Wednesday W.O.W - Central Bank Digital Currencies 🏦🪙

[5min read] Your mid-week bite sized treat on emerging tech and our journey to the Metaverse. Today, all you need to know about CBDCs and the role they play in the future of money.

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important to users as well as businesses & brands.

This is week 18 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

What is a CBDC?

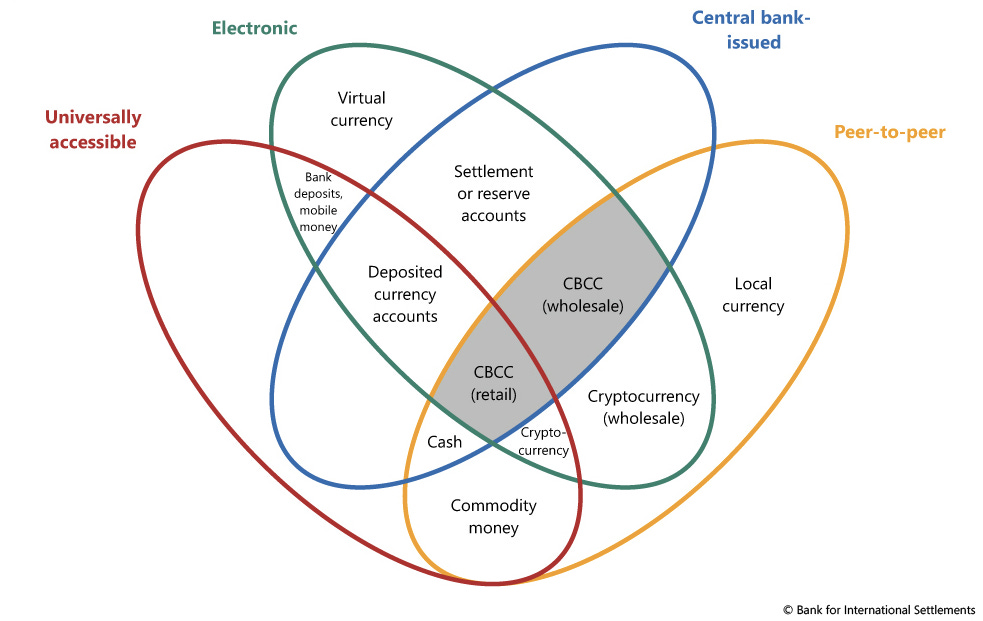

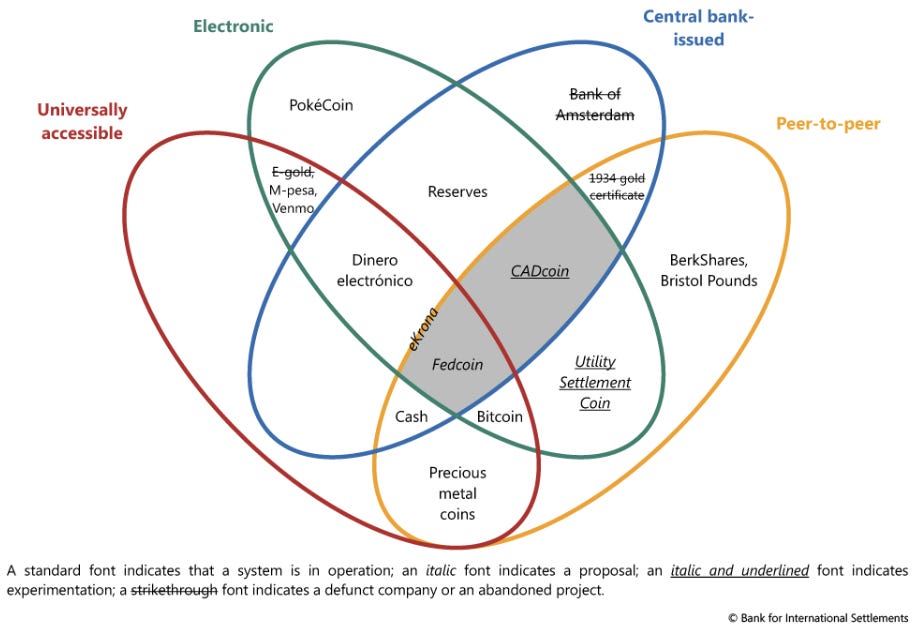

A central bank digital currency (CBDC) is a virtual currency backed and issued by a central bank. Unlike cryptocurrencies and stablecoins, which are issued by private entities, CBDCs are issued by central banks and are considered to be a form of digital fiat currency.

