📔 Weekly Journal: US Open Dives Into Roblox

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & how the US Open is expanding reach with the Roblox Metaverse, engaging young fans

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 92 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week. Nasty!

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Yikes!

🗞️ Interesting news from this week

🎾 As the US Open concludes, it embraces the metaverse by integrating with Roblox, aiming to extend the tournament's reach and engage younger audiences. The US Open, alongside other major tournaments, has crafted a dedicated gaming space in NYC's Billie Jean King Tennis Center, offering various tennis video games, including official US Open experiences on Fortnite and Roblox. This initiative has drawn significant traffic, with millions playing these games. It facilitates year-round engagement by allowing players to navigate between different tournaments' virtual worlds, thus maintaining interest and potentially converting virtual experiences into real-world tennis engagement.

Ⓜ️ China's metaverse sector is forecast to expand significantly over the next three years, driven by advancements in 5G, AI, blockchain, cloud computing, and VR. Highlighted in a Hurun Report at Shanghai's 2024 Consumer Technology and Innovation Exhibition, the industry's growth is set to transform entertainment, education, and healthcare. The report lists 200 companies with significant potential, led by Huawei, Alibaba, and Baidu, predominantly located in Beijing, Shanghai, and Shenzhen. This expansion is expected to revolutionise both production and lifestyle, necessitating continuous development in technical standards, platform construction, user experience, and regulatory frameworks to support the burgeoning metaverse.

