📔 Weekly Journal: Year of the Dragon 🐉🧧

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as why the Mandarin Chinese term for "dragon" has mnemetic significance.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 62 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

- Ryan

Market Update

Bitcoin soared above $46,000, hitting a one-month peak, coinciding with East Asia's festivities for the Chinese New Year. The Mandarin Chinese term for "dragon" bears a resemblance to "long," holding mnemic significance some traders.

The Bitcoin ETFs continue to break records for volume in first month, and also 100% continuous inflow days which is unheard of. There are some signs that the OTC market for Bitcoin is drying up and the ETFs are starting to buy off exchanges which will bring intense price volatility in both directions. The overall pattern will likely be slow grinds up in price, punctured by 10-20% selloffs (aka “buying opportunities”).

Kudos to Bitcoin for going from untouchable by most of Traditional Finance to something increasingly valued as a scarce asset. After all, it is the only major financial asset with inelastic demand - no matter how much it’s valued, no one can make more other than the predetermined mining rate (~1.8% inflation) which halves this May and every four years! This is unusual - if gold prices tripled, more mining operations would begin to increase demand. If a stock price goes up, companies usually issue more shares.

🔥🗺️ 7-day heatmap below, lots of green this week.

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Back firmly in the greed zone.

Interesting news from this week🗞️

☀️ In December 2022, the National Ignition Facility achieved a breakthrough in fusion energy, generating more energy than consumed, marking a pivotal advancement. Detailed analyses of subsequent reactions, particularly recent one exhibiting nearly double the energy output, highlight the technology's burgeoning potential. Though fusion offers prospects for abundant, clean power, its widespread implementation remains distant, necessitating continued investment in current renewable energy solutions to address the pressing climate crisis while the promise of fusion unfolds.

🧠🔌 Elon Musk's Neuralink has conducted its inaugural human trial, implanting a brain–computer interface (BCI) device aiming to enable device control via thought alone. While some researchers express cautious optimism, others highlight concerns over transparency and safety. Lack of detailed trial information frustrates experts. Emphasis lies on long-term safety and effectiveness assessments. Transparency is crucial for patient trust and confidence in BCI technology advancements.

