📔 Weekly Journal: USDC Goes Apple: Tap-to-Pay Feature Coming Soon

[6 min read] Your weekend guide to getting ahead on the digital frontier. Today, the usual market news & the stablecoin integrating with Apple's tap-to-pay, advancing blockchain adoption.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 89 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

- Ryan

🌐 Digital Assets Market Update

To me, the Metaverse is the convergence of physical & virtual lives. As we work, play and socialise in virtual worlds, we need virtual currencies & assets. These have now reached mainstream finance as a defined asset class:

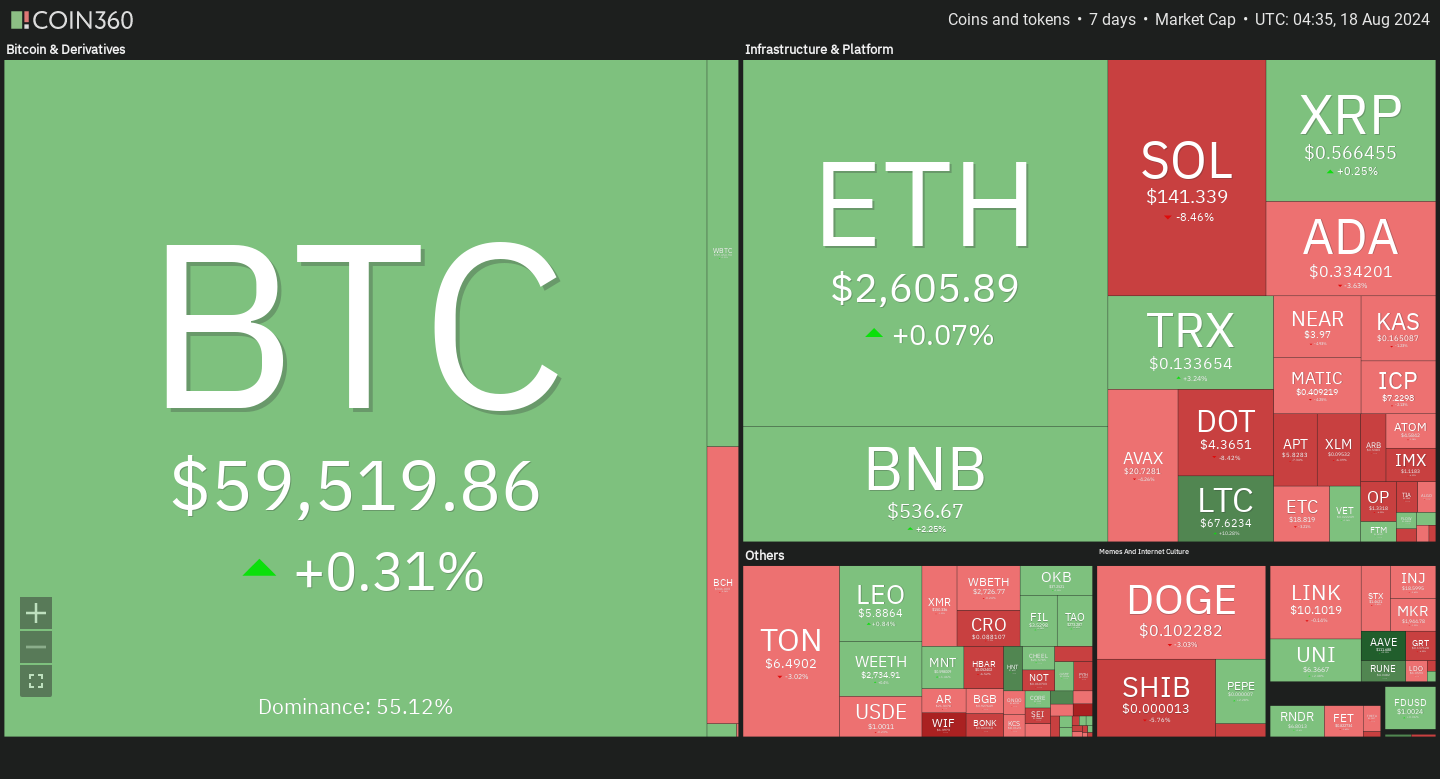

🔥🗺️ 7-day heatmap below, showing the current share of the market for the top cryptocurrencies, and their change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. It has been a rough week for sentiment!

