Wednesday W.O.W - Bonds ⏳💵⌛💵

[4 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Learn how bonds work, what they bring to a portfolio, and why they are the second largest asset class.

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is.

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important.

This is week 50 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

Note: This week is a primer that will lay the foundation for a new type of investment product. You need to know the status quo before we can appreciate what is innovation.

“Know the rules well, so you can break them effectively.”

―Dalai Lama XIV

🇼 What are bonds?

Bonds are a long-standing form of fixed-income security, essentially a loan made by an investor to an entity, often a corporation or government. When an individual buys a bond, they are lending money to the issuer in exchange for periodic interest payments and the repayment of the bond's face value at maturity.

These financial instruments are typically issued for a specific period, known as the maturity date, which can range from a few months to several decades. Bonds have a face value (the amount that will be repaid at maturity) and an interest rate (known as the coupon rate), which determines the periodic interest payments.

Governments issue government bonds to fund various projects, while companies use corporate bonds to finance business operations or expansions. Bonds can be bought and sold on the open market, and their prices are influenced by interest rates, credit ratings, and economic conditions.

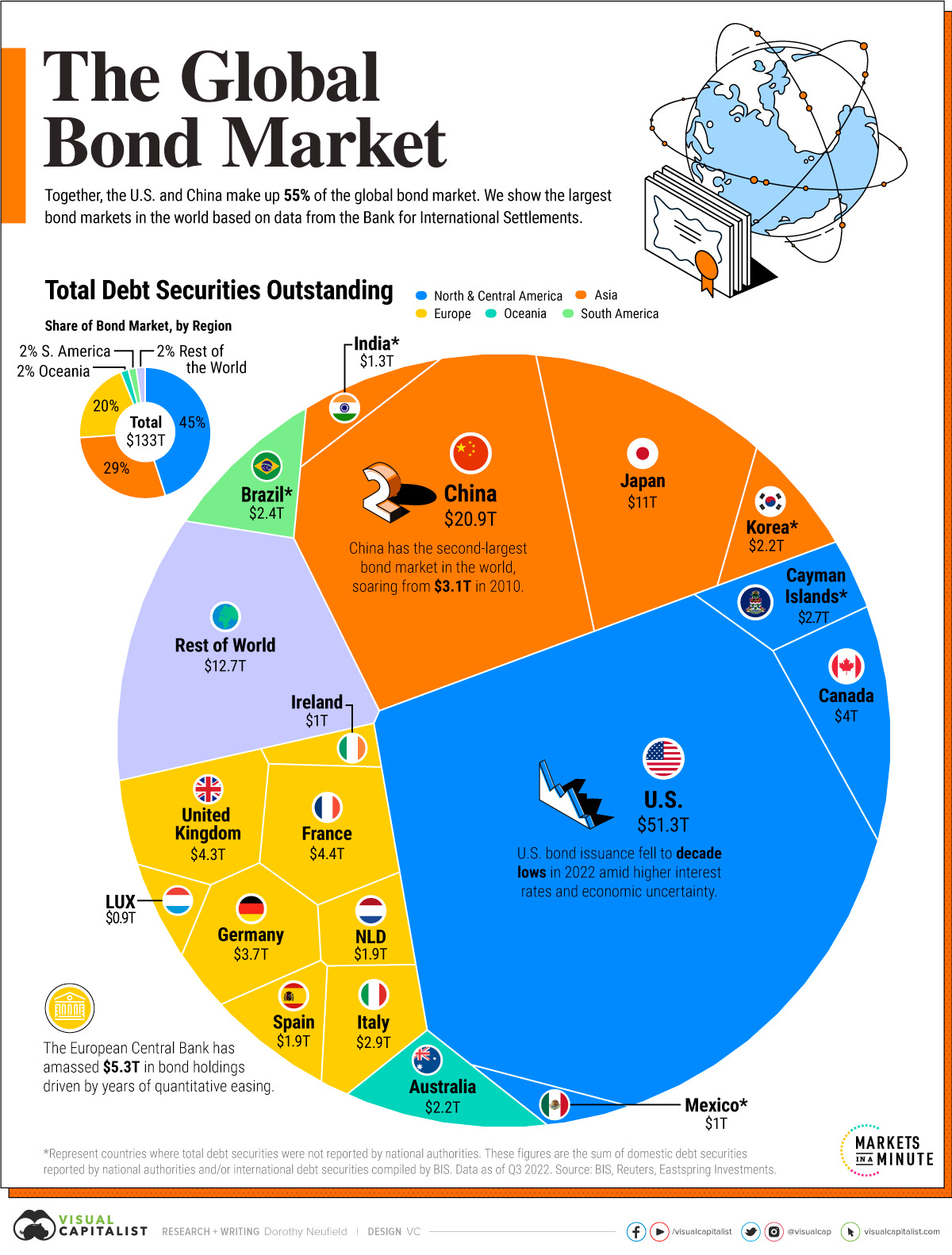

Investors are attracted to bonds for their comparatively lower risk compared to stocks and the consistent income they generate through interest payments. The only global asset class bigger than bonds is real estate!

🇴 What are the Objectives?

The three primary objectives of investing in bonds include income generation, capital preservation, and portfolio diversification.

Income generation: Consider a retiree looking for a stable stream of income. Investing in bonds that offer regular interest payments can be a reliable source of revenue.

Capital preservation: Bonds are generally considered less risky than stocks, making them a valuable component of a conservative investment strategy aimed at safeguarding the initial capital.

