Wednesday W.O.W - Ethereum Liquid Staking

[5 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Learn why Liquid Staking, LSD tokens, and restaking represent a fascinating evolution of DeFi

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is.

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important.

This is week 49 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

🇼 What is Ethereum Liquid Staking?

At its core, liquid staking is a method of transforming traditionally illiquid staked assets into highly liquid ones. It provides the ability to utilise these assets while still enjoying the benefits of staking. Previously, staking on platforms like Ethereum involved locking a substantial amount of tokens to secure the network and earn rewards. However, this locked capital was essentially out of reach for the investor. Liquid staking enters the scene as a remedy to this liquidity challenge. It enables users to access the value of their staked tokens through the issuance of derivative tokens, which can be traded or used as collateral.

LSD tokens, such as Lido's stETH and RocketPool's RETH, offer a novel approach to staking. By delegating your Ether to a service, you receive an equivalent LSD token that mirrors the value of your staked Ether, which can be redeemed on a 1:1 basis at any time. The allure of LSD tokens is the liquidity they provide for staked Ether, opening up additional yield opportunities for DeFi users. Think of it like depositing money in a savings account and simultaneously receiving equivalent funds to use as you see fit. It's an enticing proposition, no doubt.

🇴 What are the Objectives?

Enhanced Liquidity: The primary objective of liquid staking is to unlock the potential of your staked assets. Enhanced liquidy can be overstated, however. While Ethereum records daily trading volumes in the billions for its native ETH, the largest liquid staking derivative, stETH, struggles to surpass $20 million per day. Consequently, investors must cautiously assess derivative liquidity. In times of heightened demand or market stress, inadequate liquidity could hinder the ability to exit positions or promptly convert back to the original tokens.

Risk Mitigation: One of the benefits of liquid staking is risk mitigation. In traditional staking, delegating your tokens to a validator can expose you to potential losses if the validator experiences downtime. Liquid staking, however, spreads the risk by distributing your tokens across different nodes in a liquidity pool. This diversification minimises the impact of slashed tokens, making it a safer choice for risk-averse investors.

Faster Access to Staked Tokens: Liquid staking streamlines the process of accessing your staked tokens. In conventional staking, many blockchains impose mandatory waiting periods before you can unstake your assets. For instance, Polkadot users must endure a 28-day unbonding period. With liquid staking, you can bypass this waiting period by exchanging your derivative tokens for the original tokens on the open market.

Like most things in life, there are also (different) risks:

Depegging & Market Volatility: In liquid staking, one primary risk is the de-pegging of derivative tokens from their original counterparts. Unlike conventional staking, where your assets typically maintain stability, liquid staking derivatives can fluctuate. Their prices are dictated by market dynamics, rendering them susceptible to market forces. During bear markets or liquidity crises, derivative tokens might significantly devalue in comparison to the original tokens, resulting in substantial investor losses.

