📔 Weekly Journal: Van Gogh in Web3 🎨🖌️

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as the program equipping museums with web3 technology knowledge

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 63 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

Bitcoin ETFs are absorbing a staggering 10 times more Bitcoin than what miners could produce. On Monday, spot Bitcoin ETFs attracted a remarkable $493.4 million, equivalent to around 10,280 Bitcoin, dwarfing the mere 1,059 Bitcoin mined on the same day. This surge underscores the growing mainstream adoption of cryptocurrencies and poses challenges regarding supply shortages and market stability. Five US spot bitcoin ETFs now have at least $1 billion in assets each.

🔥🗺️ 7-day heatmap below, lots of green this week.

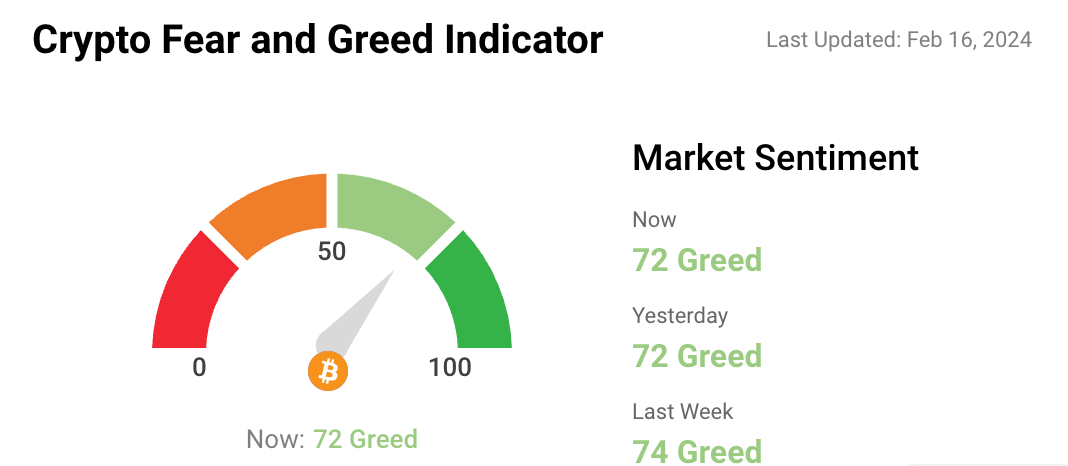

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Back firmly in the greed zone.

Interesting news from this week🗞️

In a surprising turn, Indonesia's presidential election sees former defense minister Prabowo Subianto and crypto advocate Gibran Rakabuming Raka claim victory, securing nearly 60% of votes in "Quick Counts" across the nation. With promises to bolster crypto-friendly policies, including tighter tax supervision and support for blockchain education, the duo aims to continue the trend set by incumbent President Joko Widodo. The outcome hints at a potential expansion of Indonesia's crypto landscape under the new leadership.

We Are Museums, in collaboration with the Tezos Foundation and LAL ART, has unveiled the selection of 20 esteemed cultural institutions for WAC Lab Season 3. Notable institutions include the Van Gogh Museum and Palais de Tokyo. Led by industry experts like Regina Harsanyi and Chris Michaels, the program equips museums with web3 technology knowledge, covering blockchain ethics and decentralised curation. With support from mentors and Tezos Foundation, the program propels institutions towards WAC Factory, fostering innovative web3 projects. This initiative marks a pivotal moment in reshaping the future of cultural engagement and technological integration in the arts sector.

Invitation to my upcoming Webinar

Who is this session for? This session is designed for investors eyeing new opportunities, companies or fund managers on the lookout for different venture capital channels, and projects exploring the tokenisation of real-world assets (including tokenised financial products).

Location: Online Zoom meeting

When: Thursday 22 February 10:00-11:30 am (NZ standard time)

Format: Presentation + Q&A

Presenters: Ryan Johnson-Hunt, Tracey McDonald, Graeme Leversha, Bryan Ventura

👓Read of the Week

This week I really enjoyed the Ark Invest Big Ideas 2024 Annual Research Report.

Here were my top 10 highlights:

Technological Convergence: Global equity market value linked to disruptive innovation could surge to 60% by 2030, driven by AI breakthroughs.

Artificial Intelligence: AI training costs may plummet by 75% annually through 2030 due to hardware-software convergence.

Bitcoin Allocation: Bitcoin's annualised return averaged ~44% over seven years, outpacing major assets.

Smart Contracts: Smart contracts could generate over $450 billion in annual fees by 2030 if adopted akin to the internet.

Digital Consumers: Spending on digital leisure could skyrocket to $23 trillion by 2030, growing at 19% annually.

Electric Vehicles: EV sales could hit 74 million units by 2030, growing at 33% annually.

Robotics: Generalisable robotics could yield over $24 trillion in revenue annually with declining costs.

Robotaxis: Robotaxi platforms might generate $28 trillion in enterprise value in 5-10 years.

Autonomous Logistics: Revenues from autonomous delivery could reach $900 billion by 2030.

3D Printing: 3D printing revenues could soar to $180 billion by 2030, growing at ~40% annually.

🎥 Watch of the week

While on the topic of Ark Invest, I really enjoyed this recent Ted Talk from Cathie Wood on the concurrent advancement of five crucial innovation platforms, an unprecedented occurrence.

AI 🎨🤖🎵✍🏼

This week, OpenAI introduced Sora, an AI model captivating the internet with its ability to craft vivid video scenes from mere text prompts. Sora exhibits the capacity to produce intricate scenarios featuring numerous characters, distinct motion patterns, and precise depictions of subjects and backgrounds. Not only does the model grasp the user's prompts, but it also comprehends the spatial dynamics and physical attributes inherent in those directives, ensuring faithful representation of real-world elements.

Sora's debut marks a leap forward in AI's comprehension of the physical world, aimed at aiding problem-solving in real-world scenarios. Initial access to Sora is limited for risk assessment and select creatives for feedback.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.