📔 Weekly Journal: A "Strategic Reserve" of Bitcoin for US?

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news and what it would mean if Trump creates a "Strategic Reserve" of Bitcoin

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 85 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

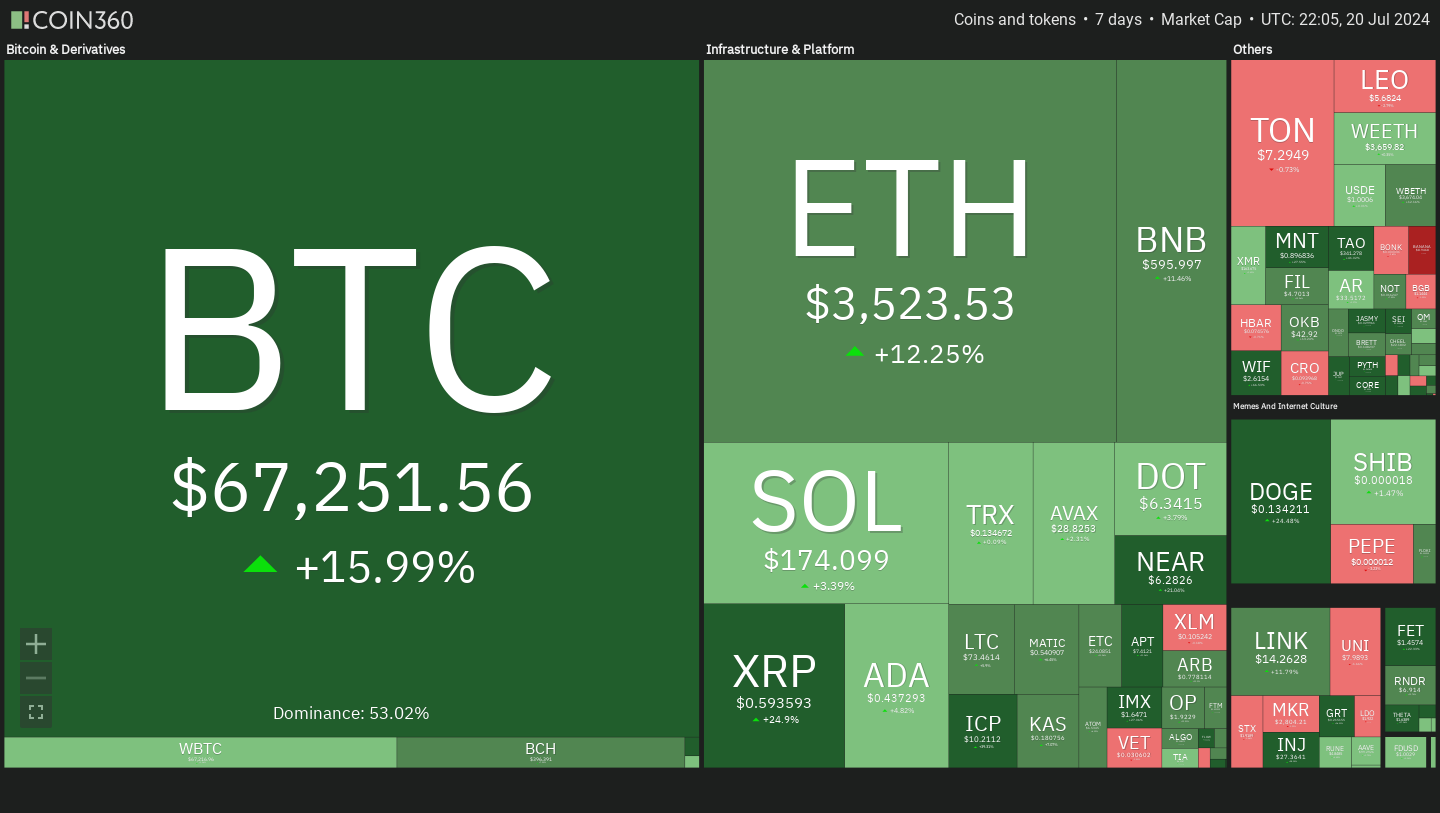

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

In recent newsletters, I wrote about how Bitcoin and Crypto are becoming increasingly politicised. Bitcoin surged 13.5% this week amid investor optimism for a potential Trump win in the U.S. presidential election. Enthusiasts anticipate Trump's Bitcoin 2024 conference speech, speculating he might discuss Bitcoin as a treasury reserve asset, potentially boosting adoption.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