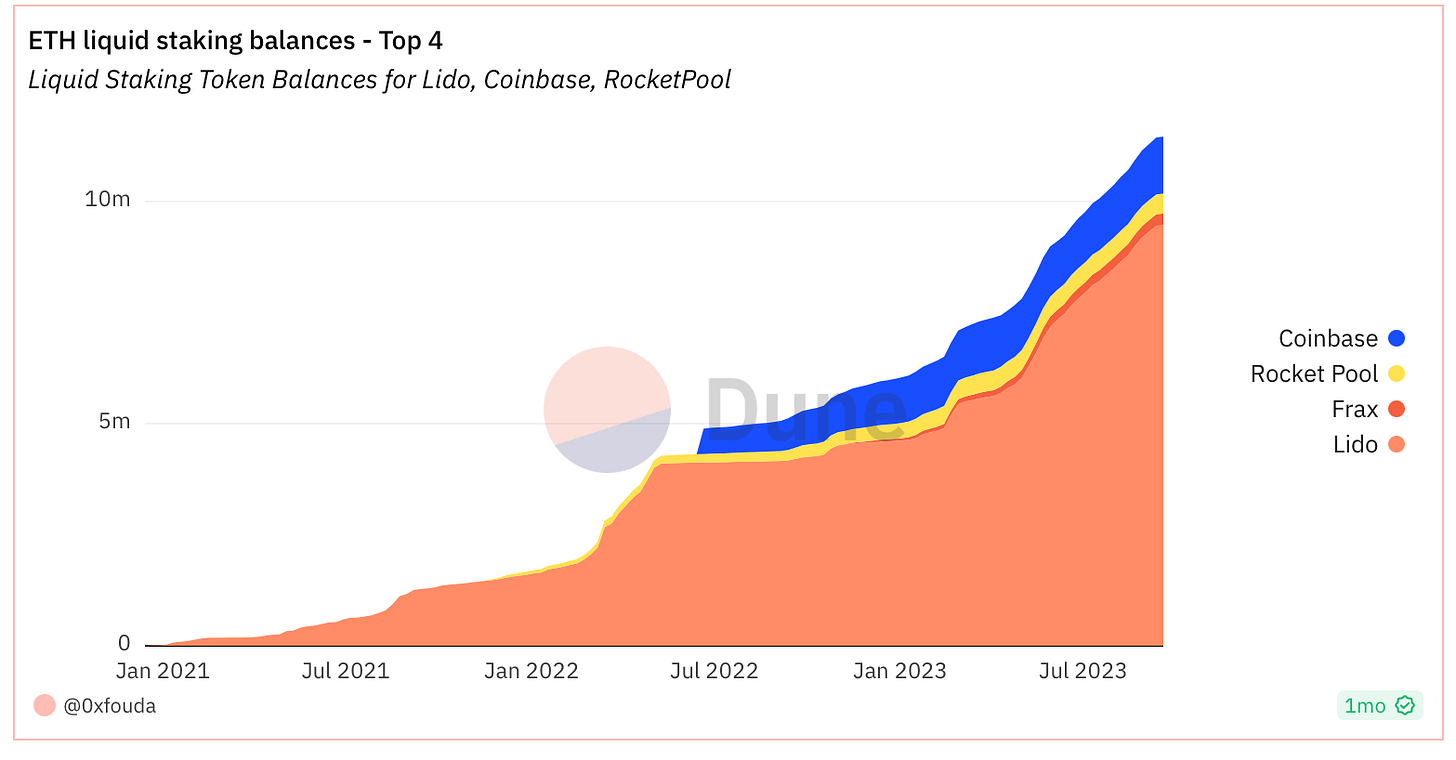

Centralisation Threat: Liquid staking introduces the huge risk of centralisation. Large liquidity pools holding substantial staked tokens can delegate these tokens to multiple stakers. As these pools expand in size and influence, they could amass significant governance authority over the blockchain, potentially leading to a takeover. This risk raises concerns about the long-term decentralisation of the blockchain.

Smart Contract Vulnerabilities: Liquid staking primarily relies on smart contracts, thereby exposing investors to vulnerabilities and security breaches. These smart contract-based operations might lead to failures or malicious activities. To mitigate this risk, opting for liquidity providers with robust market reputations or thorough smart contract audits, where possible, is crucial.

🇼 Why Could Ethereum Liquid Staking Shape the Future of DeFi?

Ethereum is the world’s largest decentralised software platform, and the cornerstone of decentralised finance. New innovative products on Ethereum are constantly pushing the frontier of possibilities, here is why Liquid Staking could have a lasting impact:

