📔 Weekly Journal: Battle for the Future of Money

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as the battle to decide the balance between oversight & freedom with the future of money.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 73 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

🔥🗺️ 7-day heatmap below, which shows the current share of market for the top cryptocurrencies, alongside total marketcap (USD) and the change in price over the last week. With the panic about Israel & Iran starting WW3, there have been more seller than buyers.

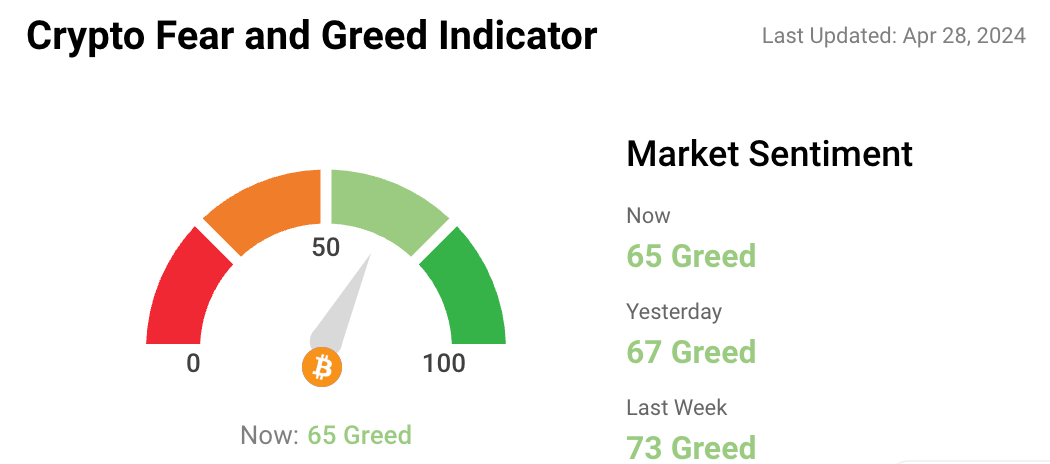

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

Interesting news from this week🗞️

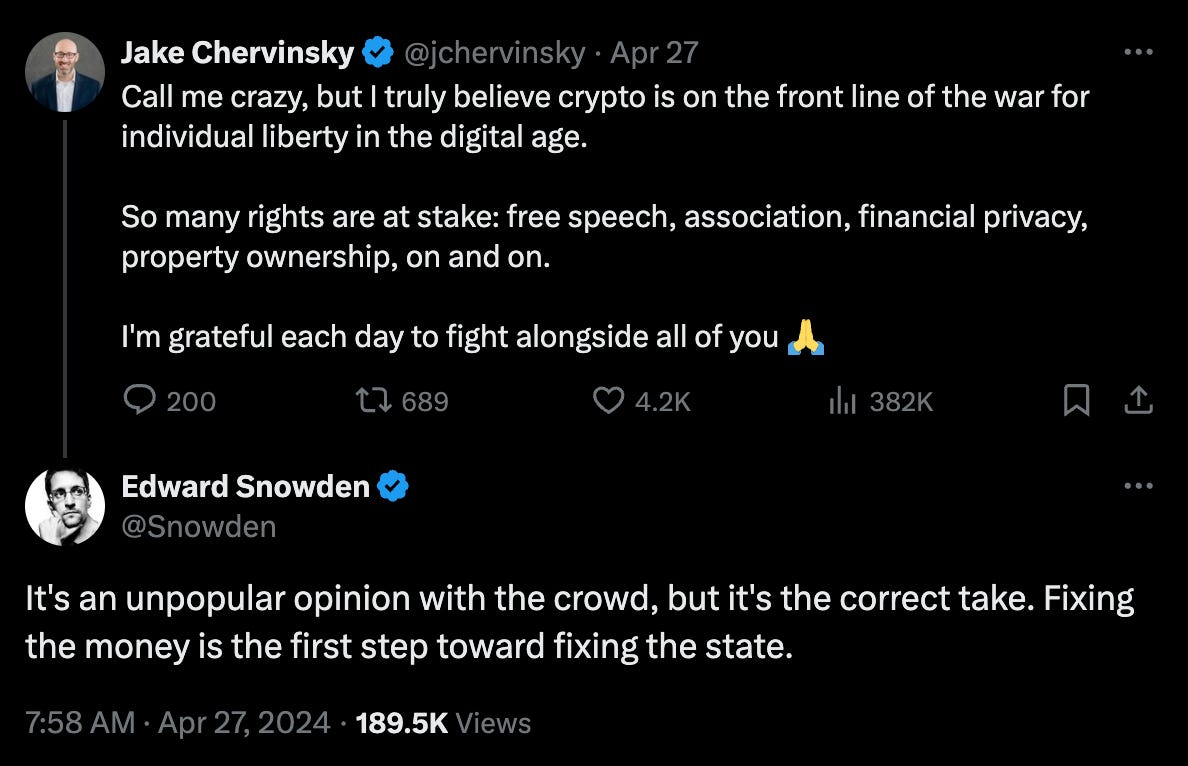

Samourai Wallet founders, Keonne Rodriguez and William Lonergan Hill were arrested this week on money laundering charges. Samourai Wallet is engineered specifically to safeguard anonymity and autonomy, integrating features that obscure transaction details, thereby empowering users with greater control over their financial privacy and freedom. The idea was to replicate the freedom of using cash but in the digital space. In the battle for freedom, the Department of Justice's recent arrests of Samourai Wallet founders underscore the clash between privacy and regulatory scrutiny. Advocates argue for privacy in financial transactions as a fundamental right, challenging oversight. Meanwhile, the debate extends to philosophical realms, questioning the freedom of code as speech.

This post on X drove it home for me:

Each part of the US govt treats this new digital money differently, this post on X makes the hypocrisy clear:

On a more positive note, Stripe announced its return to the crypto market, marking a significant development in the industry. This move signifies a major shift as the company recognizes the advancements in crypto infrastructure, with cheaper transactions and faster settlement times compared to their previous attempt. With a focus on practicality rather than hype, Stripe's decision underscores the growing integration of crypto into mainstream business operations, potentially impacting millions of businesses across 120 countries and bringing crypto wallets to a wider audience.

Mark Zuckerberg defends Meta’s increased spending on AI, aiming to make it a leading AI company, despite a 12% drop in shares. Revenue for the first quarter rose 27%, slightly surpassing expectations. Meta plans to raise capital expenditure to $40bn to support AI initiatives, with a forecasted increase in expenses. Zuckerberg acknowledges the need for substantial investment before generating significant revenue from new products. Meta's focus includes chatbots, AI chips, and smart glasses. Analysts debate Meta's ability to compete in the AI race while managing finances.

