📔 Weekly Journal: Adopt a virtual AI Pet 🥽🐠

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as a new type of pet becoming available with the rise of mixed reality headsets.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 61 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Market Update

Blackrocks Bitcoin ETF just hit $3 Billion USD in assets, putting it in the top 10% of all ETFs worldwide. A reminder of why this is a huge deal:

Bitcoin is a scarce digital asset, there is only around 2 million Bitcoin “liquid” meaning on the market to buy.

The buying and selling of this liquid BTC is what drives price.

These ETFs are gobbling up BTC (around 2000 each working day), which will be locked away indefinitely.

Simple supply vs demand dictates a massive supply shock coming which means price almost certainly will go up over the next year.

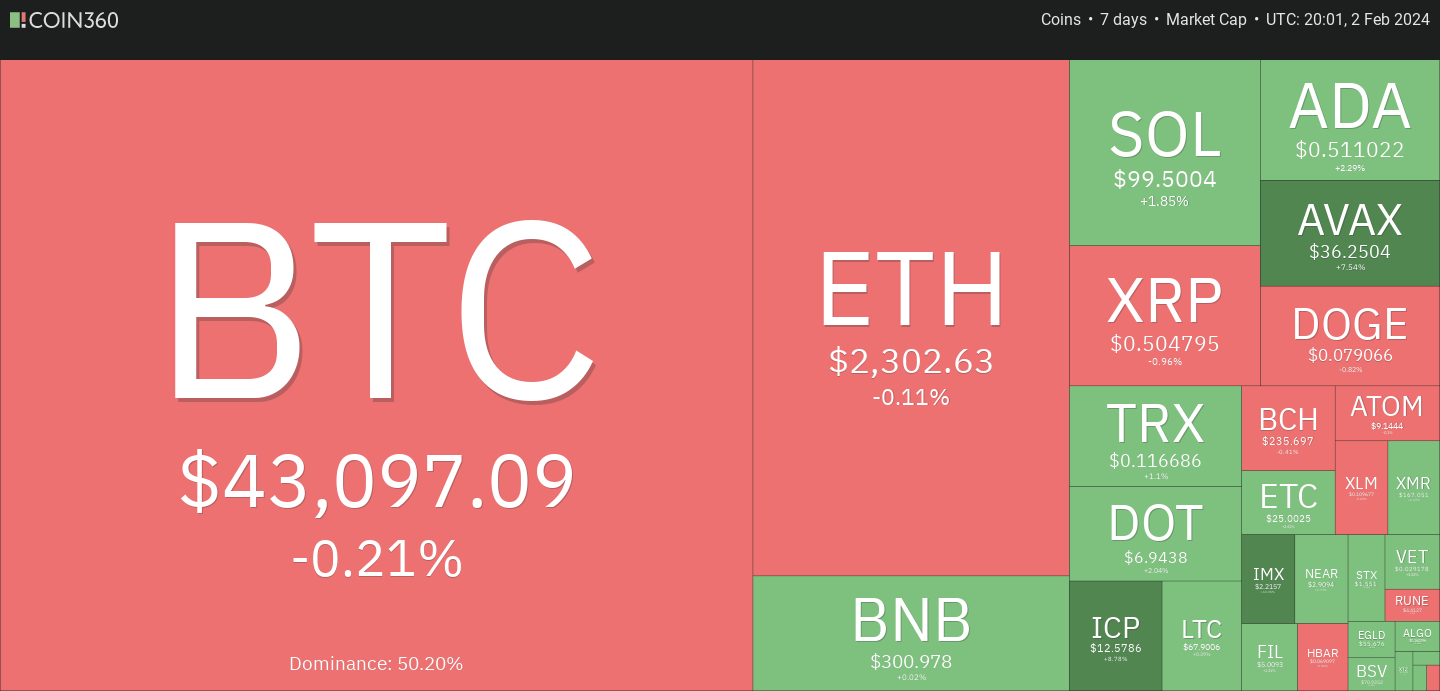

🔥🗺️ 7-day heatmap below, relatively flat week on week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Back firmly in the greed zone.