🗞️ Interesting news from this week

💳 Mastercard is shifting its focus in the cryptocurrency space, moving away from stablecoins and concentrating on digital assets more broadly. The company is prioritising investments in blockchain technology and cryptocurrency infrastructure, reflecting a strategic pivot to support diverse digital asset use cases. Mastercard's new approach includes partnerships and initiatives aimed at enhancing cryptocurrency payments, security, and accessibility. This shift is part of a broader trend where traditional financial institutions are adapting to the evolving digital asset landscape. Mastercard's commitment to this area highlights its role in shaping the future of digital finance, with a focus on fostering innovation and integration of cryptocurrencies into mainstream financial systems. The company’s strategy aims to capitalise on the growth of the crypto market while navigating the regulatory and technological challenges that come with it.

⚽️ SSC Napoli has announced its entry into the metaverse through a strategic partnership with The Sandbox, a leading decentralised gaming platform. This collaboration marks the Serie A football club's expansion into the digital space, aiming to engage with fans in innovative ways. The partnership will feature exclusive digital assets and virtual experiences, including branded land and interactive content within The Sandbox universe. Fans will have the opportunity to explore a virtual Napoli-themed environment, participate in unique events, and access exclusive NFTs. This move is part of SSC Napoli's broader strategy to enhance its global presence and connect with a tech-savvy audience. The integration of football culture with emerging digital technologies highlights the growing intersection of sports and the metaverse. This initiative is expected to boost fan engagement and open new revenue streams for the club.

🍎 Circle is set to integrate its USDC stablecoin with Apple’s tap-to-pay feature, enhancing digital payment options on iPhones. The upcoming integration will enable users to make payments with USDC by simply tapping their iPhones. Circle CEO Jeremy Allaire announced that this new feature aims to streamline transactions and boost the adoption of digital currencies. The move aligns with Apple's expansion of its payment ecosystem and represents a significant step towards integrating blockchain technology into everyday financial activities.

👓 Read of the Week

In this week's "Read of the Week," we delve into an insightful article uncovers essential AI tools tailored for non-techies. The piece highlights user-friendly solutions designed to enhance productivity and creativity without requiring deep technical knowledge. From ChatGPT’s versatile conversational capabilities to Midjourney’s impressive image generation, and tools like Jasper for content creation and Synthesia for AI-driven videos, this article showcases how advanced AI can be accessible and practical. Whether you're looking to streamline tasks or boost innovation, these tools offer intuitive ways to integrate AI into your workflow:

🎥 Watch of the week

MicroStrategy is changing how companies manage their finances by using creative strategies to increase their Bitcoin holdings. By issuing more shares and taking on debt, they’ve grown their market value 26 times. This panel interview explains how Michael Saylor’s approach is pioneering a new way for businesses to adopt Bitcoin.

Similarly, Real Bedford FC, a football club, is accumulating Bitcoin and accepting it for merchandise and sponsorships to strengthen their financial position at every level. In Tokyo, Metaplanet is also focused on gathering Bitcoin, using financial strategies that are even written into their company’s core principles.

As Bitcoin demand increases, more businesses are seeing it as a better option than traditional money, which keeps losing value. Although Bitcoin has a huge market value, it’s still not fully appreciated in traditional finance—but big firms like BlackRock are starting to notice its potential.

AI 🎨🤖🎵✍🏼

In the Metaverse, AI will be critical for creating intelligent virtual environments and avatars that can understand and respond to users with human-like cognition and natural interactions:

In today’s article “The good, bad and ugly of AI for news”, it’s clear AI's role in news media is a double-edged sword, offering both advancements and challenges. Recently, New Zealand's use of AI in editorials faced criticism, yet it remains integral to enhancing efficiency in an enviroment of slim margins and budget cuts.

“Before the end of the current year, checking will be done by AI . . . by a separate set of programs, of material that is actually originated by AI,” said ABC's chair Kim Williams - also a veteran of commercial media, entertainment and news companies - about the news agency Reuters. “Pretty scary when you think about it,” he added as an afterthought.

Globally, AI's influence varies, with some newsrooms harnessing it to counteract misinformation, while others, like Hong Kong Free Press, reject AI to avoid inaccuracies. AI-generated content, including deepfakes, poses significant risks, as illustrated by misleading videos and fake news proliferating online.

Tools like TrueMedia are developed to detect such fakes, but the technology is not foolproof. Despite AI's benefits in automating tasks and improving accessibility, experts stress the importance of maintaining human oversight to ensure accuracy and trustworthiness. As AI evolves, journalists are urged to balance its use, leveraging its strengths while safeguarding against its flaws.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.