📔 Weekly Journal: The Trump Effect

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & how investors view digital assets as a hedge against political instability and inflation

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 101 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

Regardless of what you think about him, Donald Trump's re-election bid has had a notable influence on the Bitcoin and crypto markets (largely due to his economic policies and the broader political climate). Historically, Trump’s presidency coincided with significant market volatility, which often drove interest in Bitcoin as a hedge against traditional financial instability. His stance on issues like inflation, fiscal policy, and regulatory uncertainty has reinforced Bitcoin's appeal as a store of value.

In addition, his criticism of the US Federal Reserve's monetary policy, alongside his rhetoric on government control, has fueled demand for decentralised assets like Bitcoin, which are seen as alternatives to fiat currencies. The crypto market also anticipates regulatory uncertainty during a second Trump term, which could either hinder or accelerate innovation in blockchain technology depending on how his administration approaches digital assets. These factors have contributed to fluctuations in the crypto market as investors react to the shifting political landscape.

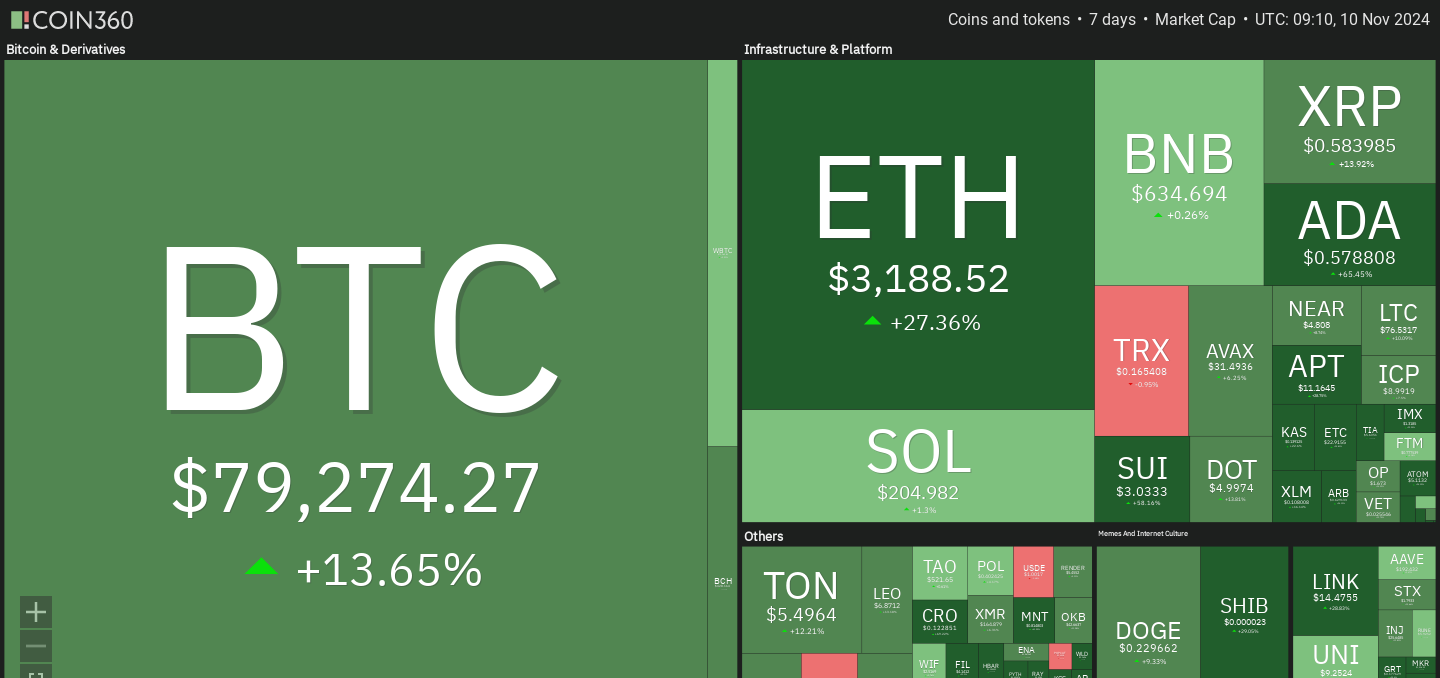

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week. A sea of green this week.

