📔 Weekly Journal: Trump & Biden Memecoins 🗳🪙

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as the memecoins intersecting politics, technology, and financial behaviour.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 66 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

Inflows into Bitcoin ETFs have far surpassed those of Gold, and it is not even close. The “digital gold” and fixed supply narrative is very appealing in a global economy with inflation issues everywhere.

🔥🗺️ 7-day heatmap below, which shows the current share of market for the top cryptocurrencies, alongside total marketcap (USD) and the change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. If I were trading I might take some profits but I’m in it for the long term.

Interesting news from this week🗞️

🇺🇸 Political memecoins are having a moment! They offer a fascinating glimpse into the psyche of retail investors within financial markets. These digital tokens, often driven more by sentiment than traditional fundamentals, reflect a convergence of politics and finance in the age of social media. The surge in projects like the "MAGA memecoin" or "ReptilianZuckerBidenBartcoin" underscores the power of narrative and collective belief in shaping market dynamics. Moreover, the fluctuating fortunes of these coins, influenced by political events and online discourse, highlight the agility and impulsivity of retail investors, who readily embrace unconventional assets tied to their ideological affiliations. I like to think that political memecoins not only serve as speculative instruments but also as cultural artefacts reflecting the intersection of politics, technology, and financial behaviour in the digital age.

🐭 Disney is investing $1.5 billion in Epic Games to create a vast interconnected gaming and entertainment universe linked to Fortnite. This collaboration mirrors a previous deal with Lego. The project, described as a "persistent universe," (*COUGH*metaverse*COUGH*) will incorporate Disney, Pixar, Marvel, Star Wars, and Avatar franchises. Players can expect a diverse range of experiences and content, powered by Unreal Engine. While specifics remain scarce, the venture aims to merge the Disney and Fortnite communities in innovative ways, promising groundbreaking storytelling and gameplay opportunities.

🎟 OpenSea's collaboration with Coachella signals NFT potential beyond profile images. The partnership unveils three NFT collections offering virtual and real-life VIP experiences and merchandise. Priced at $1,499 each, the initial collection includes a VIP pass and lounge access. Powered by Avalanche blockchain, Coachella aims for utility-driven NFTs. CEO Devin Finzer sees ticketed collections as key for crypto mainstream adoption. OpenSea's move towards accessible NFT purchasing via email sign-ups reflects industry efforts to enhance usability. The partnership highlights NFTs' evolving role beyond collectibles to offer tangible real-world benefits.

👓Read of the Week

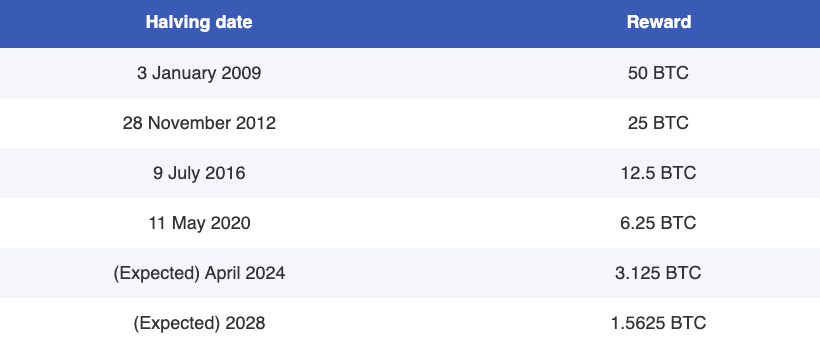

In 2024, Bitcoin undergoes its halving event, reducing mining rewards by half every four years. Read all about it in the Forbes article published this week: Bitcoin Halving 2024 – What You Need To Know

This scarcity mechanism, designed to combat inflation, affects Bitcoin's price dynamics. The first halving was in 2012, followed by subsequent events in 2016 and 2020. Predictably, the next halving is expected around April 21, 2024. While halvings historically lead to price volatility, they often result in long-term bullish trends given the reduced supply.

🎥 Watch of the week

This week we have a great example of a 180-degree turn in narrative.

WEF in 2017: “Bitcoin mining is dirty, wasteful & on track to consume all of the world’s energy by 2020. We must stop it.”

WEF in 2024: “Bitcoin mining is clean, creates jobs, and is powering chocolate factories in the African rainforest.”

This isn’t an accident. The CEO of BlackRock, Larry Fink, is on the WEF Board of Trustees. BlackRock is the largest spot Bitcoin ETF provider in the world and they are adding billions of dollars in Bitcoin every week to their fund. Bitcoin mining is being positioned as ESG-friendly.

AI 🎨🤖🎵✍🏼

🇮🇳 India has allocated $1.24 billion to bolster the growth of AI through the IndiaAI Mission, aiming to democratise access to computing power and foster nationwide AI development. The Union Cabinet approved the initiative, earmarking 10,300 crore rupees ($1.24 billion USD) for the next five years. The mission seeks to support AI startups and innovations, providing essential resources for students, innovators, and educational institutions. With a focus on public-private partnerships, the mission aims to build AI infrastructure, introduce educational courses, and finance deep-tech AI startups. Prime Minister Narendra Modi sees this as a significant step towards global AI leadership, anticipating economic expansion and job creation.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.