📔 Weekly Journal: Bitcoin Primed & Ready 🦾₿

[8min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats plus all you need to know about some exciting Bitcoin breaking news

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 22 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: Another bank fails, Biden’s crypto mining tax, and discussions of forestry’s fit in NZ’s ETS.

🗞️ Interesting news: BRC-20 tokens, Bitcoin bull market predictions, Sotheby's launches an NFT marketplace

👓 Read of the week: A great deep dive into the Bitcoin 4-year cycle

🎥 Video of the week: A fireside chat on innovation & money in financial services at the FinTech Hui Taumata 2023 in Feb.

🤖 This week’s AI showcase: Will open-source models AI models make the Google Bard & OpenAI obsolete?

✅ Weekly poll: Help chose the emerging tech topic for Wedensday’s showcase

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🇺🇸 Yesterday, the U.S. Federal Reserve delivered a 0.25% rate hike, bringing interest to 5.25%, the highest since September 2007. The hike may be the last in the series, with further increases being data-dependent. The US job market remains strong, and a more accommodative stance by the central bank would likely benefit crypto.

U.S. President Joe Biden’s administration is campaigning for a tax on crypto miners equal to 30% of the cost of the power they use, which would mean miners need to sell more bitcoin to cover costs. Mining pools with access to clean and cheap energy, or located outside the U.S. would be less impacted.

🇪🇺 The European Central Bank also raised interest rates by 25 basis points to 3.25%, its 7th consecutive rate hike to fight inflation.

🏦 The banking crisis continues, Republic Bank had a US$100 billion bank run and its stock price dived 45.4% last week. The bank was placed under receivership and was the second-largest banking failure in U.S. history, before JPMorgan Chase swooped in to get a great deal on the bank’s assets.

🏦 Issues with the global banking system seems to increase demand for Bitcoin, as it is viewed as a safe haven asset by some investors. Bitcoin price has risen over 45% since 10th March when Silicon Valley Bank collapsed.

🥝 Lots of discussions this week over the future role of forestry in New Zealand's Emissions Trading Scheme (ETS) has led to a fall in the spot price for carbon units, scaring investors off the market. The Ministry for the Environment has been tasked with a review of the scheme, which aims to incentivize emitters to make gross reductions rather than relying on (much cheaper) offsets. Suggestions have been floated of limiting the amount of forestry in the scheme, imposing a minimum price, or setting up a separate forestry scheme to increase the carbon price.

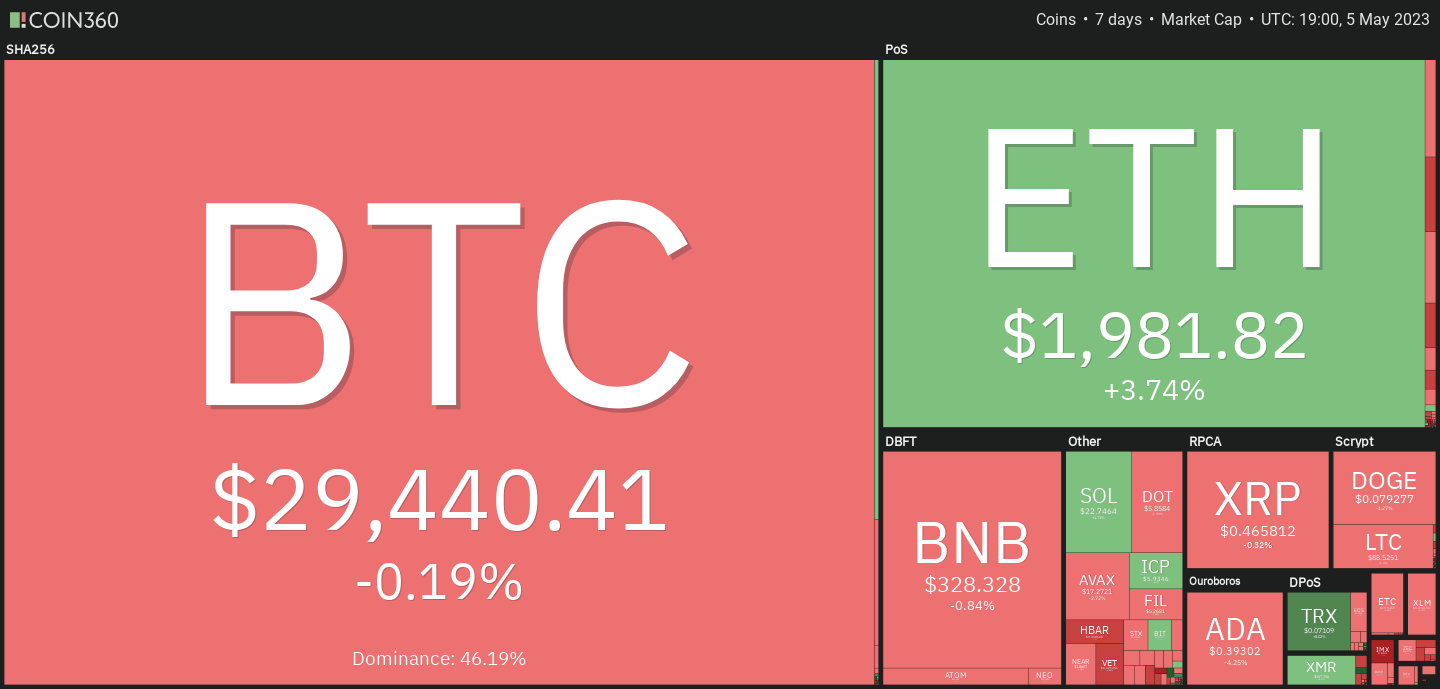

7-day Crypto Heatmap below - price relatively flat, sometimes boring is just fine (size of the blocks are market share, colour & % show the change over the last week)

