📔 Weekly Journal: 5 of the 10 Most Valuable Companies Globally are Making Metaverse Hardware

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & despite waning hype, why the metaverse is quietly evolving, not dying.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 98 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

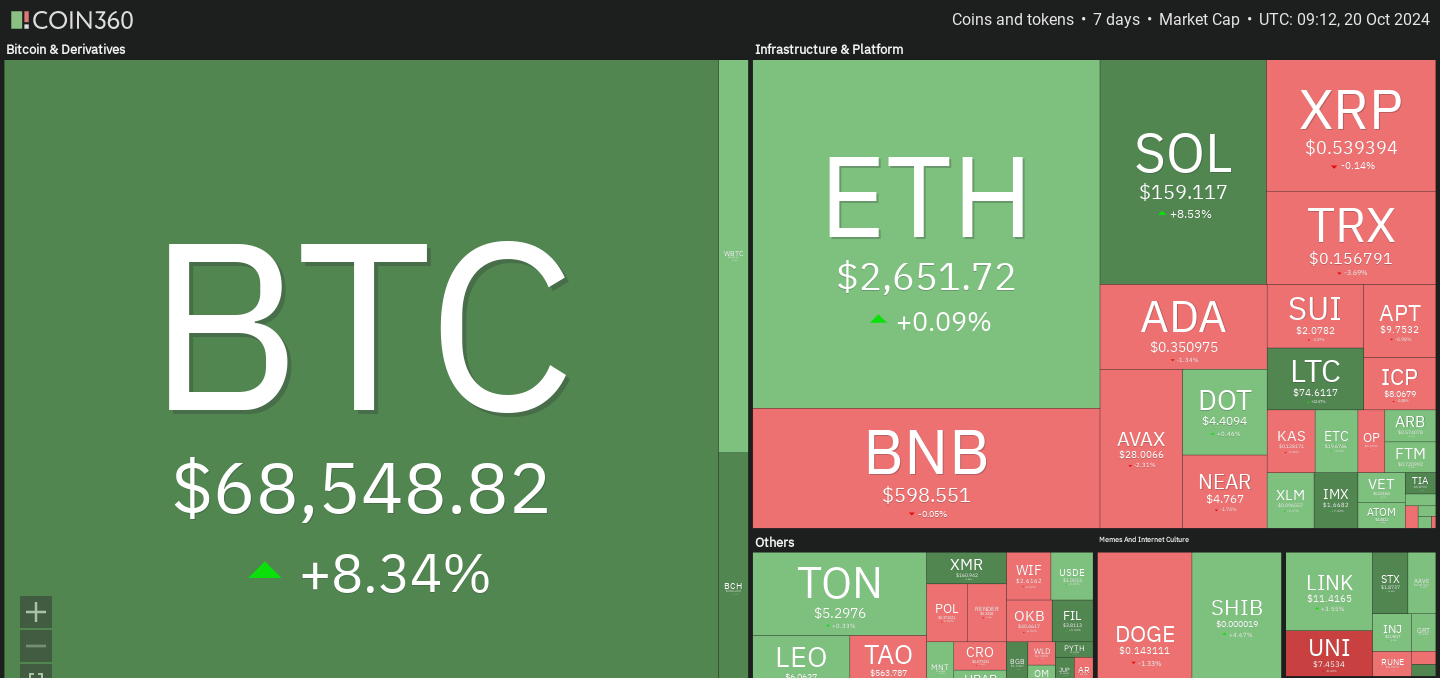

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week. Bitcoin's price surged 10% this week, driven partly by significant inflows into BlackRock's iShares Bitcoin ETF, which attracted over $1 billion. Favorable macroeconomic conditions, including falling interest rates, are prompting investors to seek alternative assets like Bitcoin. Increased trading volume and successful spot ETFs are indicators of the cryptocurrency market's maturity, with reports showing monthly active addresses hitting all-time highs, fueling the upward momentum.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Huge change in sentiment with the price changes.

🗞️ Interesting news from this week

Five of the ten most valuable companies globally—Apple, Google, Meta, Microsoft, and Nvidia—are actively developing metaverse hardware, showing that despite scepticism, the metaverse is far from dead. Microsoft's new collaboration with Samsung for a spatial computing device highlights growing investments in immersive technologies. While the term "metaverse" may have lost its initial hype, the continued development of hardware by these tech giants signals a broader evolution towards more immersive digital experiences. Nvidia's GPU dominance and Meta's heavy investment further emphasise that the metaverse is evolving, rather than fading, as a crucial aspect of future digital ecosystems.

Kenya's Africa VR Campus and Center is introducing rural communities to the metaverse, offering socioeconomic empowerment through immersive technology. Founder Paul Simon Waiyaki Wa Hinga began this initiative to engage students, bringing the metaverse to places like Kiambu, where residents experience VR for the first time. The project, which hosts weekly metaverse events, aims to boost local industries by integrating their stories and skills into the digital realm. Despite infrastructure challenges, the initiative helps locals, particularly youth, explore new economic opportunities, creating a pathway toward sustainable development and digital innovation in Kenya’s “Silicon Savannah.”

