📔 Weekly Journal: The Political Rise of Bitcoin in America 🇺🇸

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as how bipartisan support for bitcoin & crypto is helping shape the upcoming US election

Happy long weekend to all you Kiwis!

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 78 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

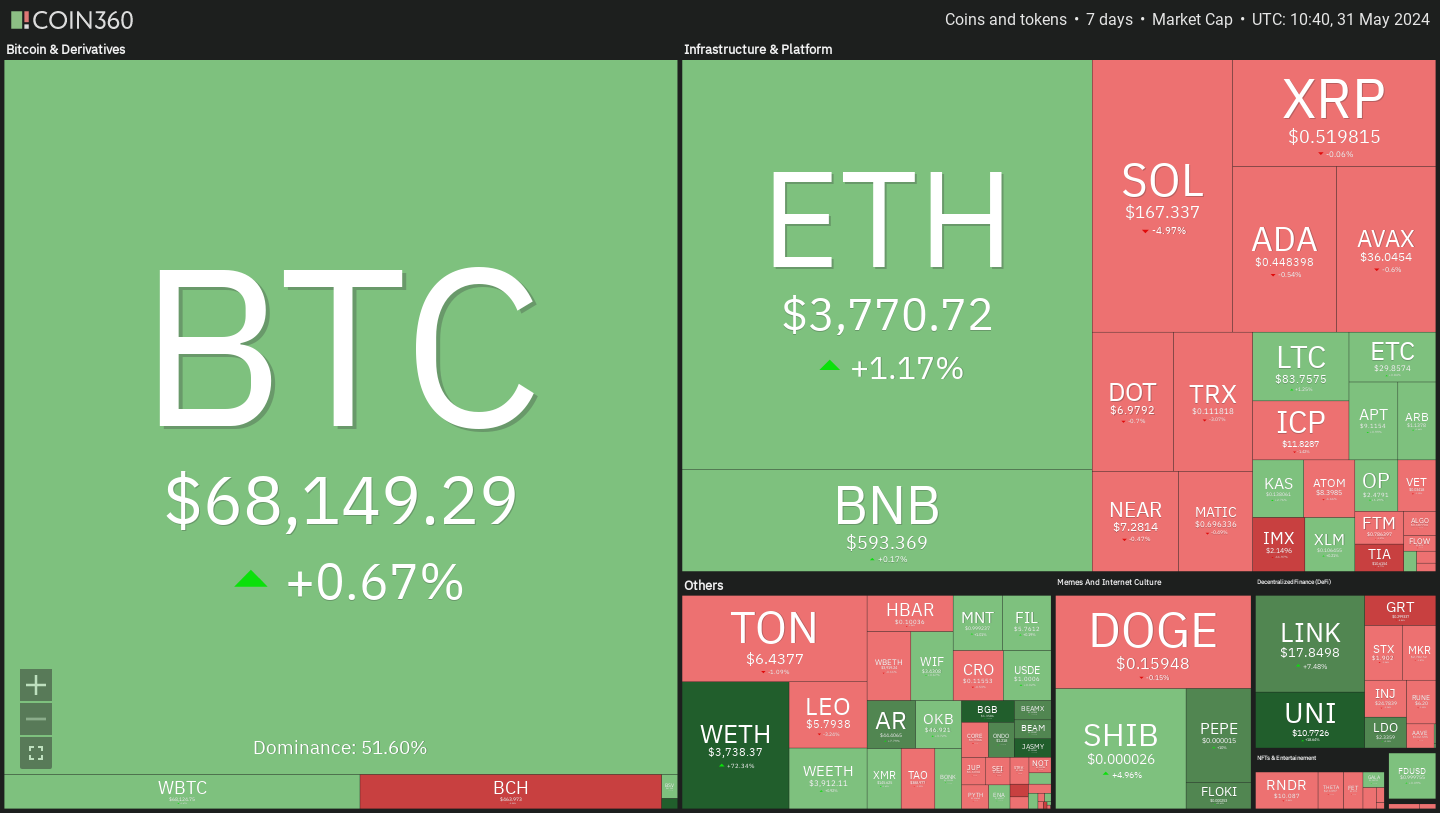

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

🇺🇸 President Joe Biden vetoed a bipartisan House Joint Resolution to overturn the SEC's Staff Accounting Bulletin 121, which mandates financial institutions holding crypto for customers to keep these assets on their balance sheets. This guidance, widely criticised by both parties, banking groups, and the crypto community, is seen as overly restrictive. By vetoing this resolution, Biden has alienated himself from these key groups. Critics argue his decision ignores the practical challenges faced by financial institutions and hampers the crypto industry's growth. Biden's stance, framed as protecting consumer and investor well-being, instead restricts the SEC's ability to adapt to the evolving financial landscape.

