Wednesday W.O.W - Tokenisation of Fine Art 🧩🖼️📈

[5 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Learn about a fusion of tradition & technology with the potential to reshape the future of art ownership

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is.

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important.

This is week 44 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

🇼 What is tokenised fine art?

Tokenised fine art is a relatively new financial concept that brings together the world of art, securities law, and blockchain technology. At its core, it involves the usual ownership rights and legal protections of securities (aka “shares”), but representing these as digital tokens on a blockchain. These “digital shares” legally represent fractional ownership of a Special Purpose Vehicle (SPV) company that owns the underlying artwork, allowing investors to own a piece of a valuable masterpiece without having to acquire the entire piece.

These tokens are stored securely on a blockchain, providing transparency, traceability, and security. Tokenisation introduces liquidity (more people buying and selling) to the traditionally illiquid art market, as well as making it more accessible to a wider range of investors. It also eliminates many of the barriers that have historically deterred potential art investors, such as the need for significant capital, expertise in art valuation, and concerns about storage and insurance.

🇴 What are its Objectives?

Tokenised fine art serves several objectives that make it an appealing investment option, particularly for those looking to diversify their portfolios. Let's explore these objectives with some illustrative examples.

1. Fractional Ownership: Tokenisation allows for the division of artwork ownership into smaller, more affordable fractions. Consider a renowned painting valued at $1 million. Through tokenisation, this artwork can be divided into 1,000 tokens, each representing a $1,000 share. This enables a broader spectrum of investors to participate in art ownership.

2. Transparency and Provenance: Blockchain technology, the backbone of tokenisation, ensures transparency and provenance tracking. Every transaction related to the artwork is recorded on the blockchain, creating an immutable and publicly accessible ledger. This transparency, allong with all the legal protections of securities law, enhances trust among investors and collectors.

3. Accessibility: Tokenised art opens the doors of art investment to a global audience. Anyone with an internet connection (who meets the legal eligability requirements of the investment offering) can invest in a tokenised artwork, eliminating the geographical constraints associated with traditional art markets. Like any other investment, a comprehensive Know Your Customer (KYC) and Anti Money Laundering (AML) process will be required before purchasing due to the way investments are regulated. This is not Decentralised Finance (DeFi)!

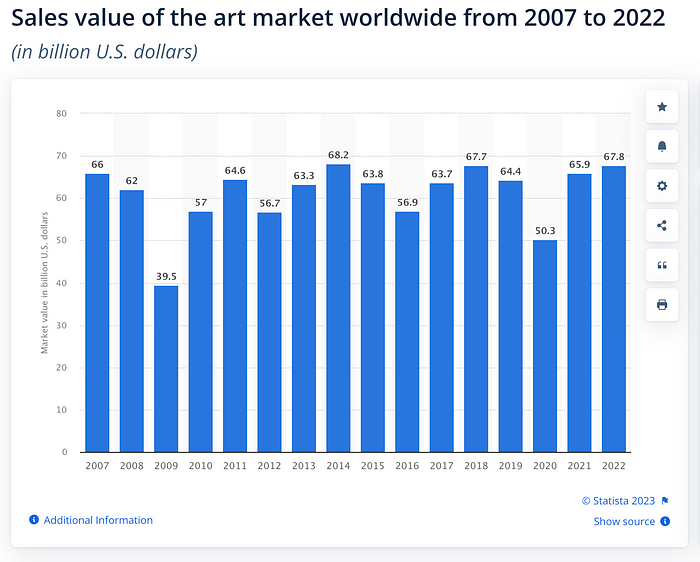

4. Liquidity: As you can see in the graph below, the art market is fairly stable (and lucrative!) but there is a major limitation. Unlike traditional art investments, which may require years to find a buyer, tokenised art offers liquidity. Investors can buy and sell their tokens on regulated blockchain-connected secondary markets, facilitating quicker and more efficient transactions.

5. Expert Appraisals: The process usually involves regular expert appraisers who assess the value of the underlying artworks. These appraisals provide investors with real-world valuation data, a critical aspect often lacking in the world of other digital art like non-fungible tokens (NFTs).

🇼 Why could fine art tokenisation have a role to play in the future of art?

The concept of "software eating the world" has now firmly reached the capital markets, ushering in a transformative era of security tokenisation. Just as software disrupted traditional industries, the tokenisation of securities leverages blockchain technology to digitise and streamline ownership, trading, and compliance in the financial realm. This digital revolution enhances market efficiency, liquidity, and accessibility, offering a glimpse into a future where financial assets are seamlessly traded across borders with reduced intermediaries.

Tokenised fine art is just one application of this, bridging the gap between traditional and digital assets. While NFTs have had their moment in the spotlight, concerns over their quality, value, and the unregulated nature of the market have dampened investor enthusiasm. Tokenised fine art, on the other hand, combines the benefits of digital asset securities with the enduring appeal of tangible artworks.

Moreover, tokenised fine art can democratise art investment. Fine art has historically outperformed the stock market, but its exclusivity has limited the number of people who could benefit from this asset class. Tokenisation breaks down these barriers, allowing a wider range of investors to participate in the art market, potentially leading to increased liquidity and demand for fine art.

🎬 Bonus watch

Learn about a (work in progress) blockchain-based platform that allows people to invest in fine art through digital securitites, which is offering an exclusive four-piece collection of prints from pop artist Andy Warhol. I enjoyed listening to the different viewpoints from “The Hash” team discussing the details and what this means for fine art tokenisation.

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.