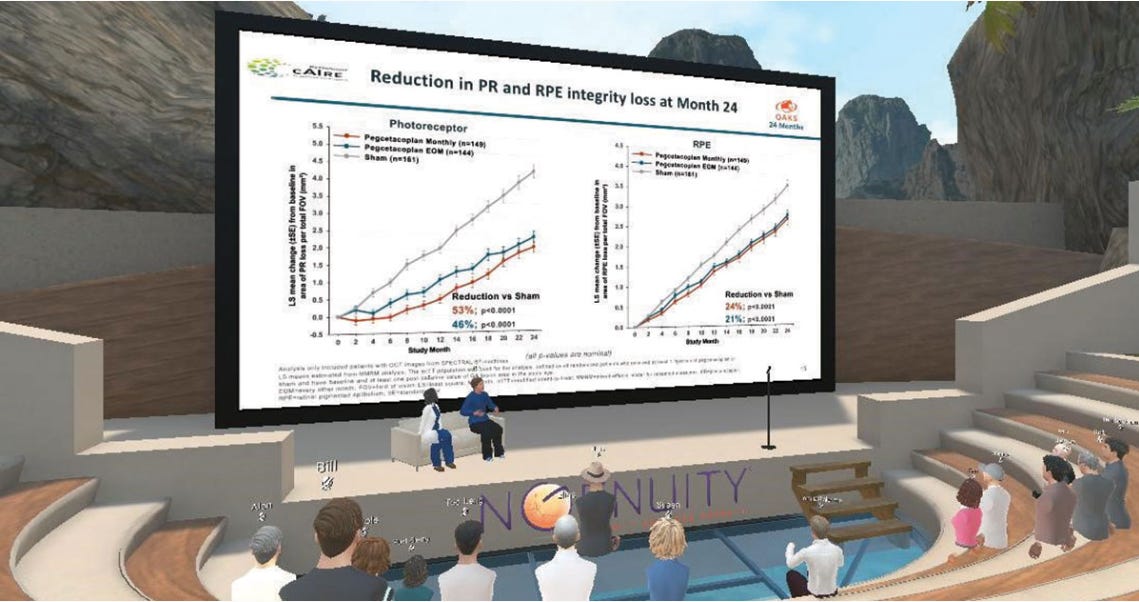

Ophthalmology has embraced spatial computing, evolving beyond virtual meetings to leverage augmented reality (AR) and virtual reality (VR) in surgical training, patient education, and even live surgery preparation. As spatial computing matures, it allows physicians to engage with 3D data, collaborate remotely, and perform precise, real-time surgical tasks. AR systems, like Apple Vision Pro, integrate digital tools into real-world environments, enhancing communication and accuracy in procedures. Though in its early stages, spatial computing is set to revolutionise ophthalmology, offering asynchronous care and improved patient education, heralding a new era of medical innovation in the metaverse.

👓 Read of the Week

This week’s Read of the Week is “Tokenization: From Proof of Concept to Scalable Opportunity” explores the growing potential of tokenisation as we move to a more and more digital economy. As the financial services industry grapples with blockchain’s transformative possibilities, tokenization offers numerous advantages, such as faster settlement, enhanced transparency, and operational cost reductions. However, the article delves into the complexities surrounding regulatory compliance and the need for robust infrastructure to enable wider adoption. Key industry figures from Deloitte, Citi, and J.P. Morgan weigh in on how tokenization could unlock new investment opportunities, streamline operations, and ultimately reshape how we interact with financial assets.

🎥 Watch of the week

In this week’s must-watch video, the discussion dives into the pivotal role sovereign wealth funds could play in the future of Bitcoin and the need to dispel persistent myths about Bitcoin's environmental impact. The video, titled “Sovereign Wealth Fund Adoption of Bitcoin and the Death of Energy Misinformation”, highlights that while $65 trillion of potential capital remains on the sidelines due to misconceptions about Bitcoin's energy usage, new data is turning the tide. Daniel Batten explores how these misconceptions echo historical skepticism about disruptive technologies like bicycles and radios and stresses the urgency of changing the narrative to unlock Bitcoin's true potential.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

The proposal for a $10 billion AI data centre on a dairy farm in Rakaia represents an ambitious step towards integrating New Zealand into the burgeoning digital economy, particularly with applications in the emerging metaverse. Local investors, in collaboration with Taiwanese company Mobii Green Energy, aim to establish a green hydrogen-powered AI data hub capable of supporting driverless cars and chatbots across the South Pacific. This advanced facility, boasting 450MW of solar energy at Rakaia and an even larger complex near Lake Benmore, promises to revolutionise renewable AI computing.

However, the audacity of the project raises questions. While the New Zealand partners, North Rakaia Ltd, have secured land and funding, the credibility of Mobii Green Energy's hydrogen technology is difficult to verify. Claims of a "breakthrough" process enabling on-site hydrogen generation remain unsubstantiated. This echoes a previous, unrealised development plan from North Rakaia—a 900-home solar-powered village—raising concerns over whether the data centres will also falter.

Still, the global appetite for AI infrastructure is undeniable. Should the project succeed, it positions New Zealand as a green energy hub for the digital age, potentially serving up to 60% of the world’s population. The metaverse's rapid growth, with its increasing demand for real-time processing and vast data storage, underscores the significance of such futuristic infrastructures. As AI applications expand within this digital ecosystem, centres like Rakaia could become pivotal, transforming rural landscapes into nerve centres of the global metaverse.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.