin ETFs can pave the way for the institutional adoption of cryptocurrencies. Institutional investors often have specific requirements and regulations that limit their ability to directly invest in cryptocurrencies. However, by investing in Bitcoin ETFs, they can gain exposure to the asset class while adhering to their compliance requirements. This integration of cryptocurrencies into institutional portfolios can contribute to the overall growth and maturation of the digital asset market.

Regulatory Clarity and Investor Protection

The launch of Bitcoin ETFs necessitates regulatory scrutiny and oversight. Regulators need to establish clear guidelines and frameworks for these investment vehicles, which can lead to greater investor protection and market stability. As regulatory bodies gain a better understanding of cryptocurrencies through ETFs, they can develop comprehensive regulations that mitigate risks and foster investor confidence.

Accessibility

Bitcoin ETFs can serve as a bridge between traditional financial systems and the world of cryptocurrencies, offering a regulated and familiar investment avenue for a broader range of investors globally.

Will a Spot Bitcoin ETF approval mean a surge in the price of Bitcoin? Excellent read: Ecoinometrics - The BlackRock Bitcoin ETF: are we expecting too much from it?

In conclusion, Bitcoin ETFs play a vital role in bridging the gap between traditional finance and the digital asset ecosystem. Whether it's through spot ETFs or futures ETFs, these investment vehicles offer diversification, affordability, security, and regulatory oversight. Moreover, they have the potential to drive mainstream adoption, improve market efficiency, facilitate institutional integration, establish regulatory clarity, and promote global financial inclusion.

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.