📔 Weekly Journal: High Fashion Embracing Blockchain 👜🔗✅

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as how High Fashion is embracing blockchain-based digital authenticity certificates.

Happy long weekend to all you Aussies!

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 79 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

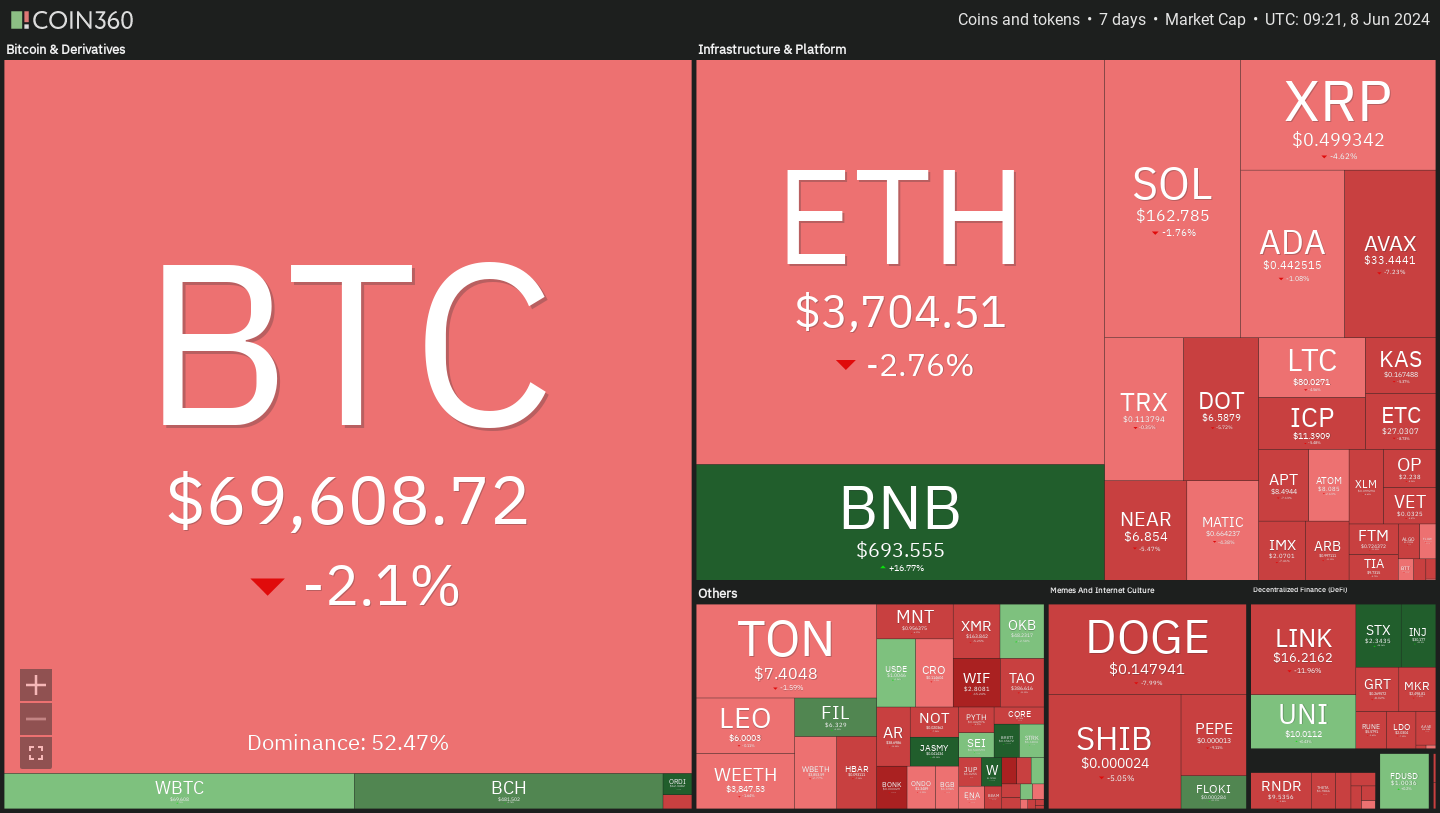

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week. Bitcoin fell below $70,000 in a major Friday selloff, sparked by stronger-than-expected U.S. employment data, which dashed hopes for lower interest rates.