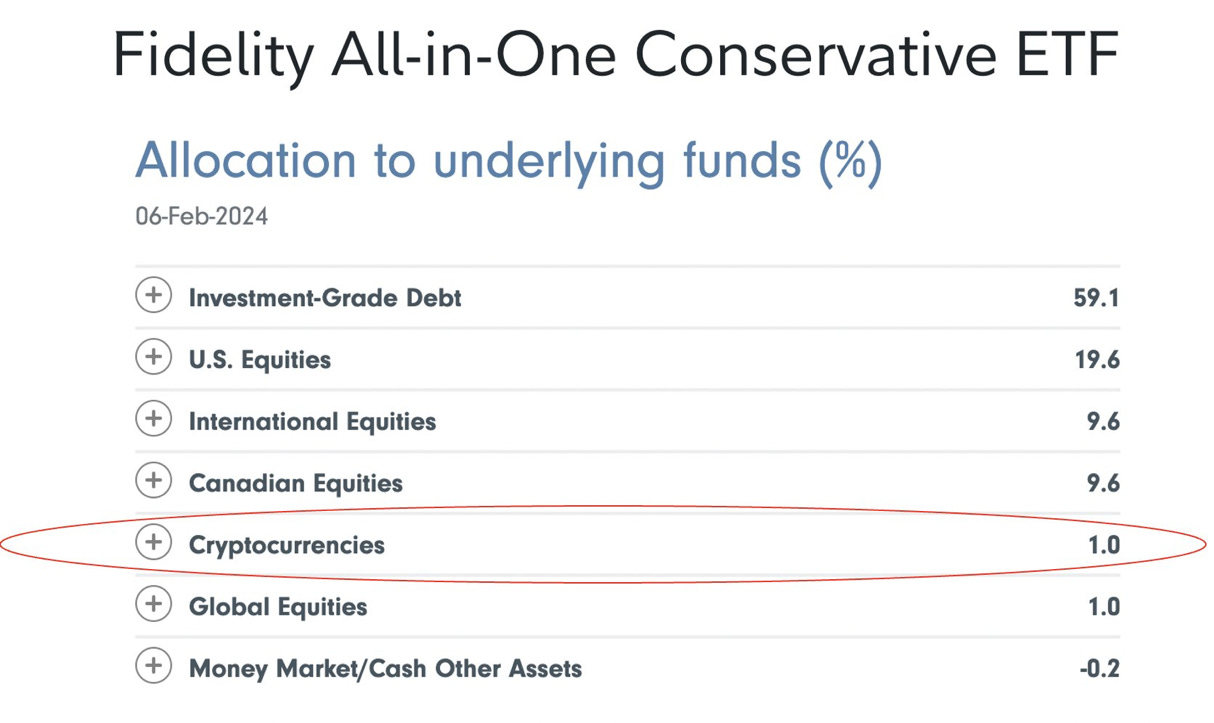

1️⃣2️⃣3️⃣ Fidelity has a 1-3% bitcoin allocation in their "All-in-One" asset allocation funds in Canada, using spot bitcoin ETFs. The "Conservative" version is posted below. They have 3.1% allocation in the aggressive portfolio and 2.5% in the balanced portfolio. What if this 1,2,3 rule becomes the normal for many large funds?

Invitation to my upcoming Webinar

Who is this session for? This session is designed for investors eyeing new opportunities, companies or fund managers on the lookout for different venture capital channels, and projects exploring the tokenisation of real world assets (including tokenised financial products).

Location: Online Zoom meeting

When: Thursday 22 February 10:00-11:30 am (NZ standard time)

Format: Presentation + Q&A

Presenters: Ryan Johnson-Hunt, Tracey McDonald, Graeme Leversha, Bryan Ventura

👓Read of the Week

Few would argue that the entertainment sector is experiencing a shift, as blockchain technology addresses issues such as unfair royalties and transparency in streaming. Despite the industry's growth, current models suffer from fragmentation and opaque payment structures.

Is YouTube new? This week I encourage you to read about Replay, a Web3 platform built on Theta's Core Blockchain, aiming to solve these challenges. Replay aggregates content, connecting creators directly with viewers, and ensures transparent payments through blockchain. Features like Rewarded.TV offer ad-free viewing and community engagement. Replay, leveraging Theta's network, aims to revolutionise streaming, empowering creators and providing viewers with a rewarding experience. By utilising blockchain, Replay seeks to reshape the streaming landscape, offering transparency and fairness to all stakeholders.

🎥 Watch of the week

Darcy Ungaro is the host of the Everyday Investor podcast, and he advises clients in a range of financial matters from mortgages all the way to Bitcoin. In this conversation, Darcy covers financial advice in the age of digital assets such as the Bitcoin ETF and strategies to modernise concepts of portfolio management.

AI 🎨🤖🎵✍🏼

The rapid advancement of Artificial Intelligence (AI) in the UK brings numerous benefits, from safer and more fulfilling jobs to wildlife conservation and climate change mitigation.

This week the UK Govt received a consultation outcome: “A pro-innovation approach to AI regulation: government response”

Here are the highlights:

The government emphasises a pro-innovation stance, aiming for AI's trustworthiness and widespread adoption through rigorous safety measures.

With substantial investments exceeding £100 million, the UK prioritises AI safety and regulatory capabilities, fostering innovation while ensuring public safety.

Initiatives include enhancing regulator skills, promoting responsible AI partnerships, and supporting research hubs.

A context-based regulatory framework, backed by international collaboration, aims to address emerging risks while fostering transformative AI opportunities.

Future legislative actions will be considered cautiously to balance innovation with risk mitigation.

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.