📔 Weekly Journal: The Mumbai Metropolis Metaverse 🇮🇳🥽🌐

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as Mumbai's 3D VR platform where citizens explore city-wide megaprojects

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 64 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

Lots of buzz as European Central Bank maintained their stance that Bitcoin's fair value remained zero, despite recent developments. The approval of 11 spot Bitcoin ETFs in the US, surpassing $3 billion in net flows, didn't sway their opinion. They argued that Bitcoin's slow, costly transactions and environmental impact made it an unsuitable investment, emphasising its “history of manipulation and fraud”. As Bitcoin hit $51,645.91 with a $1 trillion market cap, their dissenting views sparked controversy on Crypto Twitter, my favourite clap back is below:

🔥🗺️ 7-day heatmap below, Bitcoin took a little breather, Ethereum knocking on $3000

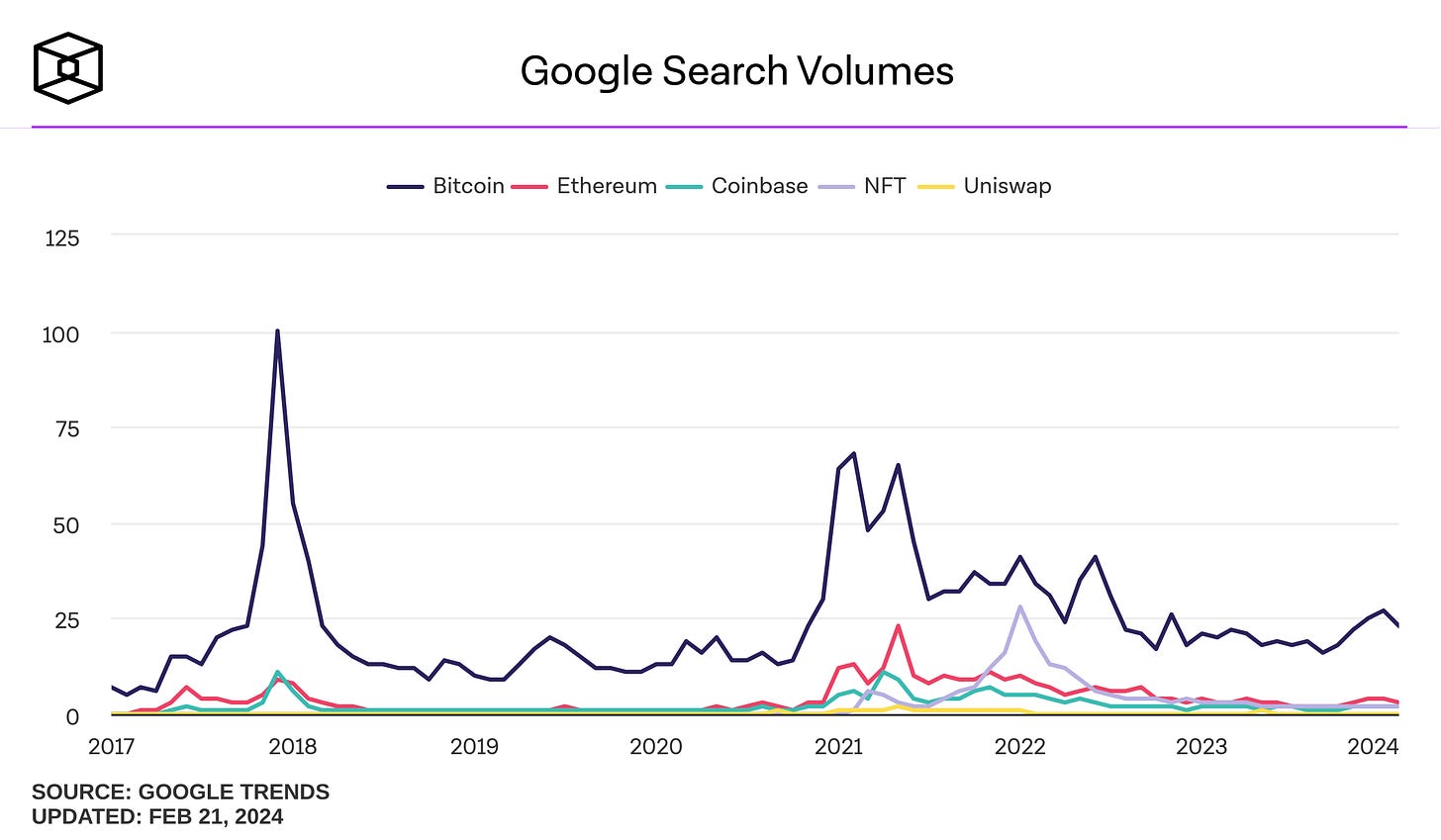

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. What’s interesting is that there is hardly any interest from retail (see google searchs below), so when the FOMO hits there should be a mother of all bull runs.

Interesting news from this week🗞️

🇮🇳 In a bid to showcase its infrastructure revolution, Mumbai, India's financial hub, recently unveiled the Mumbai Metropolis Metaverse. This virtual platform enables users to explore ongoing and upcoming city-wide megaprojects via 3D and VR. The initiative, launched by Maharashtra's deputy chief minister, Devendra Fadnavis, aims to engage citizens in monitoring developments impacting their daily lives. Alongside, the Reserve Bank of India plans to introduce offline functionality for its digital rupee to facilitate transactions in areas with poor internet access.

🏦 Citibank is trialling the tokenisation of private equity funds on the Avalanche blockchain. Partnering with industry giants like WisdomTree and Wellington Management, they are exploring the potential of Avalanche's Spruce Subnet, to revamp capital markets. This move signifies Wall Street's deepening interest in blockchain applications, following other financial heavyweights embracing the technology. The trial includes various aspects like token transfers and collateralised lending, showcasing the potential for automation and improved compliance in investment processes. Nisha Surendran, Citi Digital Assets' emerging solutions lead, emphasises the quest for operational efficiencies and new market models.

