📔 Weekly Journal: Breathing New Life into On-chain Art 🌬️🔗🖼️

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as the NFT exhibition using sounds from visitors exhaling into their phones

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 65 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

🚀 During another record-breaking week of Bitcoin ETF activity, markets experienced extreme volatility. On February 28, spot Bitcoin ETFs amassed $8 billion in trade volume and attracted $637 million in inflows. Bitcoin surged to $63,637, near its all-time high, but swiftly retreated, wiping $1.6 billion in derivatives interest in just 15 minutes. Ether also surged to $3,473. The spike in ETF demand signals a bullish trend, with Registered Investment Advisors (RIAs) cautiously embracing Bitcoin ETFs amidst regulatory developments and market uncertainty. Supply and demand dynamics are still bullish, this is the first ETF in history with a hard fixed supply - things could get wild.

🔥🗺️ 7-day heatmap below, which shows the current share of market for the top cryptocurrencies, alongside total marketcap (USD) and the change in price over the last week.

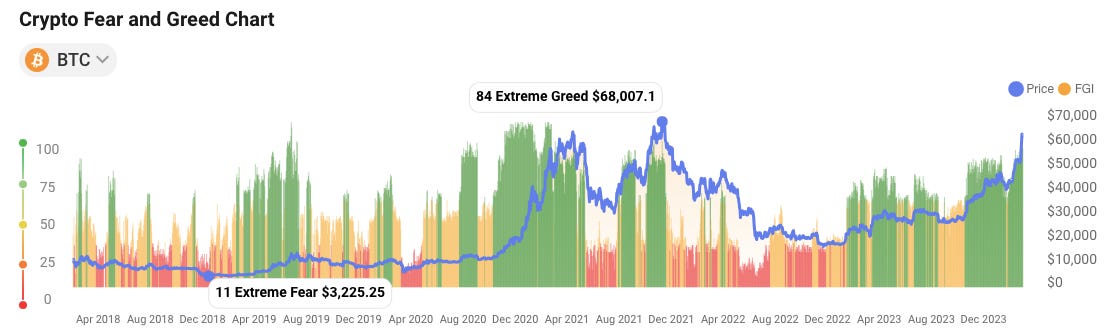

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. If I were trading I might take some profits but I’m in it for the long term.

Interesting news from this week🗞️

🌬️ Let’s kick off with something a little bit different….the Musée d’Orsay unveils an NFT auction linked to its groundbreaking on-chain exhibition, "Code d’Orsay". Five NFTs named “The Convergence of Breath” will be auctioned, stemming from a collaborative effort between experimental artists and the museum's leadership. The pieces, inspired by a steel sculpture titled “Sigma Lumina,” are minted on the Tezos blockchain and reflect the interaction of visitors who contributed by exhaling into their phones.

💸 Uniswap, a leading DeFi protocol, witnessed a staggering 60% surge in its native token, UNI, following a proposal to distribute protocol fees to token stakers. This move, if approved, could significantly enhance the economic power of UNI holders, potentially increasing the token's utility beyond governance functions. However, the withdrawal of a substantial amount of UNI tokens to Binance highlights the influence of large token holders on the protocol's economic dynamics. The proposal to mandate delegation for staking aims to bolster governance participation, potentially reshaping the economic landscape of Uniswap and other major DeFi protocols.

Jamie Coutts makes a great observation:

Uniswap 'fee switch' could be a pivotal moment for Crypto assets in this cycle as it demonstrates just how cashflow generative some of these open finance protocols have become. Not to mention a big FU to the SEC. UNI token has rallied 50% since the news. This is a $10b mkt cap asset on track to do $760m in fee revenue this year, which is the equivalent of the 2023 revenues for the 13th and 14th largest global exchanges (ASX & SGX). It trades on a 14x P/S multiple, which isn't necessarily 'cheap' by traditional standards but is the same multiple as the CME with one difference (of many)-- Uniswap has an effective workforce of around 40 developers, which means it collects around $18.75m in sales per employee vs CME at $1.45 million per employee.

📱Nokia's 2030 strategy targets metaverse, Web3, and AI advancements, expecting a 22%-25% surge in network demand. Plans involve substantial investment in infrastructure, catering to emerging ecosystems like decentralization and blockchain. The company anticipates transformations in connectivity, manufacturing, and digital interaction. Labs and experiments demonstrate Nokia's commitment to the metaverse, envisioning real-time interactions in supply chains and manufacturing, while Web3's decentralised infrastructure and AI advancements shape digital transformation. Nokia aims for dynamic network infrastructure, offering real-time performance optimisation and converging mobile and fixed broadband services for seamless connectivity.

📈 Telegram will split ad revenue with creators in Toncoin, spiking TON's value by 31% as it reaches a two-year high. Starting Friday, channel owners will receive 50% of ad earnings, paid fully in TON. Pavel Durov, Telegram's founder, announced the move, aiming to empower content creators. TON's surge follows regulatory hurdles faced by Telegram's original plans for Gram. Despite volatility in the crypto market, TON's rise reflects optimism in its new revenue-sharing model which could be replicated. Imagine a $UTBE token for YouTube.

👓Read of the Week

This week’s read is on "Mobility" referring to the movement of people and goods within urban environments. The mobility landscape is evolving rapidly due to urbanisation, environmental concerns, and technological advancements like connected vehicles and electric aircraft. Consumers now favour online shopping, reducing car ownership, and demanding on-demand services. The industry faces fragmentation as digital newcomers vie with traditional players for market share.

This paper dissects nine disruptive trends (see below) and attempts to navigate a strategy for them. Overall a good read!

Read it here: Fast-Tracking the Mobility Revolution - Shaping the future of sustainable mobility

🎥 Watch of the week

Computer chips are the backbone of emerging technologies, propelling us towards the Metaverse. From smartphones to smart homes, they orchestrate our digital lives. However, the hurdle lies in their costly production. Sam Altman, founder of OpenAI, urges a $7 trillion investment to fuel this crucial industry. I found this discussion with Chris Miller (author of "Chip War") fascinating.

AI 🎨🤖🎵✍🏼

Elon Musk sued OpenAI this week alleging a departure from their commitment to public benefit with the closed-source release of AI technology to Microsoft. Musk contends that OpenAI's alignment with Microsoft prioritises profit over humanity, contrary to their founding principles. The suit accuses OpenAI of breach of contract and unfair practices, demanding a return to open-source principles.

Musk highlights concerns over AI technology's development and control, citing potential risks to public safety. He points out the transformation of OpenAI's non-profit structure into a profit-driven entity, with a board lacking technical expertise. Many would say that the lawsuit underscores the need to preserve AI's potential for societal benefit.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.