📔 Weekly Journal: Toyota Robot Breaks Basketball Record

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news as well as Toyota's example of how robot tech is accelerating.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 105 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week. On Thursday this week, Bitcoin finally reached the USD$100,000 milestone. It continues to enjoy a privileged position of the first mainstream asset in history that has inelastic supply, with increasing demand. This means that no matter how much demand, there will never be a change in how many fresh bitcoins are made. Add to this the disillusionment in traditional currencies with central banks debasing their currencies leading to inflation. All it takes is basic understanding of supply & demand to predict that the BTC/USD price is therefore likely to go up. We are in uncharted territory!

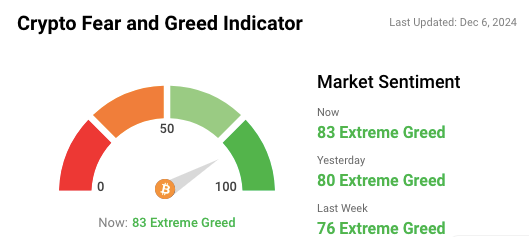

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

🗞️ Interesting news from this week

Toyota’s AI-powered humanoid robot, CUE6, has earned its second Guinness World Record for the longest successful basketball shot by a robot, sinking a basket from nearly 25 meters away. Originally a LEGO prototype created in 2017 by Toyota volunteers, CUE has evolved into a highly sophisticated robot, capable of real-time learning, dribbling, and even retrieving the ball. This latest achievement, witnessed in Nagakute, Japan, marks a new milestone in the robot’s journey, following its 2019 record of 2,020 consecutive free throws. As robots like CUE continue to push the limits of sports, including demonstrating skills at the B.League All-Star Game, they could soon bridge the gap between physical sports and the emerging metaverse, where AI-driven athletic feats are set to reshape how we engage with both virtual and real-world games. Could the NBA be next for CUE? Only time will tell.

Samsung is set to unveil its first smart glasses during its January Unpacked event, alongside the Galaxy S25 series. Unlike Meta's Ray-Bans, these smart glasses will focus on a more traditional wearable design, weighing only 50 grams. Features are expected to include a voice assistant, audio playback, gesture recognition, and the ability to make payments, but without the augmented reality display or projector seen in other models. Samsung's glasses aim to blend in with everyday fashion while offering subtle tech enhancements. The glasses are not part of the company's collaboration with Qualcomm and Google on mixed-reality devices, indicating a more accessible consumer product. While a full launch may not happen until later in the year, the teaser at the Unpacked event signals increased competition in the smart glasses market, a positive for consumers as more options emerge in the expanding metaverse.

David Sacks, newly appointed as "AI and Crypto Czar" by President-elect Donald Trump, recently discussed Bitcoin's potential to separate money from the state. Speaking with Anthony Pompliano, Sacks, a seasoned technologist and pro-crypto advocate, highlighted Bitcoin's censorship-resistant nature and its ability to hedge against fiat inflation. He compared the historic union of church and state to the current relationship between money and government, suggesting that Bitcoin could be the key to decoupling these two forces in a "sci-fi future." His comments reflect a growing movement within the cryptocurrency space, emphasizing Bitcoin's autonomy and role in the emerging metaverse. Sacks' appointment is seen as a major win for the crypto industry, signaling potential regulatory clarity ahead. Additionally, his continued support for Solana and Multicoin Capital underscores his commitment to shaping the future of digital assets.

👓 Read of the Week:

A Wall of Separation Between Money and State – Policy and Philosophy for the Era of Cryptocurrency

Adding some colour to the concept of separating Money & State, I came across this article. Exploring the evolving landscape of money in the digital age, it makes a strong a case for the need for a clear distinction between money and state. The authors delve into two long-standing debates: the role of the state in creating money and whether it should be a tool for political or economic control. With the rise of decentralised cryptocurrencies like Bitcoin, the authors advocate for the separation of money from state control, arguing that Bitcoin and other decentralised currencies offer a safeguard against political manipulation and inflation. They present a clear classification of digital currencies, distinguishing between centralised and decentralised systems, and argue that government-backed digital currencies (CBDCs) could lead to unprecedented surveillance and control over personal finances.

The article also proposes policies for adopting decentralised digital currencies in developing nations, where unstable currencies and inflation often result from government mismanagement. By embracing private, decentralised currencies, these economies could restore monetary stability and attract foreign investment. Ultimately, the authors call for a rethinking of money, advocating for a decentralised, fixed-supply model that challenges the discretionary powers of central banks, offering a more stable and transparent alternative for the future.

🎥 Watch of the week

Watch the record-breaking shot, and learn about how it came to be

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

The recent Popular Mechanics piece suggesting that the technological singularity might be just around the corner based on improved AI translation speeds is a glaring example of superficial analysis in tech journalism. Singularity, the theoretical point at which artificial general intelligence (AGI) surpasses all human intelligence, cannot be measured by mere translation efficiencies. The article's reliance on "Time to Edit" (TTE) as a metric for approaching singularity is fundamentally flawed and misleading.

AI's ability to translate or transcribe faster than a human no more indicates AGI than Microsoft Excel's capacity to handle spreadsheets implies it is on the brink of conscious thought. Large language models (LLMs), like those used for translations, are designed for specific tasks—optimised through extensive training on vast datasets to perform well in narrow, predefined domains. This is a far cry from AGI, which requires an ability to understand, learn, and apply knowledge across a broad range of tasks, akin to human intelligence.

The article's approach oversimplifies the complex, nuanced field of AI development. It fails to distinguish between specialised tools and the holistic capabilities expected of AGI. Popular Mechanics, a publication with a rich history of covering science and technology, should offer its readers a more critical and nuanced analysis. Readers deserve clear explanations of AI terms and progress, enabling them to discern genuine advancements from sensationalised metrics.

In fostering a more informed readership, media outlets must challenge themselves to elevate their reporting standards, particularly on topics as significant and potentially transformative as AI and singularity. This is crucial not just for accurate reporting, but for helping the public understand and engage with technological developments critically and constructively. Stay smart out there everyone.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.