📔 Weekly Journal: Welcome to Blobs ⏱🔗

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as Ethereum's upgrade this week ("blobs") making layer 2 blockchains 90% cheaper

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 67 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Digital Assets Market Update

Bitcoin ETFs are now attracting over $1 billion in daily inflows, prompting concerns about a potential liquidity crunch. Despite consistent outflows from Grayscale Bitcoin Trust, other ETFs like BlackRock’s iShares Bitcoin Trust saw record inflows, with smaller rivals also gaining traction. These ETFs, launched in January, have accumulated $11.1 billion in just two months, driving Bitcoin to new highs. Analysts warn that if this pace persists, the market may face a liquidity crisis within six months, impacting Bitcoin's volatility (in the upward direction!).

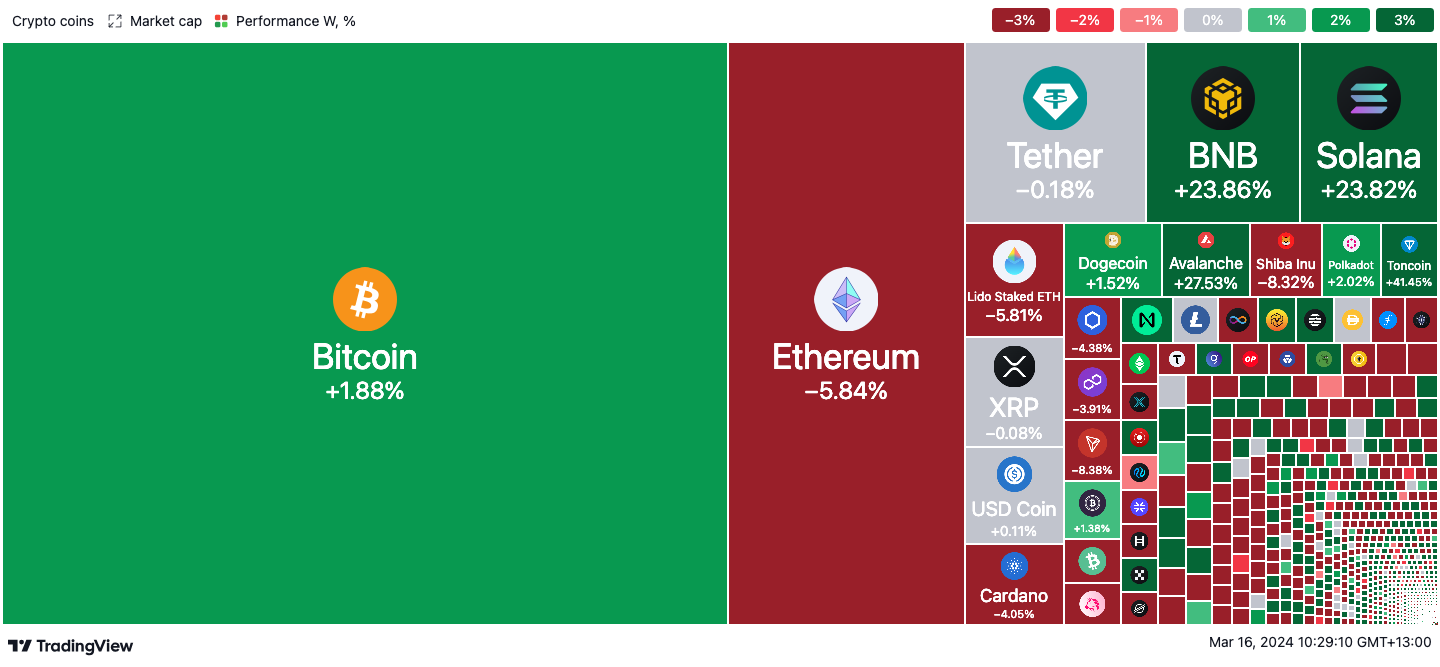

🔥🗺️ 7-day heatmap below, which shows the current share of market for the top cryptocurrencies, alongside total marketcap (USD) and the change in price over the last week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces.

Interesting news from this week🗞️

🔗 Good news: After Ethereum's Dencun upgrade this week, layer 2 blockchains like Optimism and Base witness reduced transaction costs due to the introduction of "blobs," storing data more affordably than previous call data. The upgrade, live since Wednesday, compresses and batches transactions before sending them to the mainnet, as shown by blockchain analyst Marcov's tracker. With blobs, data storage becomes cheaper, potentially leading to a 90% decrease in costs, although investor interest in rollup tokens remains unchanged post-upgrade.

☕️ Bad news: Starbucks is discontinuing its Starbucks Odyssey Beta NFT rewards program, built on Polygon's Ethereum scaling network. The closure, effective March 31, casts doubt on its revival. While Starbucks aims to evolve its program, there's uncertainty about its return or in what form. Initially launched in late 2022, Odyssey attracted attention as Starbucks' venture into Web3. Despite its closure, Starbucks plans to leverage insights gained for future initiatives. The program's NFT stamps, tradable on Nifty Gateway, persist beyond the platform's shutdown and may even end up being limited edition collector’s items.

🇭🇰 Good or bad news? Hong Kong Monetary Authority (HKMA) has initiated Phase 2 of its central bank digital currency (CBDC) pilot, the e-HKD. Building upon Phase 1's testing of retail payments and asset tokenisation, Phase 2 will delve deeper into programmability, tokenisation, atomic settlement, and uncover novel use cases. This phase will be facilitated by HKMA's recently launched regulatory sandbox for testing wholesale CBDCs and tokenisation. Hong Kong joins over 100 jurisdictions exploring potential issuance and applications of CBDCs alongside private cryptocurrencies like stablecoins.

👓Read of the Week

This week’s read is the article “The Metaverse Unleashed: The Rise of Human-Scale Digital Venues” by architect John Marx. It explores the evolution of the Metaverse, focusing on immersive digital venues. From Neal Stephenson's early concept to contemporary platforms like Fortnite and Roblox, the Metaverse has evolved. Immersive entertainment, including virtual concerts and digital exhibitions, is shaping the Metaverse's human-scale experiences. These venues, like the Illuminariums, offer realistic digital environments. John Marx encourages architects to consider flexibility and technical infrastructure when designing such spaces, impacting art, entertainment, and social gatherings.

🎥 Watch of the week

After reading about Illuminariums above, net is a video of one that recently launched in Toronto's Distillery District. Its inaugural exhibit invites guests on a thrilling adventure titled "SPACE: A Journey to the Moon and Beyond." The video explores the potential impact of this venue on the local arts scene, anticipating fresh opportunities for artists and events.

AI 🎨🤖🎵✍🏼

Guns N' Roses collaborated with Creative Works London to create their latest music video, "The General," using generative AI. The unsettling visuals depict a young boy navigating a magenta cityscape haunted by menacing toys. Initially conceived as an animated video, the project shifted when introduced to Stable Diffusion AI. Director Dan Potter combined Unreal Engine footage with AI prompts, creating surreal imagery. Potter emphasises AI as a creative tool, not a replacement, envisioning its integration into live performances. The future, he believes, lies in augmenting artistic expression rather than supplanting it.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.