📔 Weekly Journal: Meta Eyes Up 5% Luxxotica Stake 👓

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & how Meta is making moves in the eyewear market

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 95 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

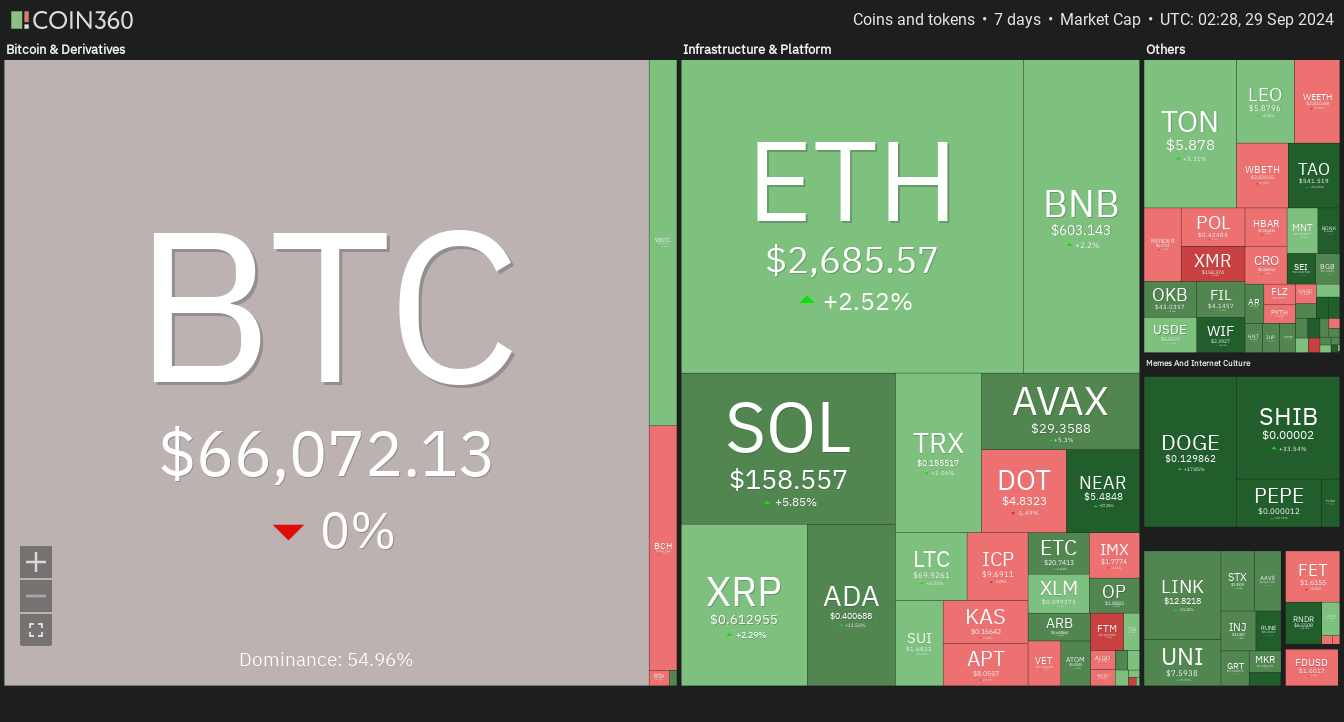

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

Meta CEO Mark Zuckerberg called the potential investment in eyeglass giant EssilorLuxottica "symbolic," aiming to strengthen their partnership in augmented reality (AR) technology. EssilorLuxottica, which dominates the global eyewear market, controls brands like Ray-Ban and Oakley, giving Meta a significant ally in its AR glasses ambitions. The collaboration, ongoing since 2019, has led to two generations of Ray-Ban smart glasses, with the latest model seeing greater demand than expected. A possible 5% stake would cement Meta’s access to EssilorLuxottica's vast distribution network, bolstering Meta's AR goals as it seeks to blend eyewear with advanced technology in this rapidly evolving market.

