📔 Weekly Journal: Digital Identity Special

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as a deep dive into Digital Identity and its role in our present and future lives.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 106 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

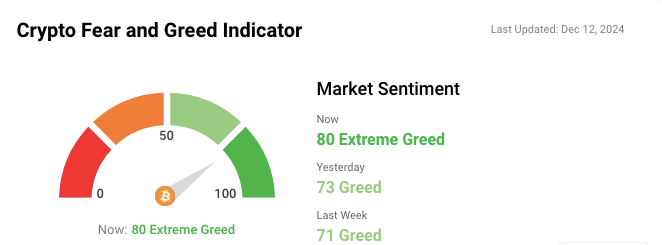

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

As facial recognition technology (FRT) gains momentum in retail security, New Zealand legal experts predict that Australian laws may soon change to accommodate its widespread use. Speaking at a Digital Identity New Zealand (DINZ) panel recently, Campbell Featherston, partner at Dentons New Zealand, highlighted that New Zealand’s privacy laws are more permissive than Australia's, where retailers like Bunnings face challenges due to strict consent requirements for biometric data collection. Featherston speculated that Australia may adjust its privacy laws, potentially removing the need for consent, to facilitate the deployment of FRT. The discussion comes amid rising adoption of FRT by retailers, driven by health and safety concerns. Experts also emphasised the importance of mitigating racial biases in FRT systems, urging retailers to ensure their technology is trained on diverse, well-curated data sets to avoid discrimination. Transparency and proper staff training were key compliance recommendations shared during the event.

This week iProov highlighted digital identity trends set to redefine online security and trust by 2025. Deepfake technology, seen as a growing threat to news integrity and financial markets, is expected to spark a demand for enhanced identity verification and content attribution systems. This includes biometric systems, like facial recognition, which are set to streamline travel at border crossings and strengthen security. The rise of decentralised identities and biometric authentication will also reshape the financial sector, driven by rising concerns over fraud and deepfake-related scams. iProov predicts that industries, particularly banking, will embrace biometrics to safeguard transactions. Meanwhile, new challenges surrounding digital identity projects, such as the EU’s Identity Wallet, will prompt debates on privacy and accountability. As tech firms like Meta and Mercado Libre expand their role in identity management, the future of secure online interactions will rely on robust, user-controlled solutions, ensuring data privacy in an increasingly connected world. Digital identity will be pivotal in the emerging metaverse, ensuring secure, personalized, and trusted interactions across virtual spaces as the boundaries between physical and digital worlds continue to blur.

A new report from Omdia, published this week, underscores the growing importance of secure digital identities in financial services as the industry faces increasing threats from data breaches and transactional fraud. The report stresses the need for a multi-layered security approach combining technology, policies, and human oversight to protect sensitive digital identities, particularly in the context of open banking and open finance frameworks. With regulations like the EU's eIDAS 2.0 and the UK's Digital Identity and Attributes Trust Framework setting new standards, the industry is moving toward secure, cross-border identity verification systems. These initiatives aim to streamline access to personal financial data while safeguarding privacy. Omdia’s report highlights the rising role of digital identity services, noting successful applications such as Lloyds Bank's Smart ID app, powered by Yoti, which allows users to manage their identity data securely. As digital finance continues to expand, the need for scalable, interoperable identity systems is more urgent than ever. The evolving landscape promises a more secure, user-friendly financial ecosystem, but continuous innovation and adherence to high standards will be critical to overcoming emerging challenges.

👓 Read of the Week: What is decentralised identity in blockchain?

This week, we explore the concept of decentralised identity (DI), a revolutionary approach to managing digital identities in the metaverse. Unlike traditional systems, where governments and corporations control personal data, decentralised identity puts power back into the hands of individuals. Built on blockchain technology, DI allows users to own, manage, and share their identity securely, without relying on central authorities.

By using decentralised identifiers (DIDs) and verifiable credentials (VCs), DI ensures privacy, as only the minimum necessary information is shared, reducing risks such as data breaches and identity theft. It’s set to transform industries from finance to healthcare, enhancing security, streamlining processes, and protecting sensitive information. However, challenges remain, such as adoption barriers and regulatory hurdles.

As blockchain technology continues to evolve, decentralised identity is poised to become a cornerstone of the metaverse, empowering users with greater control over their personal data in an increasingly digital world.

🎥 Watch of the week

This video from Microsoft, although 4 years old, is still an excellent beginners guide. It aims to answer:

What is decentralized identity?

How does it give you more control over your digital identity and keep your information on the internet safer?

How can it replace usernames and passwords to verify you are who you say you are quickly and easily?

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

At the 10th edition of Banking 4.0 in Sinaia, Romania, experts highlighted AI’s growing influence on the financial sector, offering both opportunities and challenges for consumers, particularly in the context of the metaverse. AI is transforming financial services, from automated chatbots to intelligent systems managing investments and budgeting. However, concerns about transparency and fairness remain. The "black-box" nature of AI can make its decision-making processes unclear, raising questions about trust, especially when these systems control financial decisions. While AI offers convenience, it risks making consumer interactions with financial services impersonal. A recent Accenture report found that 42% of consumers struggle to differentiate between financial brands due to AI-driven automation. This signals the need for banks to engage customers in more meaningful ways.

The day began with a keynote by David Birch, exploring the future beyond Open Banking, Embedded Finance, and BaaS. He identified four key drivers shaping the industry:

AI as a game changer: From simple chatbots to intelligent agents, AI is progressing rapidly. The focus is on systems with agency—those acting autonomously in complex environments. AI's benefits include streamlined workflows, enhanced customer service, and automation, but risks like bias and lack of explainability remain.

Digital trust and the token economy: Robots will need ‘passports’ (digital identities) in the emerging token economy, which integrates CBDCs and tokenized reserves. This shift will reshape trust and security in financial systems.

Spatial computing: Tools like smart glasses will power interoperable metaverses, enabling digital identities and assets to move seamlessly across virtual worlds.

Quantum computing: The financial sector must prepare for ‘Y2Q’, a future where quantum computing disrupts current encryption.

AI’s integration into financial services is already transformative—revolutionising risk management, call centres, and customer engagement.

The rise of the metaverse further complicates matters, with AI playing a key role in managing digital identities and financial activities across virtual worlds. However, as AI gathers more data to personalise services, consumer privacy is increasingly at risk, particularly with decentralised systems like Web3. As AI, digital identity, and blockchain converge, the financial sector faces a critical challenge: ensuring that consumers benefit from these innovations without sacrificing transparency, privacy, or control over their financial lives.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.