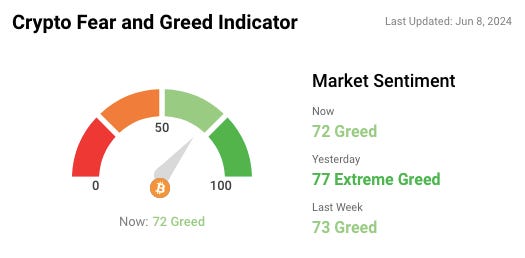

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

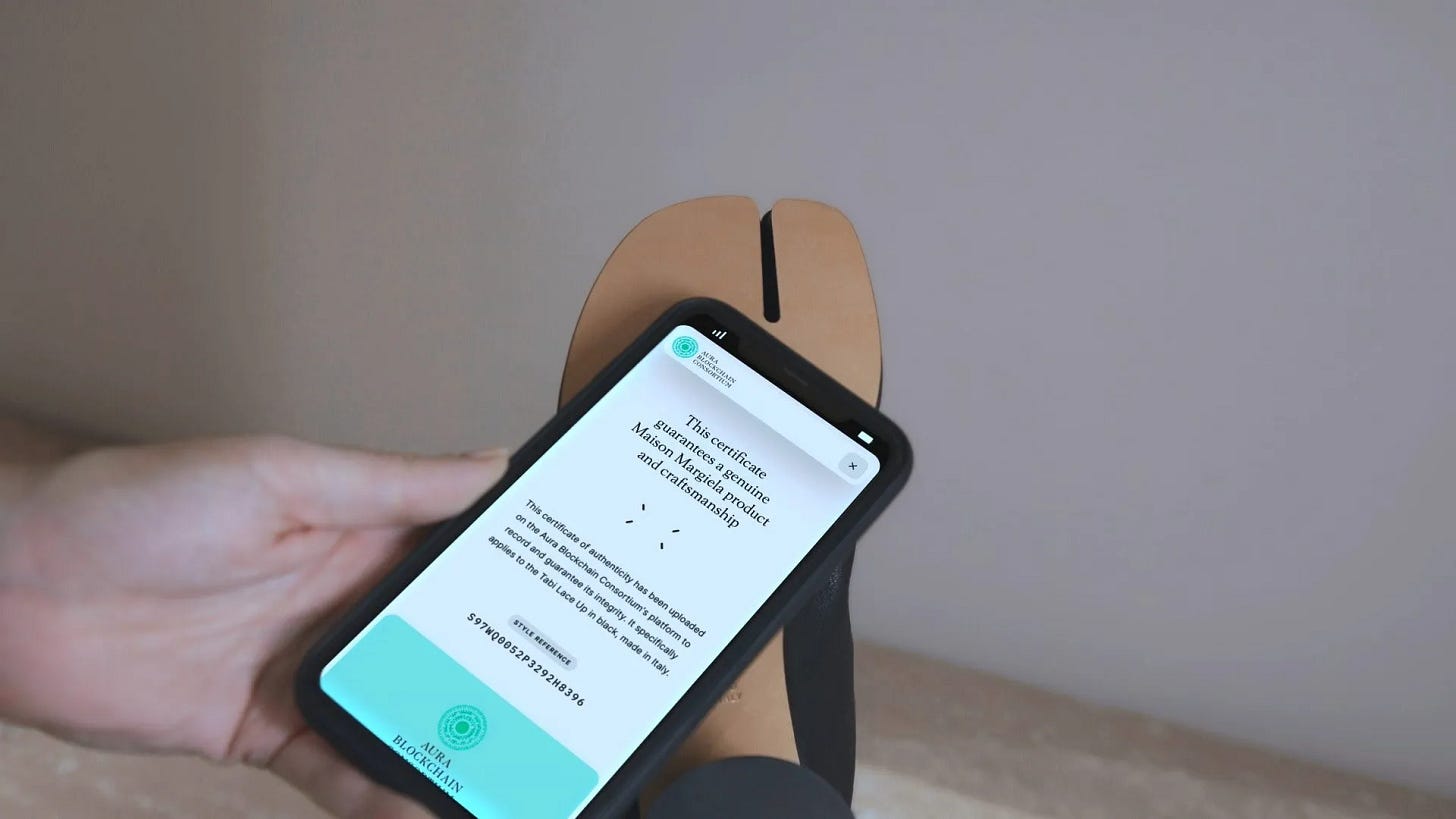

👜 OTB, owner of luxury brands Jil Sander, Maison Margiela, and Marni, will provide blockchain-based digital authenticity certificates for products starting with the Autumn/Winter 2024/2025 collections. Utilising Aura's NFC chip-based blockchain model, these certificates allow customers to verify a product's authenticity via their smartphones. This initiative, aiming for greater transparency and customer interaction, has already seen 1.2 million products registered on Aura's Ethereum-compatible blockchain since 2022. The Aura Consortium, which includes over 40 luxury brands, has registered more than 40 million products on its private blockchain.