Interesting news from this week🗞️

🥽 Apple enthusiasts eagerly queued at US stores yesterday to get their hands on the Vision Pro headsets, marking the launch of Apple's foray into "the era of spatial computing." Priced at $3,499USD, the headset combines virtual and augmented reality, challenging Meta's dominance in the niche market. CEO Tim Cook emphasised the device's intuitive interface, relying on eye movement and hand gestures for navigation. The Vision Pro's launch, though more subdued than past Apple releases, is deemed a significant step, with Cook likening it to the introduction of iconic products like the Mac, iPod, and iPhone. Despite initial projections of limited sales, analysts estimate around 180,000 units sold during the pre-order phase, contributing over $600 million in revenue.

🇮🇳 India has maintained its stringent crypto tax policies in the interim budget, disappointing hopes for a reduction. Finance Minister Nirmala Sitharaman presented the budget, with no changes to the 30% tax on profits and 1% TDS on crypto transactions. The crypto industry, facing challenges, had urged a TDS reduction. The budget's focus was limited due to upcoming elections. The high taxes have led to an exodus of five million traders, costing the government approximately $420 million in taxable revenues. Industry advocates anticipate potential changes post-elections to address concerns and foster Web3 growth.

Celsius has emerged from Chapter 11 Bankruptcy after more than 18 months and initiated the distribution of over $3 billion in crypto and fiat to its creditors. The reorganization plan, supported by 98% of account holders, involves converting altcoins to Bitcoin and Ethereum, increasing the amount available by $250 million. Celsius also formed a new Bitcoin mining company, "Ionic Digital," managed by Hut 8, with potential public trading. The former CEO, Alex Mashinsky, faces fraud charges, and his trial is set for September.

Meta, despite CEO Mark Zuckerberg facing criticism at a Senate hearing, reported robust Q4 revenue growth, beating expectations. The company declared its first-ever cash dividend of $0.50 per share. Q4 revenue reached $40.1 billion, a 25% increase, driven by ad impressions growth. Meta anticipates Q1 2024 total revenue between $34.5 billion and $37 billion. Zuckerberg highlighted the past year as a "year of efficiency" after significant job cuts, expressing optimism about community and business growth. The company is grappling with legal and regulatory challenges, with ongoing efforts to contest potential restrictions on operations.

Invitation to my upcoming Webinar

Who is this session for? This session is designed for investors eyeing new opportunities, companies or fund managers on the lookout for different venture capital channels, and projects exploring the tokenisation of real world assets (including tokenised financial products).

Location: Online Zoom meeting

When: Thursday 22 February 10:00-11:30 am (NZ standard time)