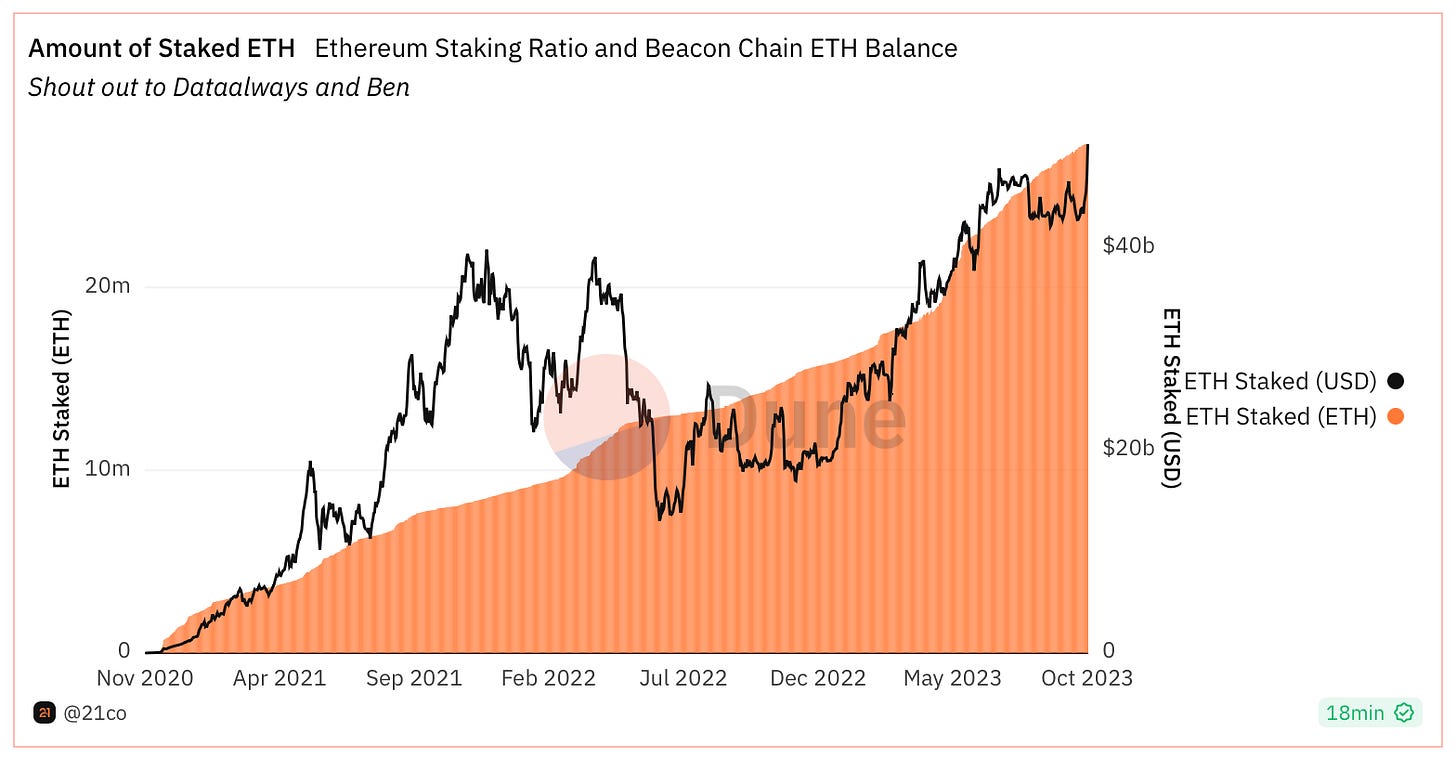

Economic Security for Ethereum: Liquid staking contributes to the economic security of Ethereum by increasing the total amount of staked ETH. With a larger portion of ETH staked, attackers must acquire more staked ETH (the derivative) to compromise the network. This increased security creates a robust foundation for the DeFi ecosystem.

Enhanced Yield: Liquid Staking presents a unique opportunity to earn a yield on your staked assets while having the flexibility to restake your tokens, potentially compounding your returns. It's safe to say this is becoming a pivotal growth area within the DeFi sector.

The Rise of Restaking: Eigenlayer, a trailblazer in Ethereum's DeFi infrastructure, is introducing a new concept known as restaking. Here, stakers use their already staked assets to secure services like rollups, bridges, and data availability networks. This innovation eliminates the need to bootstrap trust when launching new services. Eigenlayer enables stakers to allocate portions of their staked assets to emerging services, utilising Eigenlayer to secure their infrastructure. While Eigenlayer has yet to launch on the mainnet, it aims to support not only LSD tokens like RETH and stETH but also allow Ether stakers to deposit their staking rewards directly into smart contracts for allocation by the stakers themselves.

Bonus:

Deep dive into some interesting metrics on this Dune dashboard. A couple below to whet your appetite for graphs 📈

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.