Wednesday W.O.W - Ethereum Staking🔷🌐

[4 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Today, learn about Ethereum Staking its impact on the network, DeFi, and the future of finance.

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important to users as well as businesses & brands.

This is week 23 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

Wait, what is Ethereum again?

🔷 Ethereum is a decentralized blockchain platform that enables the creation and deployment of smart contracts and decentralized applications (dApps). It uses Ether (ETH) as its native cryptocurrency and facilitates the transfer of value and execution of code in a secure and transparent manner. The market cap for ETH is $350+ billion NZD at the time of writing, its second only to Bitcoin.

The Ethereum network is maintained by a community of developers and nodes distributed worldwide and operates on a proof-of-stake (PoS) algorithm. “Staking” is becoming increasingly popular as it offers an opportunity to earn passive rewards and help decentralize the network 🌐.

🇼 What is Ethereum Staking?

Ethereum staking is the process of locking up Ethereum (ETH) as collateral to validate transactions and maintain the security of the Ethereum network.

It involves holding a certain amount of ETH in a staking wallet, which is used to participate in the Proof-of-Stake (PoS) consensus mechanism using special software running on a computer.

In return for their service, validators earn rewards in the form of new ETH. Validators are chosen based on the amount of ETH they have staked, with larger stakes increasing their chances of being selected.

Ok back to the regular programming…

🇴 Objectives of Ethereum Staking?

To improve the scalability and sustainability of the Ethereum network by transitioning from the energy-intensive Proof-of-Work (PoW) consensus mechanism to the more efficient PoS consensus mechanism. This is better for the environment (and ESG narratives! 🌳)

To incentivize Ethereum holders to contribute to the network's security and maintenance by earning rewards in the form of rewards. Staking rewards are compensation for services to keep the Ethereum network secure, not “yield” or a “return” (an important distinction for regulation purposes)

To promote the decentralization of the Ethereum network by allowing anyone to participate in staking, rather than only those who have access to expensive mining equipment. More decentralisation means less potential for censorship or a central point of failure, important in the emerging Metaverse. 💪

🇼 Why is Ethereum Staking Important to the Future of Finance?

Ethereum is the Big Daddy of Defi & Web3

Staking helps maintain the security and integrity of the Ethereum network, which is essential for the development and growth of DeFi protocols and Web3 applications.

Ethereum itself is nicknamed the“Ultra Sound Money”. Bitcoin is known as digital gold, and Ethereum is digital oil. Some ETH in every transaction is “burned” forever, more is being burned than is being issued to stakers, meaning it is deflationary (Check out this cool website to visualise this).

Decentralised Finance is happening on Ethereum more than any other blockchain combined. It’s kind of a big deal.💰

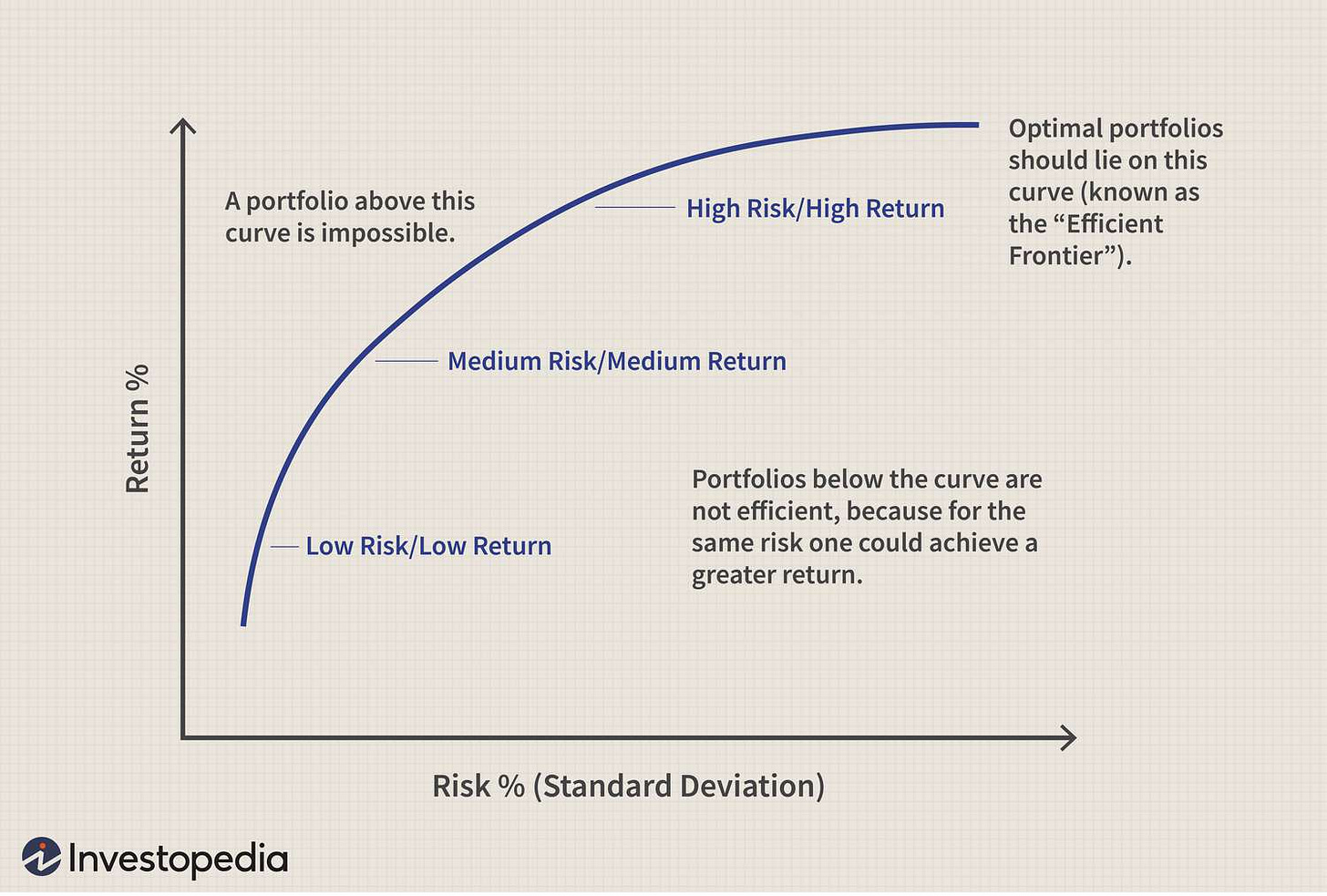

Ethereum could be the new “risk-free rate”.

As Ethereum's staking rate reflects the network's health and overall market confidence, it could serve as a key metric for the digital economy. A stable and predictable Eth staking rate could guide the cost of capital for digital assets and infrastructure.

Some believe that ETH staking reward rate could become similar to the “Risk-Free Rate” in traditional finance, used as a benchmark for evaluating the cost of borrowing and expected returns. It represents the minimum return an investor should expect without taking on any risk.

If ETH indeed becomes the anchor for a future “DeFi Yield Curve”, then the more risker the investment is than ETH, the higher the (potential) rewards to compensate investors for the additional risk. Otherwise, why wouldn’t you just stake ETH instead?

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.