Format: Presentation + Q&A

Presenters: Ryan Johnson-Hunt, Tracey McDonald, Graeme Leversha, Bryan Ventura

👓Read of the Week

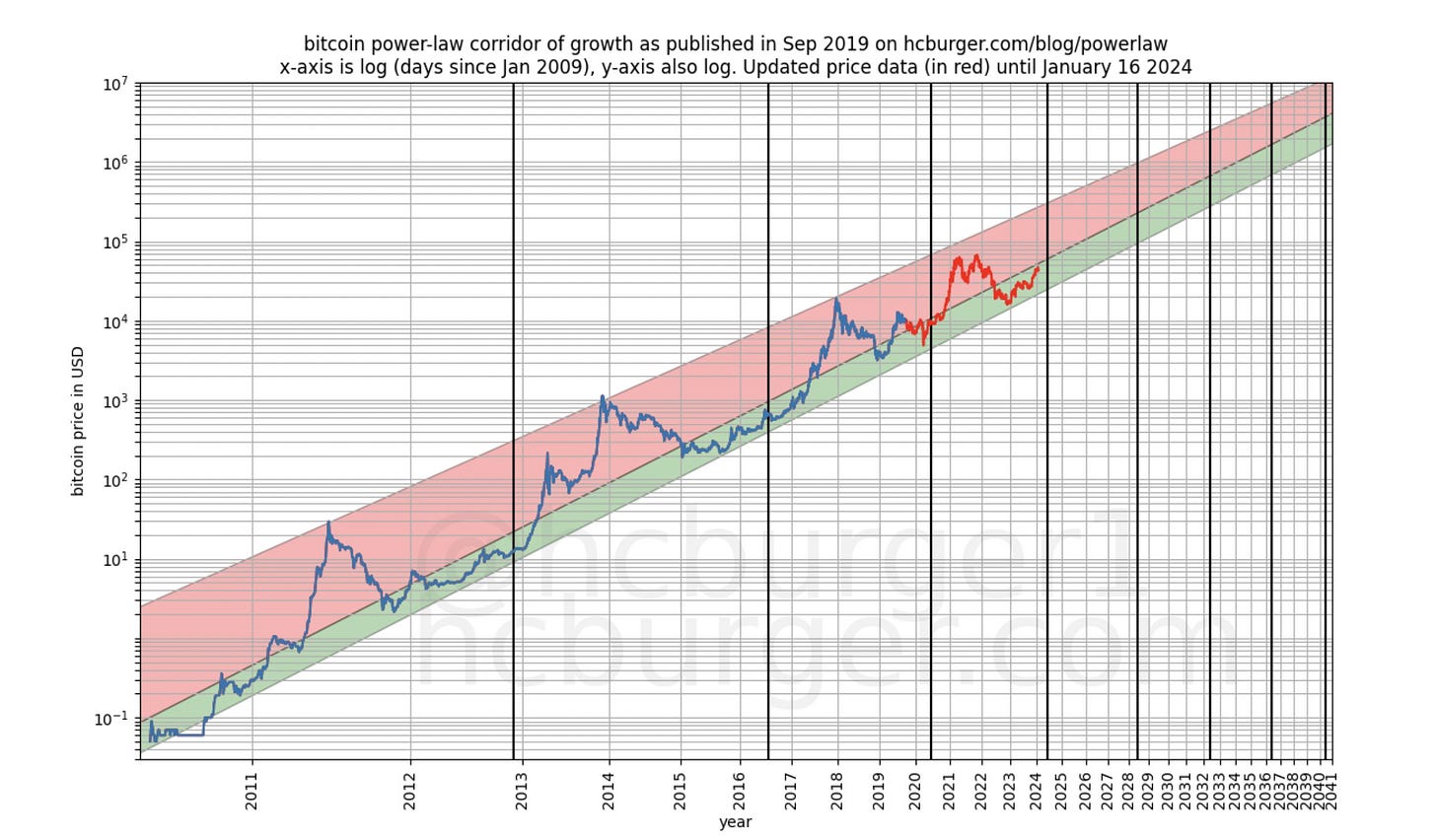

Lots of buzz about the Bitcoin price model called the "Bitcoin Power Law" that proposes a logarithmic scale to predict long-term price trends. Developed by astrophysicist Giovanni Santostasi, the model suggests a linear relationship, resembling nature's power laws. Santostasi's algebraic expression predicts Bitcoin reaching $64,564 soon and peaking at $210,000 in January 2026, followed by a dip to $60,000. Despite skepticism and comparisons to other models, Santostasi envisions Bitcoin at $1 million by 2033, emphasising its growth to analogous to a city rather than indefinite exponential growth.

Read all about it here: “Bitcoin 'Power Law' Predicts $1 Million BTC Price by 2033—Here's How It Works”

🎥 Watch of the week

Wisp, an AI pet simulation on Vision Pro by a top-tier studio, stands out for seamlessly existing in the user's space. It's akin to a house plant, quietly present, awaiting interaction—a subtle yet significant paradigm shift. I want one!

AI 🎨🤖🎵✍🏼

Yes I’m cheating with 2 videos this week! In an interview yesterday, Nvidia CEO Jensen Huang discussed the shift in the AI landscape from startup-driven waves to sovereign AI. Key points were:

The importance of nations developing their own AI systems, emphasising the need for public infrastructure supporting AI research and startups.

Huang mentioned his meeting with a Canadian government official to address the significance of Canada having its own sovereign AI capabilities.

The role of large computing infrastructure in generative AI, citing the collaboration with cloud service providers like Microsoft and AWS.

Huang acknowledged the need to comply with regulations, expressing confidence in working with various nations, including China.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.