Weekly Journal: Stripe Just Became the Default Bank of the Metaverse

[6 min read] Your weekend guide to getting ahead on the digital frontier. Learn how Stripe just positioned itself as the most powerful financial engine for the emerging Metaverse economy.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 128 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge. New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

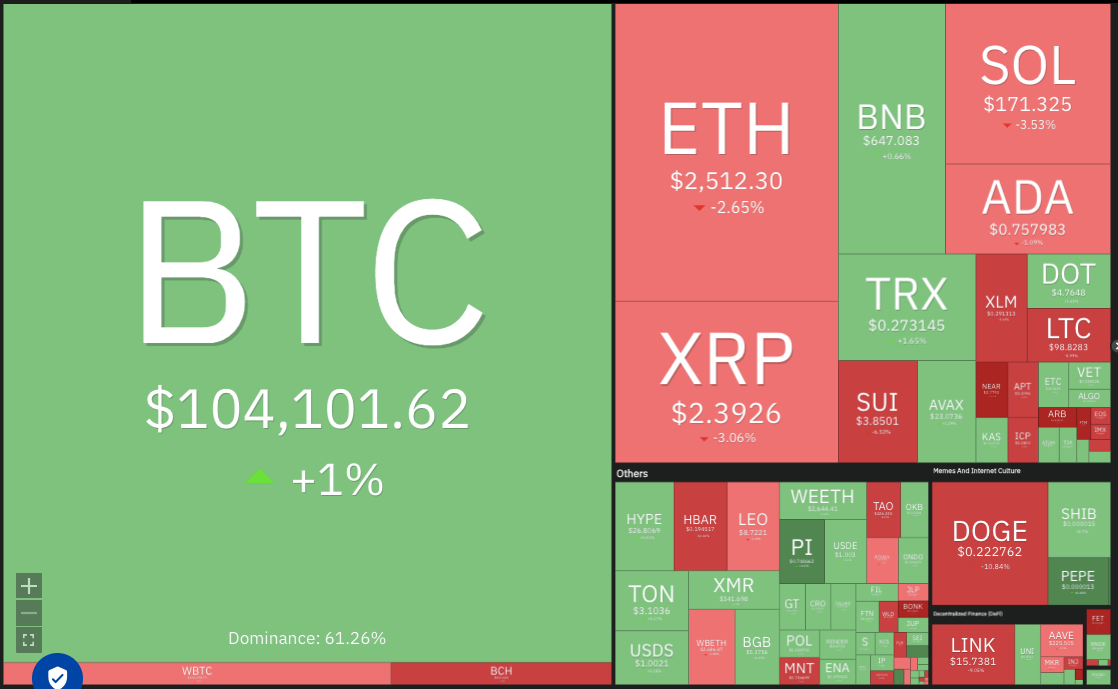

🔥🗺️Heat map shows the 7 day change in price (red down, green up) and block size is market cap. Bitcoin holding over USD$100k

🎭 Crypto Fear and Greed Index is an insight into the underlying psychological forces that drives the market’s volatility. Sentiment reveals itself across various channels—from social media activity to Google search trends—and when analysed alongside market data, these signals provide meaningful insight into the prevailing investment climate. The Fear & Greed Index aggregates these inputs, assigning weighted value to each, and distils them into a single, unified score.

🗞️ Metaverse news from this week:

Stripe Just Became the Default Bank of the Metaverse

With a single update, Stripe has positioned itself as the most powerful financial engine for the emerging metaverse economy. Its new Stablecoin Financial Accounts enable businesses—especially those building in Web3 and virtual worlds—to seamlessly manage global USD flows across both fiat and crypto rails.

For creators, DAOs, and digital marketplaces operating in immersive environments like Decentraland, Spatial, or Meta’s Horizon, this means:

• Instantly opening a USD-denominated account for their LLC

• Accepting stablecoins (USDC, USDB) or fiat payments from users worldwide

• Off-ramping to traditional bank accounts via ACH, Wire, or SEPA

• Paying contributors, vendors, or contractors—onchain or off

By acquiring infrastructure provider Bridge earlier this year for over $1B, Stripe unified crypto payments, banking, and treasury into a single, streamlined dashboard. This removes the friction that has slowed down real commerce inside metaverse platforms.

Until now, many metaverse-native businesses relied on fragmented tools—wallets with limited banking access, third-party processors, or manual workarounds. Stripe’s update finally bridges onchain money and real-world finance with institutional-grade back-office infrastructure.

Most significantly, it unlocks global access to USD without local banking dependencies, giving metaverse projects and virtual economies a scalable, compliant foundation for commerce.

