🔗 News Wrap-up

In your inbox every Saturday morning, best enjoyed with coffee and brunch ☕. Today we are talking OCR hikes in NZ, crypto regulation in NZ and Europe, and how to use a Decentralised Exchange.

Welcome to the second Weekend Link-up. Catch up on the first one here

Market update 📉

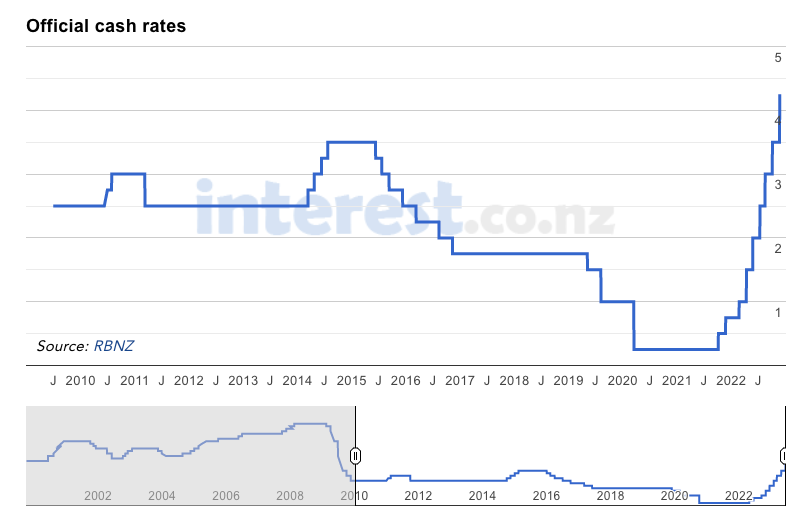

This last week was a big one for NZ economy. Our Reserve Bank increased the Official Cash Rate (OCR) up 0.75% which is a relatively large jump, bringing the baseline rate of borrowing money to 4.24%, a 14 year high. Adjusting the OCR is one of the main levers that the government and central bank have available to try and cool down our skyrocketing inflation figures 🚀.

We don’t like too much inflation because it means that our hard-earned dollars buy less, which we feel as relentless price increases. Sound familiar? 😭 Since the covid pandemic, the extra dollars of stimulus from the government have been chasing fewer goods as supply chains have been disrupted, both of these work together to drive inflation up. Ideal inflation would be 1-3% annually, whereas we are sitting at 7.2% currently 😵💫.

Coming back to the high OCR, you can see below the rate has been steadily rising this year and is forecast to reach 5.5% next year, all in the name of slowing the economy down and stamping down inflation. This means establishing or refinancing a mortgage will be painful, so be aware and budget accordingly.

In other NZ news, the Reserve Bank is seeking more consultation on crypto regulation, with a Central Bank Digital Currency (CBDC) the likely first step - think of it like a digital NZ dollar, but built on the blockchain. If you are interested check out the video below and sign up for their webinar early next year.

In regards to the crypto market, no major movement with the global cryptocurrency market cap at $876 Billion, and Bitcoin ranging between $16,800 and $17,400USD 🥱. Well boring is better than crashing that’s for sure.

Bitcoin popped back above $17,000 yesterday —rising with U.S. stocks as traders responded to a Labor Department report showing a rise in jobless claims. The logic is that the sooner the US economy shows real pain, the sooner that federal interest rate (their version of our OCR) could “pivot” back lower which would mean a surge in asset prices across stocks and crypto.

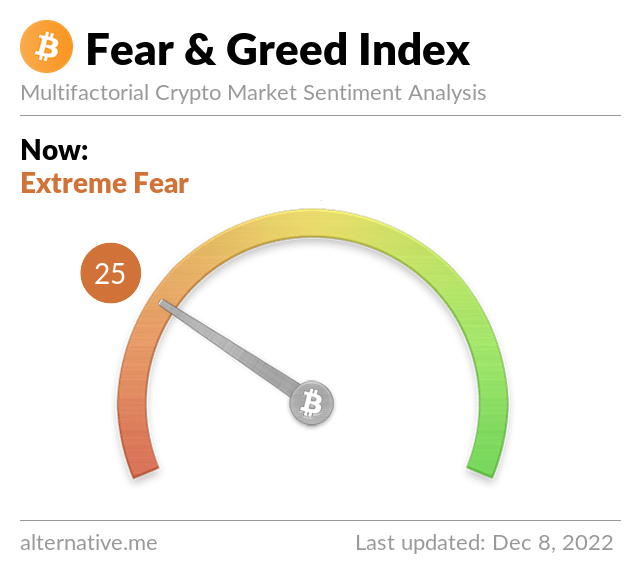

With sentiment in the Extreme Fear category, history would suggest this is a great time to be investing within your means and accumulating assets in preparation for the next Bull Market 📈

Interesting news from the week 🗞️

Here are 3 updates I think you will find interesting:

The European Central Bank is “seriously considering” a Bitcoin ban (including other cryptocurrencies) due to the “environmental damage” they can cause. To anyone who understands Bitcoin, this is mildly amusing because one of the key attributes is that it cannot be banned. It is decentralised, permissionless and can be anonymous. How can it be banned? 🤡 Also, while energy use is a valid criticism of Bitcoins “proof of work” mechanism, the majority of crypto uses other mechanisms so the energy use argument for them is invalid. Meanwhile, the ECB is still planning a digital euro - aka a Central Bank Digital Currency (CBDC) and have stated “only a central bank digital currency can provide solid foundations for the broader digital finance ecosystem required to harness the possibilities of digital technologies”. In the future I will dedicate an article to CBDCs, something we need extremely wary of due to privacy reasons.

On Thursday, the US Federal Trade Commission (FTC) announced a lawsuit to block Microsoft from acquiring Activision Blizzard, developers of the Call of Duty and Overwatch franchises. Microsoft, who has been clear about their Metaverse aspirations, said in January 2022 that it would buy Activision for $68.7 billion in the biggest gaming industry deal in history. FTC alleges the deal would give Microsoft an unfair advantage over its competitors in the gaming industry, essentially creating a monopoly. I’m sure this will not pose a long term obstacle to Microsoft’s Metaverse strategy.

The power of self-custody is the takeaway from the collapse of several centralised exchanges this year (FTX and Celcius being the 2 largest). These implosions have been a watershed moment in crypto. The upshot is reaffirming the core value in cryptocurrencies — keeping control over your own finances which the newsletter will always champion. “Not your keys, not your crypto” If you hand over control of your assets to a thrid party, you introduce the risk of losing everything. This isn’t a death knell for crypto. Just as Bernie Madoff and the subprime mortgage crash did not spell the end of financial markets, crypto and the underflying value added by the technology will continue to grow.

Learning time 💡

Last week we learned the Beginners guide to buying your first crypto in New Zealand. If you didn’t get a chance to read it, start there.

Today we are going to get hands on knowledge of one of the foundations of DeFi (Decentralised Finance) - the DEX (Decentralised Exchange). Set aside 30min, grab a hot drink, and dive in: Beginners guide to experimenting with DeFi - Decentralised Exchanges.