💸 Paxos has launched a yield-generating stablecoin called Lift Dollar (USDL), offering around 5% ARR, paid daily, aligned with U.S. Treasury bond returns. Regulated by the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM), USDL is issued in the UAE and not available in the U.S. due to regulatory issues. Paxos CEO Charles Cascarilla highlighted its secure, 1:1 dollar-backed structure, similar to their other stablecoins. At launch, USDL will target Argentina through partners, and will forgo 30 basis points of its asset management fee to increase user returns.

🏎 McLaren Formula 1 team, in partnership with cryptocurrency exchange OKX, is launching a free NFT series called "Race Rewind" on the Ethereum-based X Layer network. Starting with the Canadian Grand Prix, fans can mint these NFTs on OKX Wallet to relive race experiences through multimedia. Collectors of the full 2024 series can win prizes including a VIP McLaren Fan Experience. This initiative aims to engage the community and provide new uses for crypto beyond trading and investment

🏖The Sandbox, an Ethereum-based metaverse game, has reached a $1 billion valuation after securing $20 million in funding from investors including Animoca Brands and Kingsway Capital. This latest investment marks it as a crypto "unicorn," reflecting its substantial growth in the blockchain gaming sector. The funds will be used to enhance creator tools, introduce new social features, and develop a mobile version by 2025. The game has also launched a DAO for token holders, allowing them to influence its future. The Sandbox has gained attention through partnerships with celebrities and brands, and its SAND token remains highly ranked in the cryptocurrency market.

👓 Read of the Week

In this week’s read, “The Promises and Perils of Private Asset Tokenization”, Cristiano Ventricelli of Moody’s highlights the potential of tokenising alternative assets like natural resources, art, and private equity through blockchain technology. Tokenisation could democratise access to these high-value investments by lowering barriers to entry and enhancing liquidity. The blockchain's transparency allows real-time investment monitoring, although it doesn’t change the fundamental risks or due diligence requirements. Tokenisation may also reduce costs, boosting investor returns and operational efficiency. Despite these benefits, challenges persist, including regulatory uncertainties and technical integration issues. Enhanced transparency in private markets is possible but limited, as market managers will retain some informational advantages. I agree.

🎥 Watch of the week

I really enjoyed this video. Venice.ai distinguishes itself from AI chat platforms like ChatGPT by prioritising user privacy and ensuring conversations are neither stored nor censored. It offers a permissionless, open-source alternative that doesn't centralise data, addressing concerns about government access and the long-term storage of personal interactions. The founders criticise existing AI systems for their biased, censored responses, promoting Venice.ai as a source of uncensored and unbiased information.

Transparency is key for Venice.ai, using open-source models to build user trust and customisability. Aiming to attract a broad audience, Venice.ai provides a user-friendly, low-cost service with advanced features for $49 annually, requiring no user accounts or personal data, thus maintaining anonymity and data security.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

In a landmark study, scientists used machine learning to uncover potential new antibiotics from the global microbiome, significantly advancing antibiotic resistance research. Published in the journal Cell, the study describes how an algorithm mined microbial diversity, discovering nearly one million new molecules. Led by Professor César de la Fuente from the University of Pennsylvania, the research utilized AI to expedite the traditionally slow process of finding antimicrobial compounds, identifying nine potential antibiotics from 6,680 compounds. The urgency of this research stems from the increasing threat of antimicrobial resistance, which caused over 1.2 million deaths in 2019 and could rise to 10 million annually by 2050, according to WHO. Although AI accelerates discoveries, de la Fuente emphasises the need for biosecurity measures and sees AI as a collaborative tool, not a replacement for human researchers. The study’s data and code are freely accessible, aiming to further scientific advancement and benefit humanity. Amazing!

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.