📔 Weekly Journal: Davos: A Global Crossroads for Policy and Progress

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, all about the forum that highlights the intersection of global policymaking & innovation (and elite-driven agendas!)

Happy Auckland Anniversary Day/ Australia Day! Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 112 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

The World Economic Forum's annual gathering in Davos is often heralded as a crucial platform for addressing global challenges and shaping the future of international collaboration. Bringing together political leaders, corporate executives, and thought leaders from diverse sectors, the event sets the stage for high-level discussions on pressing issues such as economic growth, climate change, and technological innovation. However, Davos is not without its critics.

Sceptics argue that the forum perpetuates elite-driven agendas, prioritising corporate interests over grassroots solutions and leaving critical voices underrepresented. Others question the effectiveness of its ambitious declarations, citing a lack of tangible outcomes or accountability for promises made.

Despite these criticisms, Davos remains a significant bellwether for global trends. Its discussions often set the tone for policy decisions and market strategies in the years ahead. In particular, as the world navigates the complexities of the digital age, the forum provides a unique window into the priorities and challenges that will shape the future of global governance, innovation, and equity.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

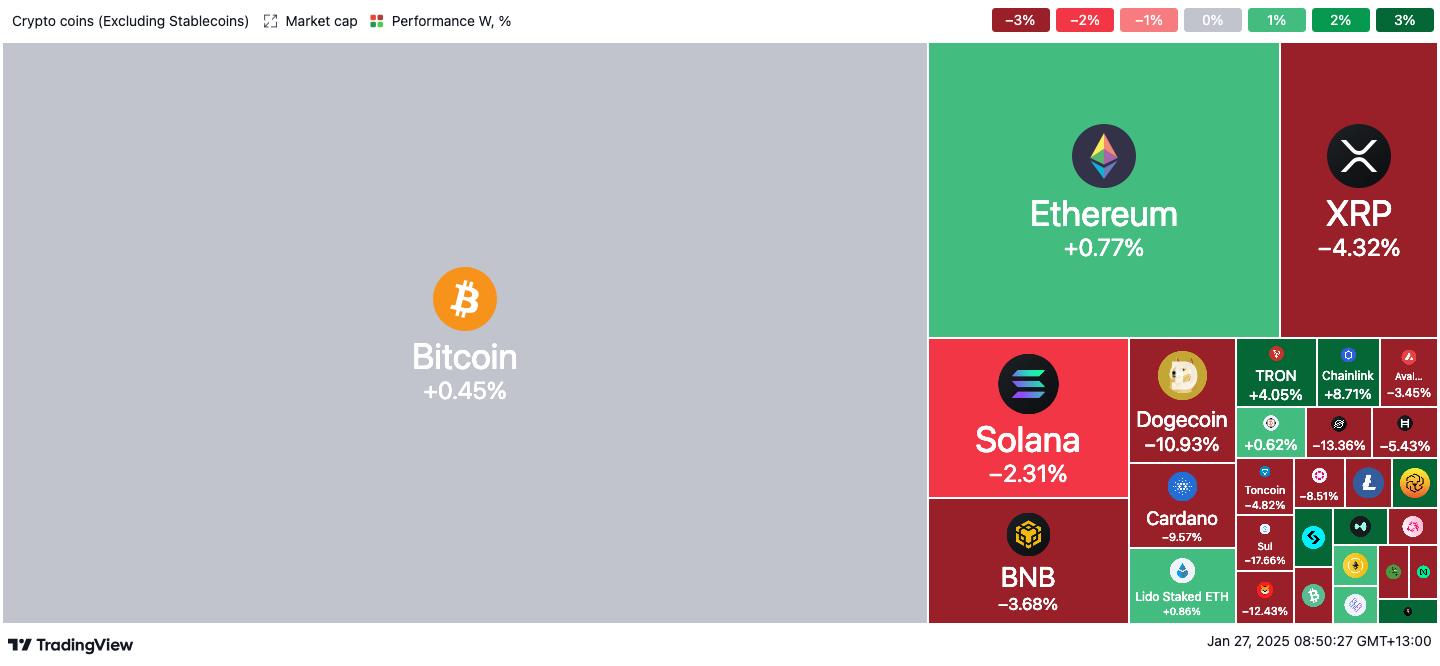

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

AI's Ascendancy in Global Investment: At the World Economic Forum in Davos, the escalating competition for dominance in artificial intelligence (AI) was a focal point. Investors are increasingly captivated by AI's potential, recognizing its pivotal role in shaping the global economy and influencing geopolitical dynamics among the U.S., China, and Europe. High-performance computing has emerged as a critical factor, with U.S. export restrictions on microchips posing significant challenges for China's AI ambitions. In Europe, despite abundant savings and talent, progress is hindered by fragmented capital markets and conservative investment cultures. Regulatory approaches vary, with the U.S. leaning towards deregulation under President Trump, the EU adopting protective measures, and China intensifying state intervention. This AI race underscores the distinct characteristics of these powers and their potential implications for the future global economic and geopolitical landscape. El País