🇺🇸 Lots of buzz this week about Trump hinting at using Bitcoin as a “strategic treasury reserve”. This year, several companies, inspired by MicroStrategy, Tesla, and Block, added Bitcoin to their reserves. If U.S. companies allocate more of their $187 billion in cash into Bitcoin, its price could rise significantly. Currently, private and public companies hold approx 816,163 bitcoins, about 3.9% of the maximum supply. El Salvador already holds Bitcoin in their treasury and if the US follows suit, it would seem that other nation-states would follow. This is mindblowing and would accelerate the path to a digital economy using more and more on-chain digital assets. This in turn paves the way for virtual metaverse spaces where regional fiat currencies are not used, only digital ones.

📚 Academic authors are upset after Taylor & Francis sold their research to Microsoft for nearly £8m without notifying them. The deal, intended to enhance Microsoft's AI systems, was revealed in May. Authors were neither informed nor given the chance to opt out and will not receive extra payments. The Society of Authors criticised the lack of consultation, raising concerns about transparency and the impact on authors' rights and income. Taylor & Francis maintains it protects authors' work and royalty rights but did not comment on the possibility of opting out. Ruthless.

🇨🇳 China announced ramping up its efforts to overcome technological obstacles in robotics, 6G, and industrial development as it hits a crucial juncture. The government is pushing for advancements to address challenges in high-tech fields and enhance the nation’s global competitiveness. Key initiatives include boosting research and development in robotics, aiming to improve manufacturing efficiency and automation. They probably see robotics as a solution for their demographics problem on the horizon. The 6G sector also seems to be a focus, China seeks to establish a leading position by advancing network infrastructure and technology. The focus is also on scaling industrial capabilities to meet domestic and international demands.

👓 Read of the Week

Treasury reserves have evolved significantly over time. Initially, they were primarily composed of physical assets like gold and silver, which provided a stable store of value and a means of currency backing. With the establishment of central banks, reserves began to include government bonds and foreign currencies. The Bretton Woods Agreement in 1944 introduced fixed exchange rates and gold-backed reserves. Post-1971, when the gold standard ended, reserves shifted towards fiat currencies and government securities. Recently, with the rise of digital assets and cryptocurrencies, there's growing interest in diversifying reserves to include innovative on-chain assets like Bitcoin.

This weeks read is the article “Bitcoin as a treasury reserve asset”, which helps explain what a treasury reserve asset is and why on-chain assets like Bitcoin are emerging as a viable option in this space.

🎥 Watch of the week

In this discussion from the Qatar Economic Forum, the metaverse is highlighted as a pivotal evolution in the Internet's future. This new digital frontier combines cutting-edge video game technology with blockchain advancements, creating immersive virtual spaces that mirror real-world environments. An example is offering virtual property tours and customisation options. Despite the current buzz around generative AI, the metaverse holds long-term promise, driven by advancements in VR hardware and a younger generation already engaged with virtual worlds like Fortnite and Roblox. As the metaverse grows, effective regulation and moderation will be essential to address challenges such as harassment and disinformation, ensuring a safe and secure online experience.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

A recent study explores the potential of consciousness in AI, emphasising the importance of distinguishing genuine consciousness from mere simulation. Wanja Wiese's research examines the possibility of consciousness in AI, aiming to differentiate real consciousness from mere imitation. Using the free energy principle, he highlights that while AI can mimic the information processes of living beings, the structural differences between brains and computers are crucial for true consciousness.

The goal is to avoid accidentally creating conscious AI and to prevent AI from misleading people into thinking it is conscious. Wiese's approach focuses on identifying which types of AI are unlikely to be conscious, reducing ethical risks. He suggests that some conditions necessary for life might also be essential for consciousness, meaning computers might need more than just advanced processing to achieve genuine conscious experience. This perspective helps clarify the requirements for consciousness in AI and ensures that many current AI systems are not mistakenly considered conscious.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.