📔 Weekly Journal: Eth rewards skyrocket 🔷🚀

[8min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats and a discussion on the rollercoaster week for Ethereum & Bitcoin

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 24 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: NZ inflation forecasts positive, US debt ceiling drama

🗞️ Interesting news: Ups and downs for Ethereum, and blockchain gaming update

👓 Read of the week: Thinkpiece from Mike Belshe on why building for crypto, web3, and DeFi is the most impactful opportunity of our lifetimes.

🎥 Video of the week: All about Pepe, the meme-coin that slowed down BTC this week

🤖 This week’s AI showcase: How NIWA is using AI to make better local climate change models

✅ Weekly poll: Help chose the emerging tech topic for Wedensday’s showcase

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🦅 If Democrats and Republicans fail to agree on raising or suspending the US debt ceiling, the US government may be unable to meet its financial obligations by June 1, including salaries, pensions, and interest payments. This would be very (very) bad for markets.

One potential (although unconventional) solution is minting a single $1 trillion platinum coin, which is technically possible with existing laws but likely a last resort.

"What a coin represents in my opinion, is the bringing back of the budget to a level that the public can understand. No complicated bond markets, no complicated debt instruments, it's something that you can talk to your seven year-old about. And to me it's only silly to people who think sounding very serious is being very serious." - Rohan Grey, Assistant Professor of Law at Willamette University's College of Law in Oregon

Businesses surveyed expect inflation in two years' time to be 2.8%, down from 3.3% in the previous survey, aligning with the central bank's target range of 1% to 3%. This suggests confidence that the Reserve Bank will be successful in controlling inflation.

The drop in wage growth expectations and predictions of a short recession also contribute to the positive inflation forecast. The survey results will be considered by the Monetary Policy Committee in setting interest rates and reviewing monetary policy.

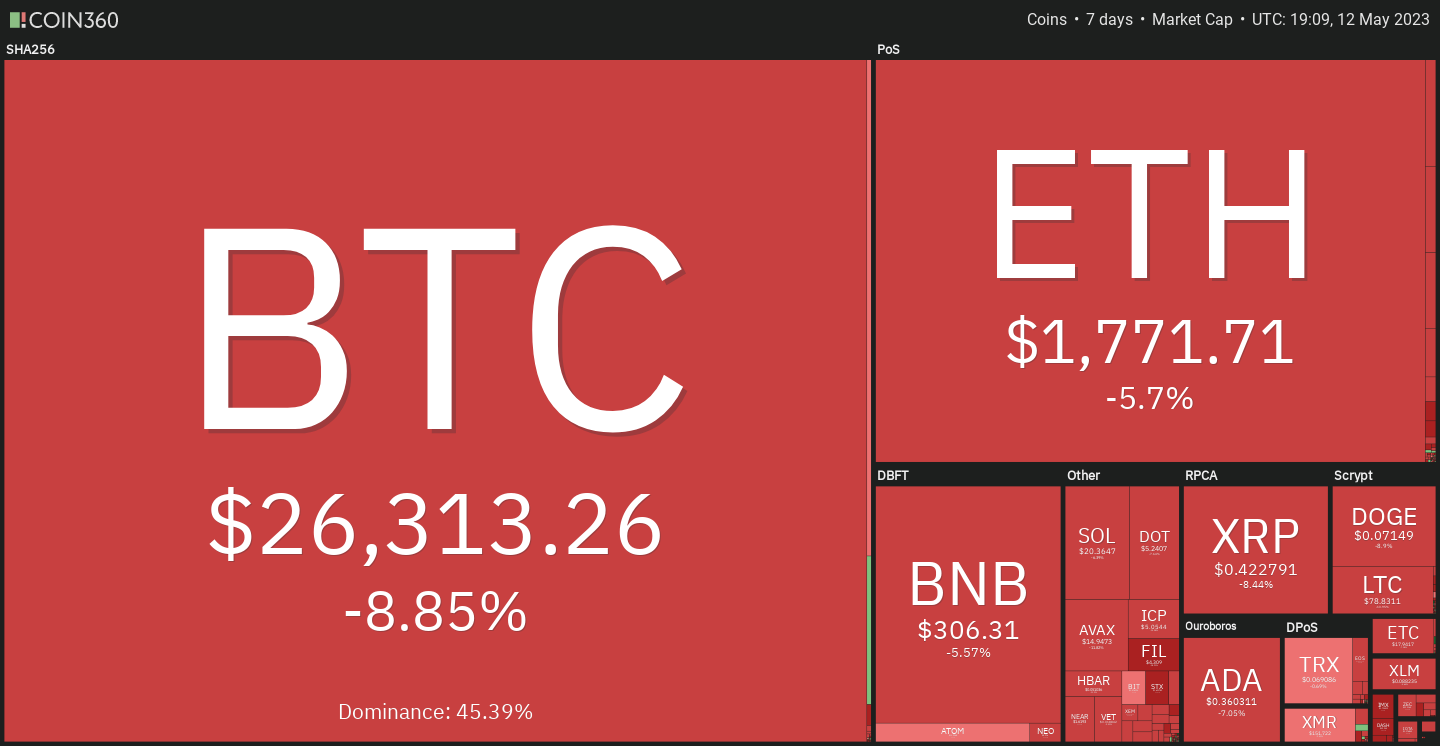

₿ 🔷 Leading cryptocurrencies have dropped to two-month lows due to concerns over market liquidity and increased regulatory scrutiny 👎🏻