📈 Social media giant Reddit has filed for an IPO with the SEC, disclosing investments in Bitcoin and Ethereum. The company revealed it added BTC and ETH to its balance sheet, though the exact amount remains undisclosed. Additionally, Reddit stated it acquired Polygon (MATIC) for virtual goods transactions. Despite winding down its crypto reward scheme, Reddit continues its crypto ventures, including launching NFT avatars on Polygon. The company, known for its digital innovation, plans to trade under the ticker RDDT on the NYSE if it goes public.

👓Read of the Week

I am a big fan of Visual Capitalist. This weeks read is looking ahead to 2024, experts offer a plethora of forecasts covering the economy, markets, geopolitics, and technology. The Prediction Consensus compiles 25 common predictions from over 700 forecasts, presenting a comprehensive overview of anticipated trends. This "bingo card" visual and accompanying article summarizes the most cited trends and opportunities experts foresee for the year, drawing from various sources including reports, interviews, and podcasts.

🎥 Watch of the week

I enjoyed this interview with Sebastien Borget as he explores the concept of an open metaverse. Lots of good discussions on blockchain, NFTs, and the future of digital ownership. His vision challenges traditional models, offering new possibilities for user interaction and engagement in virtual worlds.

AI 🎨🤖🎵✍🏼

Inspired by his father's vision loss, Ehsan Vaghefi, co-founder of Toku Eyes and a University of Auckland optometry and vision science alumnus, is spearheading AI-driven eye diagnostics. Utilising retinal imaging, his startup detects early cardiovascular and diabetic indicators, and has just raised $8m USD to grow the business.

Toku Eyes' vast image database, exceeding two million samples, prompts specialist referrals upon risk detection. Overcoming AI integration hurdles in clinical settings, the team's diversity fosters innovation. Regulatory compliance, including FDA breakthrough status, underscores privacy protection. Vaghefi envisions AI streamlining medical consultations, potentially halving appointment times. Amazing.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.