Wednesday W.O.W - Tokenised Aspen Resort 🧩⛷️🏨🏔️

[5 min read] Your mid-week bite sized treat on emerging tech on our journey to the Metaverse. Explore a successful (snow covered) case study for tokenising real-world assets, hot chocolate optional ☕

A nibble of knowledge in your inbox every Wednesday with a simple format:

🇼 What the technology is

🇴 Objective(s) - what is it trying to achieve, with some examples

🇼 Why it is important to users as well as businesses & brands.

This is week 41 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

This week is a particularly compelling case study of a successful tokenisation of Real World Assets (tRWA) project. I wrote a separate article about tRWAs here, which is a great primer for today.

In the ever-changing landscape of finance and technology, the concept of tokenisation is emerging as a transformative force. In 2011 Marc Andreessen famously claimed that “Software is Eating the World” and tokenisation is just an extension of this, software making legacy finance systems more efficient and opening up new possibilities.

Today I have an illustrative example of this phenomenon, a case study that delves into the intricate relationship between real estate, blockchain technology, and investor dynamics. This case study provides an objective exploration of the Tokenised Aspen Resort, dissecting its origin, objectives, and potential implications for the future of finance.

🇼 What is this Tokenised Aspen Resort?

In mid-2018, Elevated Returns (ER), a respected asset management company from New York, embarked on a unique collaboration with SolidBlock, a significant player in blockchain technology. Their goal was to tokenise 20% of the equity of the esteemed St. Regis Aspen Colorado resort (80% of the Resort was sold off using the usual “paper-based” securities process). This marked a departure from conventional investment strategies, uniting the world of luxury hospitality with blockchain's emerging capabilities and was quite controversial at the time.

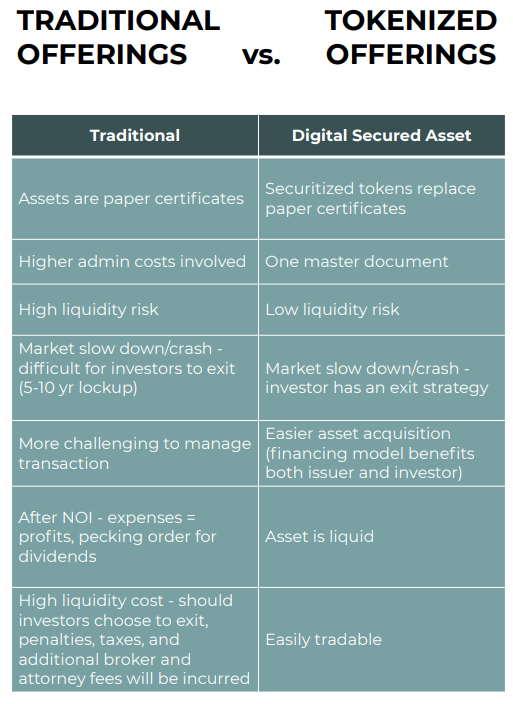

The concept was that the tokenised offerings would have some distinct advantages over the traditional offering:

🇴 Objectives - Why Tokenise it at all?

The project was essentially an experiment to see how the traditional vs tokenised versions of the shares would be priced by the market.

Seven objectives of this particular venture were to:

Maximize Revenue: Elevate income generation by leveraging the unique features of tokenisation.

Optimize Occupancy: Ensure consistent occupancy rates, even during off-peak seasons.

Enhance Facilities: Undertake selective renovations to enhance the Resort's offerings.

Boost Margins: Increase profit margins on food and beverage sales.

Revamp Marketing: Implement more effective marketing and resort management strategies.

Elevate Brand Recognition: Strengthen the recognition of the St. Regis brand.

Raise ADR: Augment the Average Daily Rate, a key performance indicator in the hospitality sector.

Around 13 investors purchased the tokenised versions, which were then available to trade on the secondary market (tZero) and were subsequently sold off in many parts and ended up being held by 2000+ investors.

The project was a resounding success! 2 years after the initial offering, the tokenised shares are trading approx 20% higher in price than the traditional “paper” shares. This is partly because investors value liquidity, being able to sell quickly for a fair price. St. Regis is currently considering tokenising more of the resort.

🇼 Why Tokenisation has a Role in the Future of Finance

This Tokenised Aspen Resort isn't a standalone case; it's a glimpse into the future of finance. By successfully demonstrating the potential of real estate tokenisation, this concept has broader implications:

Broadened Investor Access: Tokenisation democratises real estate investment, making it accessible to a wider range of investors.

Global Trading Infrastructure: The integration of blockchain and secondary trading platforms creates a global, regulated trading infrastructure.

Enhanced Liquidity: Tokenisation enhances liquidity, allowing for more agile investment strategies.

Value Enhancement: Secondary market trading has the potential to elevate the value of the underlying real estate asset over time.

Industry Evolution: Tokenisation could revolutionise the way traditional real estate investments are structured and accessed. Perks for holders give projects membership club characteristics.

Digital Secured Asset: The shift from paper certificates to securitised tokens improves efficiency and reduces administrative costs. It also makes it easy to use them as collateral for loans.

Liquidity and Flexibility: Tokenisation provides high liquidity and flexibility for investors. It facilitates smoother entry and exit strategies.

Regulatory Compliance: The tokenisation process adheres to stringent regulatory standards, such as SEC regulations, ensuring investor protection.

Secondary Market Trading: Secondary market trading, as exemplified by AspenCoin's tZero listing, extends liquidity and investment options.

Investor Confidence and Emotional Investment: The transparent nature of blockchain technology fosters investor confidence and trust. Investors feel connected to the asset in a way that you never would in an aggregated real estate fund.

To wrap up, this case study showcases the convergence of luxury hospitality and cutting-edge financial technology. Its success underscores the power of tokenisation to transform real estate investment towards a future where blockchain-based assets become integral to the financial landscape.

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

Have had this in my inbox and glad I got to it, great use case to read about.