Binance temporarily froze Bitcoin withdrawals twice, citing blockchain congestion caused by increased traffic from meme coins and higher transaction fees. People get jumpy when large players pause anything, PTSD from the last 12 months.

Institutional investors such as Jane Street Group and Jump Crypto are pulling back from U.S. digital asset trading due to regulatory scrutiny, exacerbating liquidity issues. This drop in trading volume and liquidity can lead to greater price volatility and larger price swings.

7-day Crypto Heatmap below shows the pullback after the bumpy week (size of the blocks are market share, colour & % show the change over the last week)

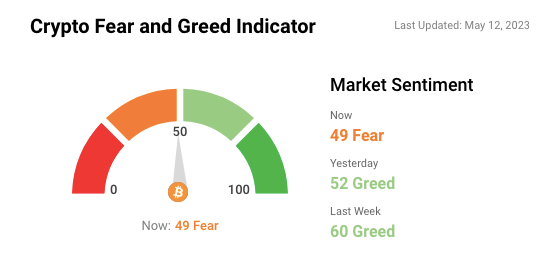

🎭 Sentiment levels have dipped into the fear zone after this week of bumpy news and events:

Interesting news

🔷 Ethereum staking rewards skyrocketed this week!

Validators earned $46 million in the first week of May, a 40% increase from the previous week, as the annual staking reward rate exceeds 8% on the Ethereum network.

The increase in rewards is attributed to the trading frenzy of the memecoin called Pepe, which raised gas fees and resulted in higher fee income for validators.

This will only boost the significant interest in ETH staking from institutions. Hmm sounds like an opportunity 💡

🔷 Ethereum's Beacon Chain experienced a temporary halt in finalizing on Thursday, causing a brief disruption in validator participation.

The chain is designed to be resilient through decentralisation, and transactions continued normally during the incident (Yay!).

Client diversity, having multiple independent clients, is crucial for the decentralization and security of the Ethereum network. The incident is considered a real-world test of consensus client diversity and is being investigated by Ethereum developers.

The gaming-oriented network Sui experienced significant gains, with its token appreciating 3,800% since its ICO, and already having 40 games being built on its network.

WAX, Arbitrum & Polygon were identified as the top gaming chains, with Polygon gaining popularity as the second-most popular chain.

Ethereum scaling solution Arbitrum saw a spike in users, growing over 118% in April, and Immutable X grew by about 9%.

A multi-chain future is emerging for Web3 gaming as different blockchain networks compete to attract gaming projects.

👓Read of the Week

Mike Belshe is a notable figure in the tech industry. He co-founded BitGo, a leading blockchain security company, and has made significant contributions to the development of cryptocurrency and blockchain technology.

I recently came across an article he wrote in October that encourages people to think about their impact and suggests that building for crypto, web3, and DeFi is the most impactful opportunity of our lifetimes.

Mike shares his experience building for web1, web2, and now web3, highlighting the potential impact of each. He argues that crypto, web3, and DeFi have the potential to change the world even more than the Internet did, because it intersects with money.

He believes that the incumbent players will lose out to small innovators, due to the “innovator's dilemma”, and urges us to take advantage of this opportunity to make a difference. Inspiring stuff!

Video of the week 🎥

Are you wondering what the Pepe hype is? This is the reason for Bitcoin network congestion, and the reason given why Binance paused Bitcoin transactions. Memecoins are by nature “pump & dumps” but it’s an interesting watch nonetheless:

Let me know what you think in the comments!

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by an AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

This week’s example is close to home, NIWA researchers are developing a physics-informed and AI-driven method to provide accurate climate change projections in NZ using ensembles of models.

Current climate models have limited resolution, hindering local decision making, but regional climate models can provide higher-resolution projections at a greater computational cost.

The team is developing an AI-driven regional climate model emulator that will generate high-resolution projections at a significantly faster and cheaper rate.

The project will collaborate with industry leaders and advisory groups to explore the added value of high-resolution climate projections for projects such as Future Coasts Aotearoa, (transforming coastal lowland systems threatened by sea-level rise into prosperous communities)

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.