📔 Weekly Journal: Roblox 2024 Earnings Forecast Raised to Over $4.34B

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & why Roblox’s soaring in-game spending illustrates its potential as a "proto-metaverse".

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 100 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

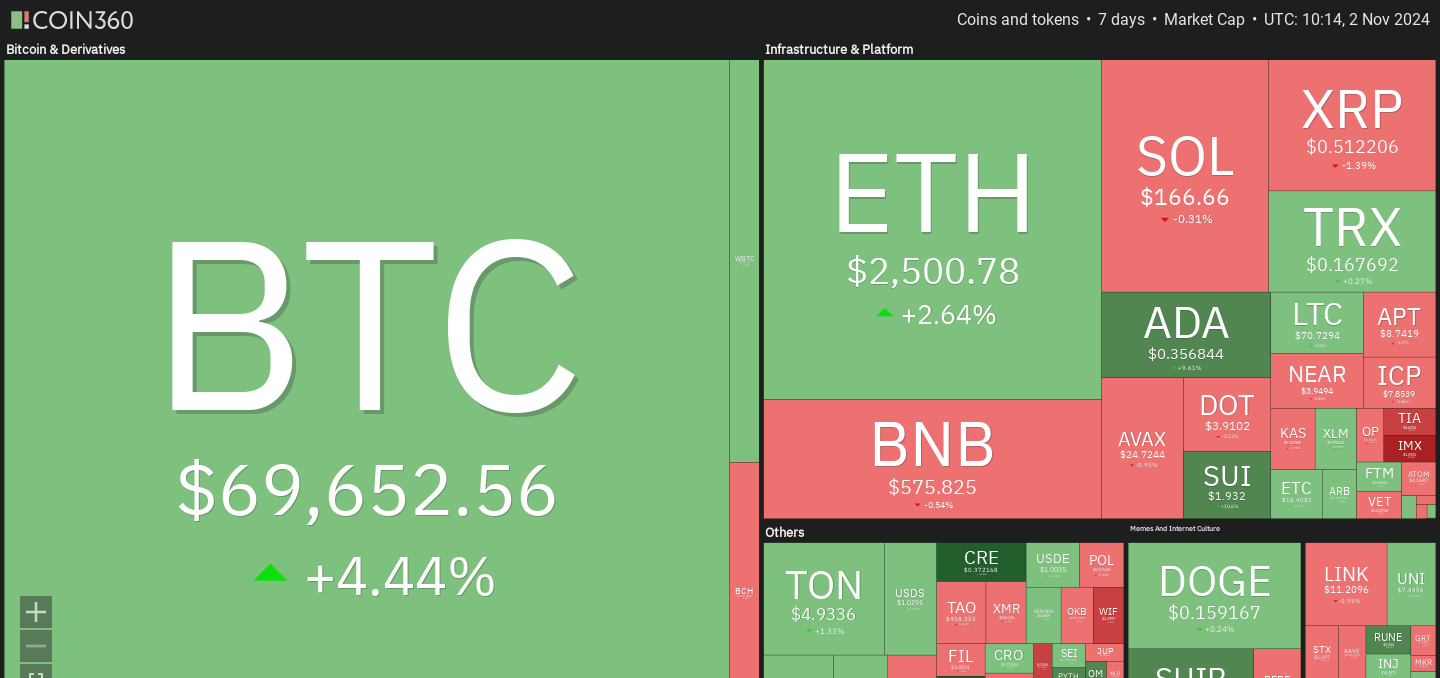

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

Roblox raised its forecast for full-year 2024 bookings to between $4.34 billion and $4.37 billion, a significant increase from its previous estimate of $4.18 billion and $4.23 billion. Roblox’s soaring revenue from in-game spending illustrates its potential as a "proto-metaverse," offering digital spaces that mirror aspects of Zuckerberg’s metaverse vision. Unlike Meta’s high-tech, VR-centric approach, Roblox focuses on cross-platform accessibility, enabling users to engage from mobile, desktop, or VR without requiring advanced hardware. However, Roblox lacks the true metaverse hallmark of interoperability, as items and currency within its platform cannot be used across different digital environments. While Meta still faces financial and technical challenges, Roblox’s success demonstrates how social engagement and user creativity can drive significant revenue in a metaverse-like ecosystem—without full integration features.

The US Treasury’s report this week highlights blockchain’s potential to modernise financial infrastructure, especially through distributed ledger technology (DLT) for payments, clearing, and settlement. With smart contracts and tokenization, Treasury market operations could become more transparent and efficient, enhancing liquidity and real-time insights for regulators and investors. Notably, stablecoins are boosting demand for Treasury bills, underpinning digital assets as essential components of future finance. The Treasury envisions a cautious, permissioned blockchain for tokenizing assets, aligning with the expanding metaverse where real-world assets increasingly gain digital counterparts, bridging traditional finance with emerging virtual economies.

👓 Read of the Week

This week’s read is ‘Companies without a crypto wallet will be left behind”

The author makes the case that in the emerging metaverse, companies without a crypto wallet risk being sidelined. A Web3 wallet isn’t just for payments; it’s a multi-functional gateway to decentralised applications, digital identity, loyalty programs, and immersive experiences. By integrating Web3 wallets, businesses can unlock new ways to engage users, streamline authentication, and explore peer-to-peer marketplaces—future-proofing their operations in a rapidly evolving digital landscape. As brands like Tesla demonstrate, adding a wallet connects Web2 businesses to the wider Web3 ecosystem. Those who hesitate risk missing out, as connectivity becomes the key differentiator in the metaverse era.

🎥 Watch of the week

Join Amelia Tomasichio, Nikita Sachdev, Jamie Anson, Anna Tutova, and Andrea Maria Cosentino as they delve into how Extended Reality (XR), the Metaverse, and Spatial Computing are reshaping the fabric of human existence. This dynamic panel discusses the impact of these groundbreaking technologies on society, culture, and business, offering a glimpse into the future of digital interaction and beyond.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

Michael J. Casey argues that decentralised AI, anchored in tokenised, user-owned frameworks, is essential to counter the control exerted by "The Six" – Microsoft, Alphabet, Apple, Meta, Amazon, and Nvidia. These tech giants monopolise the AI industry with their immense resources, dominating every layer of the AI stack, from data storage and computational chips to algorithms and user devices. Despite competing, they form an oligarchy, using closed systems to centralise AI power, which threatens individual autonomy, privacy, and innovation diversity. This top-down model, Casey suggests, extends Web2’s exploitative model into the AI-driven metaverse, where users risk becoming passive products rather than active participants.

To shift this paradigm, Casey advocates for decentralised, blockchain-powered AI where users retain control of their data and earn tokens for their contributions to open-source models. By incentivising collaboration over competition, decentralised AI can align with broader human interests, making it adaptable, transparent, and community-driven. However, he stresses that the blockchain industry must prioritise real solutions over speculative gains, with interoperable standards and cross-chain protocols to ensure inclusivity. Through the Decentralized AI Society and similar initiatives, this vision could cultivate an AI ecosystem in the emerging metaverse that empowers individuals and preserves ethical standards over corporate profit.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.