How does a CBDC work?

CBDCs are managed on a digital ledger, which can either be a blockchain or another type of digital ledger technology (DLT). This speeds up and secures payments between banks, institutions, and individuals.

How is a CBDC different from a cryptocurrency?

While cryptocurrencies are often decentralized and not issued by a government, CBDCs are centralized and backed by a central bank. Additionally, CBDCs are designed to be used as a medium of exchange, whereas cryptocurrencies are (often) seen as a store of value or provide some kind of other utility.

Objectives of a CBDC

Why are central banks exploring CBDCs?

Central banks around the world have realized that they must provide an alternative to physical money or risk missing out on the future of money. CBDCs are seen as a way to achieve the following objectives:

Provide a secure and efficient payment system

Increase financial inclusion

Enable cross-border payments and reduce reliance on the US dollar

Improve monetary policy implementation

Combat the use of cryptocurrencies for illicit activities

What are the core features of a CBDC?

A CBDC should have instrument, system, and institutional characteristics. Some of the key features of a CBDC include:

Accessibility: CBDCs should be accessible to everyone, including those without access to traditional banking services.

Programmability: Some CBDCs may be designed to be programmable, meaning they can be used to implement monetary and social policy.

Interoperability: CBDCs should be compatible with existing payment systems and be able to facilitate cross-border payments.

Why CBDCs will most likely impact the future of money?

CBDCs have the potential to revolutionize the way we think about money and finance. Some of the reasons why CBDCs could be important in our future include:

Improved financial inclusion: CBDCs could provide a secure and efficient way for those without access to traditional banking services to participate in the economy. Many other crypto assets could also do this, arguably better.

Increased competition: The introduction of CBDCs could increase competition in the payments industry and lead to lower fees and faster payment processing times. Again, other crypto assets could also do this.

Reduced reliance on the US dollar: The use of CBDCs for cross-border payments could reduce reliance on the US dollar as the world's primary reserve currency. This is strong motivation for a US CBDC.

Enhanced monetary policy implementation: CBDCs could enable central banks to implement monetary policy more effectively by providing greater control over the money supply, this seems to be the primary motivator.

Reduced use of cryptocurrencies for illicit activities: CBDCs could help combat the use of cryptocurrencies for illicit activities by providing a more traceable and transparent form of digital currency.

What are some examples of CBDC initiatives?

Several central banks around the world are exploring the use of CBDCs. Some examples include:

China's digital renminbi: China is experimenting with a digital renminbi that allows users to make payments using their mobile phones.

Europe's digital euro: As part of its five-year plan, Europe has announced the creation of a digital euro.

The US Federal Reserve: The Federal Reserve is speeding up its research and public engagement on CBDCs in light of technology platforms integrating digital private money into the US payments system and foreign authorities studying the possibilities for CBDCs

Bonus section: Pros & Cons

Pros:

CBDCs simplify monetary policy and government functions by automating processes between banks and customers, reducing work and processes required for distribution of benefits and calculation and collection of taxes.

CBDCs eliminate third-party risks in transactions since the central bank is responsible for any remaining risk in the system.

Privacy characteristics can be calibrated in a CBDC system, providing anonymity for value-based retail CBDCs and privacy protections for account-based access to CBDCs.

CBDCs can deter illegal activities since they are stored digitally and can be traced easily by the central bank throughout its jurisdiction, prohibiting criminal activities and illegal CBDC transactions.

CBDCs can provide financial inclusion for unbanked populations in developing nations by creating a direct link between customers and central banks, obviating the need for costly infrastructure.

Cons:

CBDCs delegate authority to conduct transactions to a central authority, which still influences data and transaction levers between citizens and banks, leading to centralization concerns. History has shown that this power corrupts.

CBDCs require users to give up some privacy as every transaction would be visible to the service provider, potentially leading to privacy concerns similar to those experienced by IT giants and ISPs. The potential for abuse of privacy, or even to actively control your spending or freeze people money arbitrarily is my biggest concern.

CBDCs face legal and regulatory barriers to cross-border payments due to different legal and regulatory frameworks. If there is alignment as to the political gains, these will be resolved.

CBDCs may have unintended effects on foreign exchange markets as in the case of China's CBDC threatening the dollar's dominance. This is more motivation for the US to create their own CBDC to hold onto the global reserve currency status

If you are interested in one of the (many) consulting services I offer, reach out to me at https://johnsonandhunt.com/reach-out