🇸🇬 It leaked this week that DBS, Singapore's largest bank, is reportedly an ether (ETH) whale, holding 173,753 ETH worth $647 million, according to on-chain analytics firm Nansen. This holding has already yielded a $200 million profit. Despite DBS's denial of this position, the bank is heavily involved in the crypto space, offering digital asset custody, a trading exchange for security tokens, and a portfolio management app for traditional and crypto assets. DBS's activities align with the growing trend of investment banks using Ethereum for tokenising capital markets. Since 2020, numerous firms have integrated crypto into their reserves, with Bitcoin ETFs beginning U.S. trading in January. The bank’s recent report indicates rising crypto interest from retail investors, high-frequency traders, and hedge funds.

🌐 This week NEAR Protocol has launched NEAR Name Tokens, a pioneering project aimed at revolutionising digital identities within the Web3 ecosystem. Announced on their official X account and detailed in a blog post, this initiative builds on NEAR's previous digital identity solutions and highlights their ongoing efforts to bridge Web3 and traditional internet infrastructures.

NEAR Name Tokens provide cross-platform, multichain digital identities, simplifying wallet address management and enhancing user convenience across multiple blockchain networks. They also function as infrastructure identifiers, cross-platform usernames, and verifiable credentials, facilitating seamless interactions within decentralised ecosystems like SportFi, SocialFi, GameFi, and DeFi. This launch underscores NEAR Protocol’s commitment to innovation, interoperability, and enhancing user experience in the Web3 space.

👓 Read of the Week

This weeks read is “Bitcoin at the Forefront of American Politics” by Swan.

TLDR: One of the catalysts in Bitcoin’s recent price appreciation seems to be rising political support in the US. Recent political shifts include the Senate overturning the SEC's SAB-121 rule and former President Trump’s pro-Bitcoin stance, contrasting sharply with the Biden administration's more sceptical view led by Senator Elizabeth Warren. Trump’s campaign has even pledged to accept cryptocurrency donations. These developments highlight Bitcoin’s growing political influence, with bipartisan legislative victories and an increased acceptance of cryptocurrencies. As politicians recognise the voting power of the 17% of Americans who own crypto, Bitcoin’s integration into mainstream politics is becoming inevitable, promising a brighter future for digital currencies in the US.

🎥 Watch of the week

I loved this video, part of the Consensus 2024 event this week. This was the grand finale talk from Neal Stephenson, the visionary who coined "metaverse" and foresaw technologies like virtual reality and digital currencies in his novels. Neal discusses the launch of Lamina1, a groundbreaking Layer 1 blockchain for the open metaverse, which began right here at Consensus two years ago. He talks about into the importance of creating enjoyable metaverse experiences, ensuring content creators are compensated, and the challenges of integrating blockchain with traditional game development.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

Lots of murmurings this week that Apple is planning a significant AI upgrade for Siri in iOS 18, set to debut at WWDC 2024. This update will enable Siri to control individual app features, such as opening documents, moving notes, and summarising articles. To achieve this, Apple engineers have rearchitected Siri's software with large language models (LLMs), akin to those used by chatbots like ChatGPT. While integrating OpenAI's ChatGPT and Google's Gemini, Apple's own LLM work is key. Initially, these advanced features will be exclusive to Apple apps and will only handle one command at a time. However, multi-command functionality is anticipated. Though unveiled in 2024, these features won't launch with iOS 18 in September but will roll out in 2025. Basic AI tasks will be on-device, while advanced ones will use Apple's cloud servers, with security measures like the Secure Enclave. Full details will be revealed at WWDC 2024 on June 10.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.