Britain's Competitive Edge and the Need for Urgency: Discussions at Davos highlighted the UK's strong growth potential, attributed to its top-tier universities, skilled workforce, and robust capital markets, particularly in sectors like AI, biotechnology, and clean energy. However, there is a pressing need for the UK government and businesses to collaborate more closely. The government is urged to provide clear vision, consistency, and strategic action, focusing on supply-side reforms and infrastructure investment to maintain global competitiveness. Significant projects, such as substantial battery-storage systems and public-private partnerships like Lloyds' housing initiative, exemplify the benefits of such collaboration. Charlie Nunn, CEO of Lloyds Banking Group, emphasizes the necessity of staying focused and proactive to achieve economic growth and secure the UK’s position as a top investment destination. Read more: The Times & The Sunday Times

AI Integration in Corporate Decision-Making: A notable development at Davos was the integration of AI into corporate governance. An AI agent, trained on company data, was given a seat at the boardroom table, showcasing AI's advanced capabilities in analyzing patterns and contributing to strategic decisions. This move signifies a shift towards practical AI applications in business, with experts like Mihir Shukla, CEO of Automation Anywhere, highlighting the transition from theoretical discussions to tangible implementations. Raj Sharma from EY also noted the need for new commercial models for AI services, reflecting the evolving landscape of corporate operations. More info here: Business Insider

👓 Read of the Week: “Why the Future of Finance Calls for a Permissionless Architecture”

At Davos 2025, Coinbase unveiled a whitepaper detailing the transformative potential of asset tokenisation, where real-world assets like property or art are represented as digital tokens on blockchain platforms. The approach promises faster, more transparent transactions, enhanced liquidity, and greater accessibility through fractional ownership.

The whitepaper highlights tokenisation’s potential to democratise investment and foster financial inclusion, while addressing challenges such as regulatory clarity, platform security, and scalability. It serves as a critical resource for understanding how blockchain technology could shape the future of finance.

Explore the full whitepaper here: coinbase.com.

🎥 Watch of the week: “Davos 2025 Highlights | World Economic Forum Annual Meeting 2025”

This year’s Davos gathering, themed "Collaboration for the Intelligent Age," brought together nearly 3,000 influential leaders from over 125 countries to address critical global challenges, including AI development, economic growth, and climate change. While the sessions promoted principles such as transparency and accountability, the discussions also raised questions about the balance of power in shaping global policies.

The World Economic Forum emphasised trust-building through public-private cooperation, but the event's heavy focus on AI and global governance sparked concerns about how these agendas could impact personal sovereignty and privacy rights. Critics argue that such high-level collaborations may prioritise centralised decision-making, potentially sidelining diverse perspectives and grassroots input.

This video provides an overview of the key discussions and outcomes of Davos 2025, offering insights into the strategies shaping the future of technology, economics, and global cooperation. It’s an essential watch for those interested in understanding the promises and pitfalls of this influential forum.

AI 🎨🤖🎵✍🏼: “AI at Davos 2025: Innovation Meets Scrutiny”

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

Artificial intelligence was a dominant theme at Davos 2025, with leaders exploring its vast potential alongside its more contentious implications. While sessions highlighted AI’s transformative power in areas such as healthcare, climate action, and economic efficiency, sceptics raised critical questions about its impact on privacy and personal sovereignty.

One notable session, "Balancing Innovation and Individual Autonomy," examined the growing role of "agentic AI"—systems capable of acting autonomously based on user data and preferences. Proponents praised its ability to streamline decision-making and personalise experiences, but critics warned of potential misuse. Concerns were raised about how such systems might manipulate behaviour, prioritise corporate interests, and erode individual agency.

Panellists also discussed the necessity of transparent governance frameworks to prevent unchecked AI development. As AI becomes more integrated into daily life, the lack of clear boundaries between innovation and exploitation poses risks. The forum acknowledged the urgent need for safeguards to protect users from invasive data collection and algorithmic biases that could disproportionately affect vulnerable groups.

Davos 2025 showcased both the promise and peril of AI. While its potential to revolutionise industries is undeniable, the scepticism voiced at the forum serves as a reminder that technological progress must align with ethical considerations to truly benefit society.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.