📔 Weekly Journal: McMetaverse Singapore Pilot 🇸🇬🍟

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as the Web3 experience McDonalds is using to test the market appetite.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 80 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

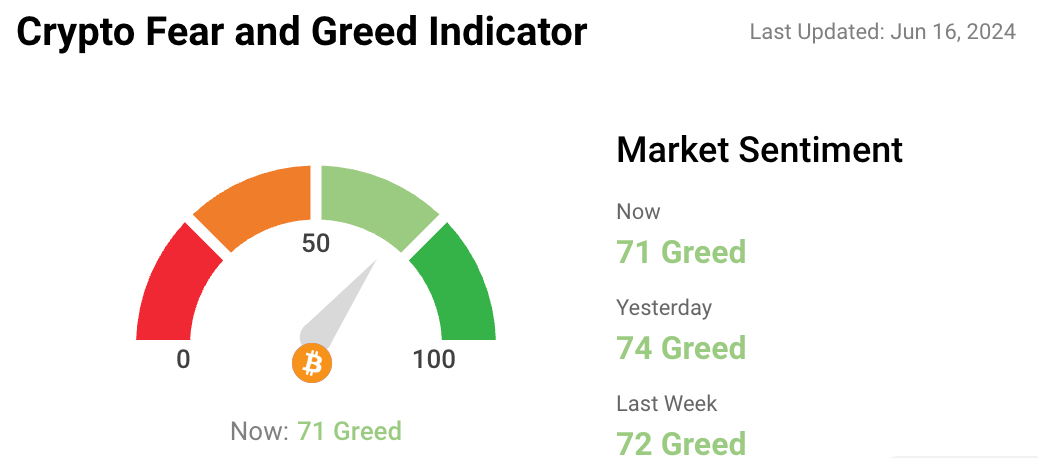

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

🍟 McDonald’s Singapore has launched the "My Happy Place" metaverse, developed with Bandwagon Labs, allowing users to build virtual burgers, play multiplayer games, and earn rewards. The initiative incorporates Web3 technologies for enhanced security and functionality, including wallet hosting services like MetaMask for secure authentication. The metaverse, active from June 6 to July 7 (only in Singapore), will assess future expansions based on its success. Clarence Chan, founder of Bandwagon Labs, emphasises the platform's creativity, multiplayer interaction, and tangible rewards, addressing common issues in metaverse experiences:

“It’s multiplayer where players can see others in the world with them. The metaverse is a creative canvas where we let users flex their creativity. And thirdly, it’s packed with daily rewards with different challenges that trigger a reward mechanism.”

🌐 A BIS survey reveals a significant rise in central bank digital currency (CBDC) experiments, especially among advanced economies. In 2023, proof of concept projects surged by 35% and CBDC pilots tripled compared to 2022. The survey, which included 83 central banks (less than 40% of the global total), indicated that 54% were experimenting with CBDC technology, and about a third were running pilots. Advanced economy central banks led in these efforts, with 81% engaged in proofs of concept and 33% in pilots. CBDCs are a contentious topic, with many concerned about Orwellian outcomes with the capacity for surveillance and spending controls.

📶 T-Mobile owner Deutsche Telekom announced at the BTC Prague conference that it will begin mining Bitcoin. Already operating nodes for Bitcoin, Bitcoin Lightning, Ethereum, and other networks, the German telecommunications giant will expand its involvement in the crypto ecosystem. Dirk Röder, head of Web3 infrastructure, confirmed this move, likening it to "digital monetary photosynthesis." Deutsche Telekom also supports Ethereum through validator nodes and partnerships with StakeWise, as well as investing in Polkadot, Flow, and Celo. The company operates a validation node for Polygon and supports the Q and Chainlink blockchain networks.

👓 Read of the Week

This weeks read is “AI will change everything – so why is the election ignoring it?” by Sean Thomas. Imagine knowing a war was imminent, set to transform societies, economies, and potentially endanger humanity, yet politicians ignored it, focusing instead on trivial matters like stealth taxes and energy drinks for teenagers. The author draws this alarming parallel to Britain’s current handling of Artificial Intelligence (AI). Despite AI’s potential to revolutionise every facet of life, from collapsing the university sector to wiping out millions of jobs across various industries, political leaders remain silent. This thinkpiece delves into the reckless irresponsibility of ignoring AI’s impending impact, likening it to ignoring a tsunami while squabbling over the division of drying seaweed.

🎥 Watch of the week

I enjoyed this watch. A former BlackRock Portfolio Manager provides his views on the economy, the Regional Banking Crisis, Central Bank Digital Currencies, and why he thinks the Trump-Biden Rematch is the worst possible scenario. Summary:

Economic Impact of COVID-19: The pandemic led to massive money printing and spending, drastically increasing the money supply and federal deficit, causing inflation.

Monetary Policy: The Federal Reserve's rapid interest rate hikes to combat inflation have historically led to economic contractions and banking crises, as seen with recent bank failures.

Government Spending and Employment: GDP growth and job creation are primarily driven by non-productive government spending, masking underlying economic weaknesses.

Stock Market Trends: The market rally is driven by a few mega-cap stocks, creating a bifurcated market with potential for significant downturns if the Federal Reserve loses control.

CBDC Concerns: Central Bank Digital Currencies could lead to increased government control and restrictions on personal freedoms, akin to China's social credit system.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

In recent years, advancements in AI and proof checkers have begun transforming mathematics, traditionally a solitary field exemplified by Andrew Wiles' solo work on Fermat’s theorem. Terence Tao, a Fields Medalist, highlights how these tools enable unprecedented collaboration, allowing mathematicians to verify proofs using formal methods and computer assistance. This shift facilitates working with numerous collaborators and tackling larger problems by breaking them into manageable pieces.

Automated proof checkers like Lean compile and verify code contributions, fostering large-scale mathematical projects. This process doesn't require all participants to be programmers; a division of labour allows mathematicians to focus on their strengths. Improved standard math libraries and search engines have made formal mathematics more practical, enhancing the efficiency of formalisation.

AI's role is expected to grow, acting as a "co-pilot" for mathematicians, assisting in proving steps and formalising proofs. While AI may not fully solve mathematics, it will significantly aid in mass-producing theorems, reshaping how mathematicians work. This evolution promises a collaborative future where mathematicians manage projects, specialise in subfields, and extract insights from AI-generated proofs, making mathematics more accessible and interconnected.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.