Portfolio diversification: This involves spreading investments across various asset classes to reduce risk. Bonds offer a counterbalance to stocks, as they often perform differently in various market conditions. During economic downturns, bonds might retain or increase in value when stocks decline, aiding in stabilizing an investment portfolio. For example, an investor allocates a portion of their portfolio to government bonds. If the stock market experiences a downturn, the value of these bonds may increase, offsetting the losses incurred in stocks.

🇼 Why do bonds play a major role in the future of capital markets?

Bonds are pivotal to the future of capital markets due to their stability and the role they play in financing both public and private sector activities. They serve as a critical source of capital for governments, aiding in funding infrastructure projects, social programs, and other essential initiatives.

Furthermore, as interest rates change and economic conditions fluctuate, bonds offer a means of adjusting investment portfolios to balance risk and returns. Their stability provides a cushion against the volatility often witnessed in stock markets.

With an aging population in many developed economies, the demand for stable income-generating assets, such as bonds, is likely to increase. This growing demand will continue to make bonds a significant component of investment strategies, influencing the stability and growth of the capital markets.

What needs to improve is access and liquidity for the retail investor, and “tokenising” these on blockchain infrastructure can achieve this. But that is another story for another Wednesday 😉

Bonus:

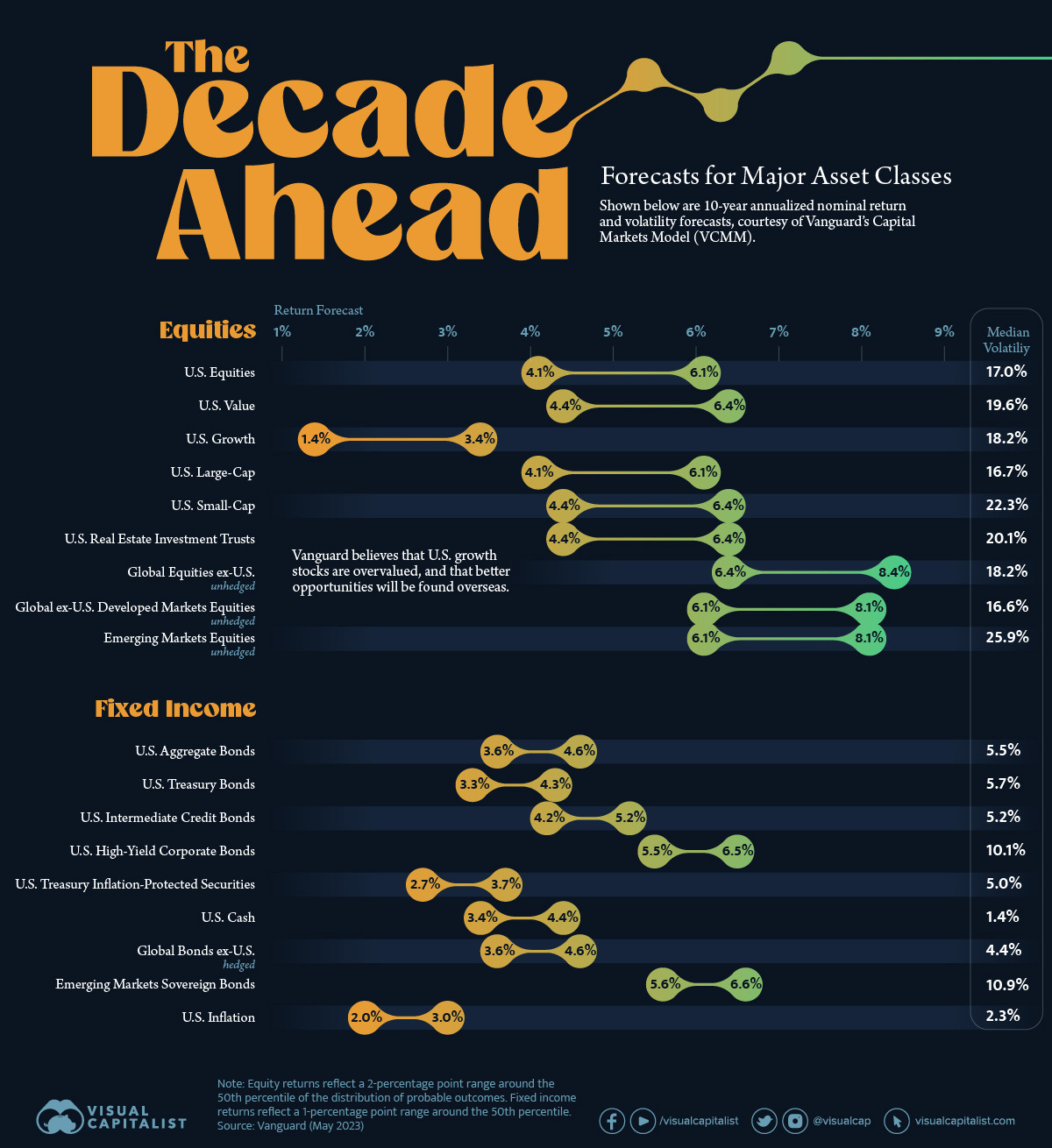

Below is a comparison of different asset classes and a forecast for the next 10 years. Any forecast is nothing really more than an educated guess but interesting to see forecasts for high-yield (high risk!) corporate bonds, and emerging markets sovereign (govt) bonds. Both are at higher risk of defualting so therefore the market demands a higher potential yield for this additional risk.

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.