In short: Stripe has quietly become the de facto financial backend of the metaverse—making digital worlds more economically interoperable than ever before.

Meta Ray-Bans Just Got Smarter—and More Inclusive—with Two Game-Changing AI Features

Meta has quietly rolled out two significant accessibility upgrades to its Ray-Ban smart glasses, turning them into even more powerful tools for spatial awareness and independent living—especially for users with low vision.

1. Visual Descriptions via AI

The first upgrade allows users to ask their glasses what they see. The onboard Meta AI responds with detailed visual descriptions, offering real-time context of the environment—everything from pathways and foliage to food items on a kitchen counter. This goes far beyond previous features like Live AI conversation support, bringing spatial computing into sharper focus for accessibility use cases.

2. “Call a Volunteer” with Be My Eyes

Coming later this month, a new partnership with Be My Eyes will allow users to initiate a live call with a sighted volunteer through their smart glasses. Volunteers—connected globally—will be able to see through the glasses’ camera and assist with everyday tasks like selecting clothing or reading signage. The service empowers blind and low-vision users to interact more independently in real-world environments.

Together, these features mark a major step forward in inclusive spatial computing. They blend AI, wearable tech, and human support into a seamless, always-available assistant—embodying the promise of the emerging metaverse not just as a virtual realm, but as an enhanced physical world with embedded intelligence.

Meta’s continued refinement of its Ray-Ban smart glasses signals that the road to the metaverse runs not just through immersive headsets, but through everyday wearables that make the real world smarter, more navigable, and more human.

👓 Read of the Week: Why Typing in XR Still Sucks

As the XR revolution accelerates, one fundamental challenge remains stubbornly unsolved: text input. This sharp and insightful piece explores why typing in extended reality (XR) still feels clunky, inefficient, and unintuitive—despite advancements in immersive hardware.

Key takeaways:

Current solutions are awkward and slow – From air typing to clunky virtual keyboards, today’s XR input options fail to replicate the speed and precision of typing on a physical keyboard.

Voice input isn’t enough – While voice-to-text has improved, it still struggles with privacy, contextual understanding, and user fatigue in long-form tasks.

AI-powered prediction may be the key – The future of XR input might not be better keyboards—it might be smarter interfaces. Context-aware, AI-assisted input could reduce the need for typing altogether, anticipating user intent and autofilling with conversational fluidity.

High-stakes UX problem – Until text entry becomes as seamless as it is in 2D computing, XR devices will remain constrained in productivity use cases—especially in metaverse work environments.

This is a must-read for anyone building XR interfaces, productivity tools, or thinking about the future of work in spatial computing.

🎥 Watch of the week: China Launches World’s Largest Fleet of Autonomous Electric Mining Trucks

State-owned energy giant Huaneng Group has deployed 100 unmanned electric mining trucks in Inner Mongolia — the world’s largest fleet of its kind. Each vehicle is equipped with Huawei’s autonomous driving systems, marking a major leap in industrial automation.

Why it matters: This move highlights China’s acceleration toward AI-powered infrastructure, where physical operations increasingly mirror digital simulations — a key tenet of the industrial metaverse. From mining to logistics, autonomous agents (both digital and physical) are becoming central to the future of work.

AI Showcase🎨🤖🎵✍🏼:

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions.

This week, Visa and Mastercard revealed plans to launch autonomous AI agents capable of spending on behalf of consumers, marking a major shift in how we interact with money. Both companies aim to integrate these “agentic” technologies into everyday shopping experiences, allowing users to assign tasks such as booking holidays, managing subscriptions, or completing errands, all with preset spending limits and approval preferences.

Visa’s “Intelligent Commerce” platform, developed in partnership with OpenAI, Microsoft, and others, lets users delegate purchases to AI bots that operate under user-defined parameters. Mastercard’s “Agent Pay” adds a strong security layer through agentic tokens, creating single-use, AI-authorised codes for transactions. Both systems are designed to increase convenience while retaining human oversight - but they raise questions about trust, debt, and fraud protection.

While the technology promises to streamline consumer spending and automate the mundane, it also sparks serious concerns. Experts warn that without careful design and regulation, AI-driven spending could exacerbate credit card debt or expose users to new fraud risks. With Australia’s big banks yet to officially adopt the systems, widespread rollout remains speculative—but security features like agentic tokens may arrive within a year, laying the groundwork for a more autonomous financial future.

That’s all for this week! If you have any organisations in mind that could benefit from keynotes about emerging technology, be sure to reach out. Public speaking is one of many services I offer.