👓Read of the Week

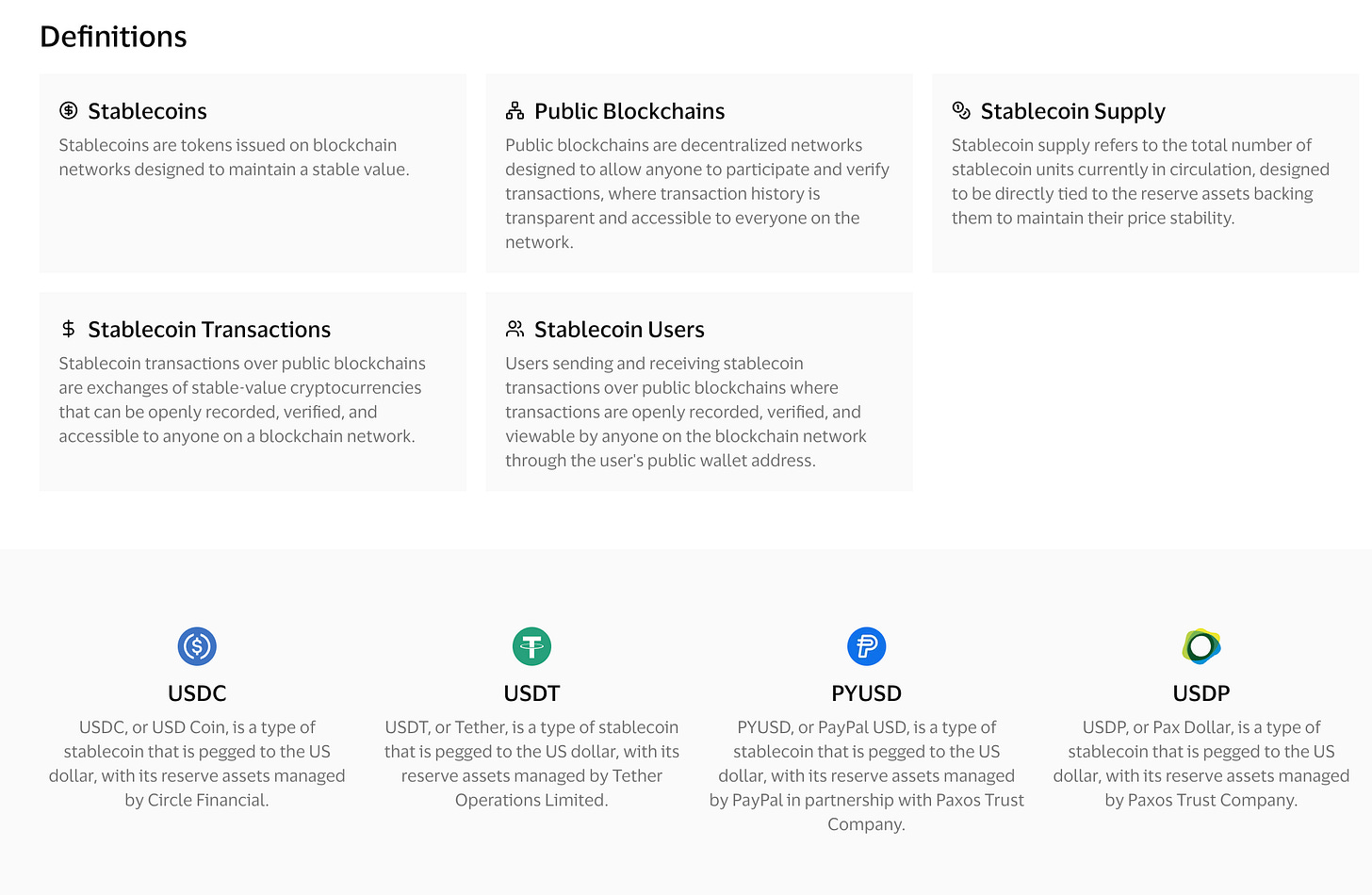

VISA unveiled its latest development this week: the Visa Onchain Analytics Dashboard, crafted in partnership with Allium Labs. This cutting-edge platform offers unparalleled insights into the global movement of fiat-backed stablecoins across public blockchains. The dashboard allows users to explore metrics on Stablecoin Supply, Stablecoin Transactions, and Stablecoin Users.

🎥 Watch of the week

I found the video fascinating because it showcases how Adobe is integrating AI tools into its workflow for editors to transform video editing. Object addition and removal, make it easy to clean up shots even on a budget. The generative extend tool intelligently elongates footage, allowing for creative control over shot duration. I like the transparency in AI usage, meaning it will always be clear when (and how) AI has been used.

AI 🎨🤖🎵✍🏼

Elon Musk's new venture, xAI, is making waves in the tech investment world, with reports suggesting it's on the verge of securing an impressive $6 billion in funding. This funding round, expected to close soon, would value the company at $18 billion, giving investors a significant stake.

Initially, the terms of the deal indicated a raise of $3 billion at a $15 billion valuation, but due to overwhelming investor interest, the numbers were swiftly adjusted. Notable participants in this funding round include Sequoia Capital, Future Ventures, Valor Equity Partners, and Gigafund, all with close ties to Musk's various ventures.

What sets xAI apart is its ambitious goal of bridging the gap between the digital and physical realms by leveraging data from Musk's diverse portfolio of companies, including Tesla, SpaceX, Boring Company, and Neuralink. This integration of data aims to revolutionize fields like autonomous vehicles and robotics.

One intriguing aspect is the connection between xAI and Musk's social media platform, X. X has already integrated xAI's chatbot, Grok, as a paid feature, hinting at a broader strategy to intertwine the two platforms. Musk envisions Grok gaining insights from data across his companies, potentially leading to groundbreaking advancements in technology.

While xAI's momentum appears promising, it also poses questions for competitors like OpenAI, which has been in Musk's crosshairs since its rapid growth. Musk's decision to open source xAI's early chatbot architecture contrasts with OpenAI's approach, leading to legal disputes between the two entities. Overall, xAI's rapid rise and its alignment with Musk's vision for the future of technology underscore its potential to reshape industries and challenge existing players in the AI landscape.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.