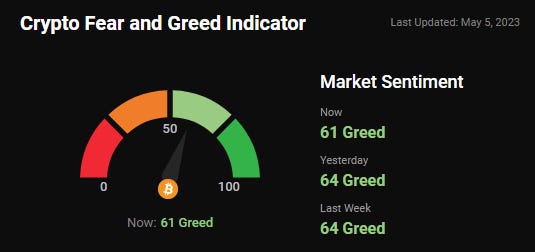

🎭 Sentiment levels have returned to the new norm, hovering at low levels of greed

Interesting news

₿ Developers are using the Bitcoin blockchain to experiment with new token types, including BRC-20 tokens, a fungible asset named after Ethereum's ERC-20 token standard. BRC-20 tokens have a market capitalization of $125 million and pushed daily transactions on the Bitcoin blockchain to an all-time high of 682,000 on May 1. BRC-20 tokens use the Ordinals protocol, which inscribes small units of Bitcoin with unique data. While there are limited applications for BRC-20 tokens at present, this innovation represents a major change in the blockchain's capabilities and opens up possibilities for greater experimentation on the Bitcoin ecosystem.

📈 It seems that the demand for bitcoin is picking up among small investors. Quarterly results from Block (formerly Square) revealed that its Cash App platform saw a surge in bitcoin sales, reaching $2.2 billion in Q1, a 25% YoY increase. Gross profits from bitcoin sales were reported to be $50 million, driven by an increase in the quantity of bitcoin sold to customers, partially offset by a decrease in the market price of bitcoin.

₿ Billionaire investor Tim Draper predicts a Bitcoin bull market amid economic uncertainty in the U.S., and that the controlling government is “killing the golden goose of Silicon Valley”. Draper expects Bitcoin to soar in value if banks start falling apart, causing a bull market. However, he expressed concern about crypto regulation, with lawmakers debating legislation to establish guardrails for the industry, and agencies targeting firms with enforcement actions. Draper backs Bitcoin but is wary of cryptocurrencies that are too centralized.

🔷 The Ethereum Foundation is planning the next upgrade for the Ethereum network, called Dencun, after the recent Shapella upgrade. Dencun includes several updates that aim to make Ethereum transactions cheaper and faster, especially on Layer 2 networks, which are alternative solutions to the Ethereum mainnet. The other updates will also improve blockspace availability and reduce storage costs. The upgrades will be rolled out gradually, with the final upgrade, the Splurge, introducing additional improvements to network efficiency and performance.

🖼️ Sotheby's, the renowned auction house, has launched an NFT marketplace on Ethereum and Polygon, featuring a limited selection of handpicked artists. The platform aims to enforce creator royalties using smart contracts and levies a 2.5% transaction fee. Sotheby's is committed to honouring artist royalties, signalling its artist-first ethos as one of the few major NFT marketplaces. The NFT community has been discussing creator royalties, with each marketplace taking its own stance on the issue. OpenSea (the incumbent) announced that it will collect a 0.5% minimum royalty on all collections.

🇿🇼 The Reserve Bank of Zimbabwe has invited individuals and financial institutions to subscribe to its gold-backed digital token, which is set to be issued on May 8th. The tokens are designed to combat Zimbabwe's volatile local currency, and will be available for person-to-person and person-to-business transactions in the second phase of the token's rollout. The bank has split the issuance and usage of the tokens into two phases, with the first phase focused on investment.

👓Read of the Week

When it comes to Bitcoin, the OG Grandaddy of the crypto space, you may have heard the term “4 year cycle”. The article is a great overview of what the 4-year cycle actually means and an informed discussion on how Bitcoin supply halving, macroeconomic factors, and self-reinforced human psychology may underly the phenomenon:

Video of the week 🎥

This fireside chat on innovation and money in financial services was part of the FinTech Hui Taumata 2023 conference in February. The following thougt leaders give their take on this topic:

Alison Mackie, BlockchainNZ, Executive Director

Sorel Carr, Bank of New Zealand, Head of FinTech Business

Jerome Faury, Immersve, Founder/CEO

Let me know what you think in the comments!

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by an AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

This week’s example is a quick but thought provoking one. A leaked internal document by a Google researcher suggests that neither Google nor OpenAI will win the AI race, and open-source models will prevail. Open-source models have been catching up quickly, with ordinary developers building models that run on phones and lightweight versions of LLaMA. The researcher predicts faster and more customizable open-source models will render OpenAI irrelevant.

This could be good news for consumers and the ecosystem, but bad news for proprietary-preaching businesses. Sharing research may lead to more choices and less stronghold by a few companies. Food for thought!

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.