BlackRock, the world’s largest asset manager, is venturing deeper into the metaverse by backing a new stablecoin, signalling a major shift in finance's digital evolution. Through its USD Institutional Digital Liquidity Fund (Buidl), BlackRock will support Ethena's stablecoin, UStb, via real-world asset tokenisation on the Securitize platform. This marks a crucial step in merging traditional finance with the metaverse's decentralised ecosystems, as tokenised assets are projected to hit $16 trillion by 2030. With BlackRock CEO Larry Fink recently embracing bitcoin, this move highlights Wall Street’s growing alignment with the metaverse, accelerating digital asset adoption amid bitcoin’s ongoing surge.

Mawari has raised $10.8 million to accelerate its role in building the infrastructure for the emerging metaverse. As a pioneer in 3D streaming, Mawari’s Decentralized Physical Infrastructure Network (DePIN) brings immersive, real-time 3D content to spatial computing devices like Apple Vision Pro and Meta Quest 3, addressing a core metaverse challenge: scalable, high-quality content delivery. This funding, led by Anfield LTD, Borderless Capital, and 1kx, will enhance Mawari’s Spatial Streaming SDK and expand its global reach. By combining Web3 decentralisation with advanced 3D technology, Mawari is positioning itself as a key enabler of the metaverse's evolving digital experiences.

👓 Read of the Week

Enjoy the Sept issue of the most successful magazine in APAC dedicated to Digital Assets (we win by default!). Read it here.

🎥 Watch of the week

This week's "Watch of the Week" dives into the next frontier of AI with Fei-Fei Li, spotlighting the rise of spatial intelligence technologies. The episode explores how AI has evolved from traditional machine learning to deep learning and now generative models, with spatial intelligence emerging as a key area for 3D perception and interaction. Fei-Fei Li explains how this development is blurring the lines between the real and virtual worlds, with profound implications for robotics, gaming, education, and more. The founders of World Labs share their vision for pioneering this space, emphasising AI's growing ability to navigate and interact in 3D environments.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

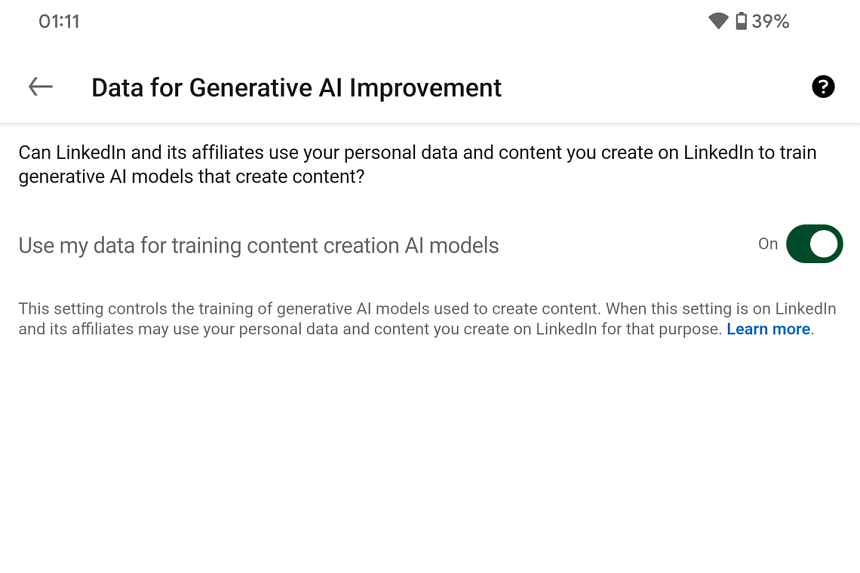

LinkedIn is under fire from users and cyber-security experts following an update to its data collection policy, which allows the platform to use personal data for artificial intelligence (AI) training. The policy, revealed in mid-September 2024, enables LinkedIn to leverage users’ posts, interactions, and other shared content to develop AI-powered writing assistants.

Many LinkedIn users voiced frustration over the lack of clear notification about the change. Singapore's privacy watchdog, the Personal Data Protection Commission (PDPC), has contacted LinkedIn for proof of user consent, emphasising that proper consent requires clear communication about data use. Despite allowing users to opt-out, many, like business growth specialist Audrey Tang, felt the process lacked transparency.

LinkedIn's approach contrasts with regulations like Singapore's Model AI Governance Framework, which stresses transparency in AI systems. As concerns over data privacy intensify, the debate continues over how AI training should balance innovation with user consent and protection.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.