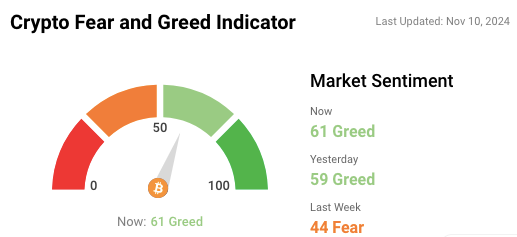

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

A man by the name of Cory Owens is creating a 3D digital replica of Downtown Memphis, called Memphis METAS Downtown Digital Twin, in the metaverse. A decade-long passion project, it uses the Unreal game engine to reconstruct iconic city landmarks. Owens sees the project as a fusion of his love for Memphis, technology, and video games. While currently a work-in-progress, the virtual city allows users to explore and interact. Owens envisions it as a tool for urban planning, tourism, education, and local business advertising. The project aims to innovate Memphis by showcasing its past, present, and future in a virtual format.

The University of Oxford's TORCH centre is launching Fantasy Futures: Guardians of Oxford, an immersive XR experience that brings Oxford’s gargoyles to life in a gamified narrative. Running from November 11-24, the project uses motion tracking technology to guide visitors through an interactive journey where computer-generated gargoyles protect the city from climate change. This innovative experience aims to engage younger audiences with Oxford's rich Humanities research, blending gaming, art, and environmental themes. The project explores hybrid creatures in Oxford's architecture and promotes a novel, participatory approach to research, with potential for national and international expansion in the metaverse.

👓 Read of the Week

This week’s read is Snow Crash author Neal Stephenson on the ‘metaverse stock price’. At the GamesBeat Next 2024 event, Neal Stephenson, author of Snow Crash, discussed the evolving concept of the metaverse, which he first introduced in his 1992 novel. Stephenson emphasized the metaverse's spatial nature, where users experience shared virtual spaces and interact across various digital environments. He likened the metaverse to a fluctuating stock, where its value rises with successful projects like Fortnite, Minecraft, or Roblox, but dips when initiatives falter.

Stephenson, also a cofounder of Lamina1, a Web3 company, advocates for a decentralized metaverse where creators are fairly compensated for their contributions. He highlighted Lamina1’s blockchain, aimed at tracking and rewarding digital creators within this open metaverse. He also explored how AI could enhance storytelling, particularly through platforms like Whenere, which integrates AI to create interactive narratives within public domain worlds, such as *Pride and Prejudice*.

Stephenson’s vision for the metaverse is one that remains open and creator-driven, avoiding monopolistic control by major platforms. He expressed concerns about the future of AI and blockchain, acknowledging their potential but stressing the importance of ethical considerations. His insights into the metaverse reflect a broader, long-term vision of immersive, decentralized digital spaces, with AI and user-generated content playing pivotal roles.

🎥 Watch of the week

This video explores the evolving relationship between real estate and emerging technologies like the metaverse, blockchain, and Web3. The metaverse, as often misrepresented in virtual real estate transactions, is not yet a fully interconnected digital space; instead, various platforms offer blockchain-backed assets without seamless integration across virtual worlds. The conversation also highlights how AI and blockchain can streamline commercial real estate processes, from automating leases to providing transparent property records. The future will see faster transactions, with blockchain making property buying and selling more efficient. AI tools will also enhance marketing and sales efforts, driving efficiencies across industries.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

In the emerging metaverse, AI-generated images are playing a crucial role in shaping virtual worlds and experiences. Tools like MidJourney (which I use for the cover imagesevery week), Leonardo AI, and Ideogram each offer unique strengths in AI image generation. MidJourney is celebrated for its creative inspiration, perfect for conceptualising visual styles, while Leonardo AI excels in providing control over precise details like character poses. This balance between creativity and control is vital for metaverse designers who need both imaginative freedom and structural consistency.

Consistency is particularly important in the metaverse, as characters and environments must maintain a coherent visual identity across various scenes and platforms. AI tools have evolved to address this with features like character references and stable diffusion models. For creators, understanding these tools and their strengths is essential for producing immersive, consistent, and visually compelling experiences in virtual spaces.

As AI tools advance, the focus is shifting from detailed prompt engineering to utilizing visual inputs, allowing creators to streamline workflows and reduce pre-production time. This is particularly impactful in the metaverse, where quick iteration and high-quality visuals are needed to meet the dynamic demands of virtual worlds and digital experiences. AI’s role in the metaverse accelerates creativity, offering both efficiency and precision for creators shaping the future of digital environments. Read more in the interview below.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.