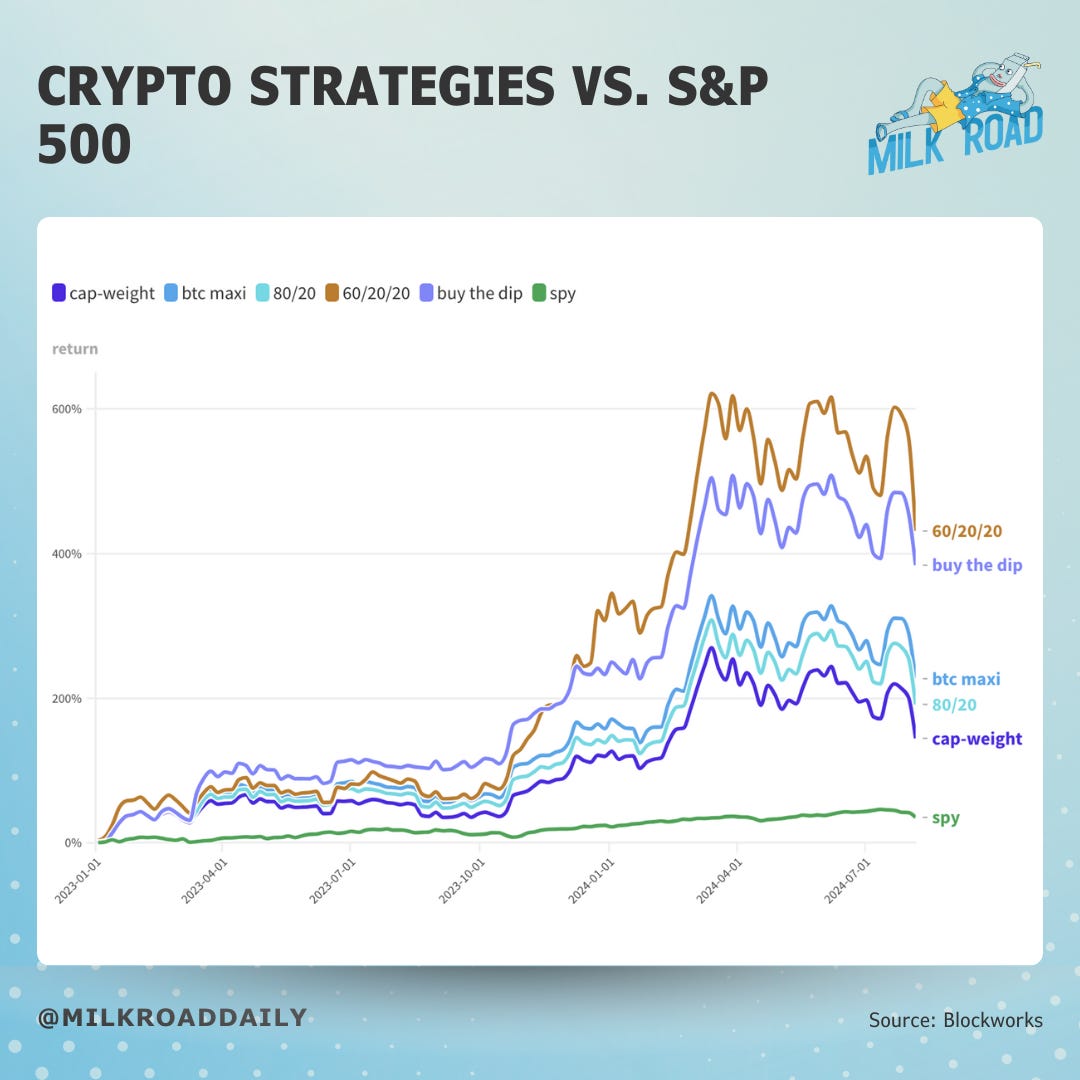

📈 This week, Mild Road published some backtesting data. Between January 2023 and August 2024, five distinct crypto investment strategies outperformed the S&P 500 by significant margins.

The cap-weighted strategy, akin to the S&P 500's approach but applied to crypto, achieved a 144% return by distributing investments among the top 20 cryptocurrencies.

The 80/20 Bitcoin-Ethereum split offered a 190% return, emphasising the solid performance of these major assets.

An all-in Bitcoin strategy yielded a 226% gain, highlighting the potential of focused investments.

The buy-the-dip strategy turned a $10,000 investment into $48,300 by capitalising on market dips, requiring acute market timing and nerve. Lastly, a mix of 60% Bitcoin, 20% Ethereum, and 20% Solana skyrocketed returns to 620%, proving that even a small allocation to high-performing assets can dramatically boost portfolio performance.

👓 Read of the Week

Eric Flaningam's expertise in the business side of Tech Markets is notably valuable, particularly his insightful analysis into the financial dynamics of Generative AI (Gen AI). This weeks read is his recent article which delves deeply into the investment and return aspects of AI, especially in the context of hyperscalers like Amazon, Google, Microsoft, and Meta who have heavily invested in AI infrastructure. Despite substantial capital expenditures amounting to $177 billion over the past year, the direct ROI on these AI investments remains ambiguous. However, Eric's analysis suggests that these investments are strategically sound, aiming to secure long-term computational power and essential resources like real estate and power, which are expected to remain scarce. His breakdown not only addresses the immediate financial implications but also sets a framework for evaluating the long-term value creation potential of AI, particularly in how it can transform business operations and consumer services. Eric champions a nuanced view, advocating for a balanced understanding of both the costs and the transformative potential of AI in the tech industry.

🎥 Watch of the week

This weeks watch listen is a dive into the world of spatial computing and virtual worlds with Cathy Hackl, a globally recognised tech and gaming executive and the CEO of Spatial Dynamics. Cathy is a leading voice in augmented reality, AI, and gaming platforms strategy, and has been instrumental in shaping the tech approaches of major brands like Nike, Ralph Lauren, and Walmart. Today, she'll share insights from her experiences at Amazon Web Services, Magic Leap, and HTC VIVE. Join us as Cathy discusses her journey into the metaverse, the pioneers of spatial computing, and the essential strategies and timeframes CMOs should consider when venturing into this transformative space. I really enjoyed this fascinating exploration of the cutting-edge intersections of technology and marketing.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

Peter-Lucas Jones, Chief Executive of Te Hiku Media, has been honoured on TIME magazine's 2024 AI list for his innovative efforts in preserving the Māori language using artificial intelligence. Operating from Kaitāia, his company has developed a speech-to-text model for te reo Māori, which boasts the highest global accuracy rate at 92%. This breakthrough demonstrates the vital role indigenous communities can play not only as consumers of technology but as its creators. Jones is set to travel to San Francisco to join the TIME 100 AI event, aiming to inspire other native leaders and highlight the significance of indigenous data sovereignty. He equates data ownership and intellectual property rights to land rights, emphasising their importance in maintaining cultural identity. Te Hiku Media has also collaborated with RNZ and the New Zealand Qualifications Authority, enhancing the provision of te reo Māori transcripts and furthering its impact.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.