📔 Weekly Journal: Ethereum Update Success 🔹🎆

Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats plus all about the recent success Ethereum update, and how it has caused the market to rally

Welcome to this weeks Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 19 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your long weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: NZ housing updates and epic week for crypto markets!

🗞️ Interesting news: Ethereum update success and why BTC also rose this week

👓 Read of the week: A summary of Citibank’s report on the big opportunity in asset tokenisation

🎥 Video of the week: A short CNBC video explaining the recent Ethereum upgrade

🤖 This week’s AI showcase: Three major AI projects you need to know about

✅ Weekly poll: Vote for the topic of next weeks Wednesday W.O.W

Market update 📈

🥝NZ

🏡 Central banks may be able to use interest rate hikes to combat high house prices, according to research by economist Andrew Coleman at the Reserve Bank of New Zealand. Coleman's paper examines "cyclical backwardation," which is when house prices or rents are temporarily above the usual cost of building homes or developing land, and "structural backwardation," when prices or rents are at normal levels but the costs of building are expected to fall permanently. Coleman concludes that a central bank wanting to reduce property prices’ cyclical backwardness could do so by increasing interest rates temporarily.

🏡 RBNZ also released a report on “Housing quality improvement, property market dynamics, and sustainable house prices” outlining two types of unsustainability in house prices:

when there is a construction boom due to an increase in demand or population, leading to a rise and fall in prices, and

when technical or regulatory changes reduce the cost of producing new houses, reflecting supply factors. The paper argues that demand for better quality housing is a major cause of unsustainable prices.

The paper argues that demand for better quality housing is a major cause of unsustainable prices

₿ Crypto Market

What a great week for the crypto market, here is why:

Why is Bitcoin’s price pumping?

Price action is complex, but here are some contributing factors:

A record high of 53% of Bitcoin's total supply hasn't been transferred in the past two years, indicating long-term holders are still committed and have control.

The market anticipates the Federal Reserve to initiate easing soon, which is positive news for all risk assets.

The global reserve currency status of the USD is being challenged for the first time in about 50 years as major nations settle trade without it.

Bank of America and Fidelity purchased more than $85 million worth of MicroStrategy shares in Q1 2023 to expand their exposure to Bitcoin.

Why is Ethereum’s price pumping?

With the successful Shanghai upgrade, Ethereum has now transitioned to proof of stake mining, allowing users to lock up their ether to validate transactions and generate yield.

The Shanghai upgrade was the final step in the transition from proof of work to proof of stake, merging the original chain into the new consensus mechanism and providing liquidity for the $30 billion of staked ether that was previously inaccessible.

The upgrade, with a main focus on EIP 4895, introduces potential new features and processes to the network and was developed over several months. There is anticipation that it could trigger a wave of withdrawals.

While there was a debate over how the upgrade may affect price, successful validation did increase the price as the market saw the benefits of technical success outweighing any selling off of unstaked Ether

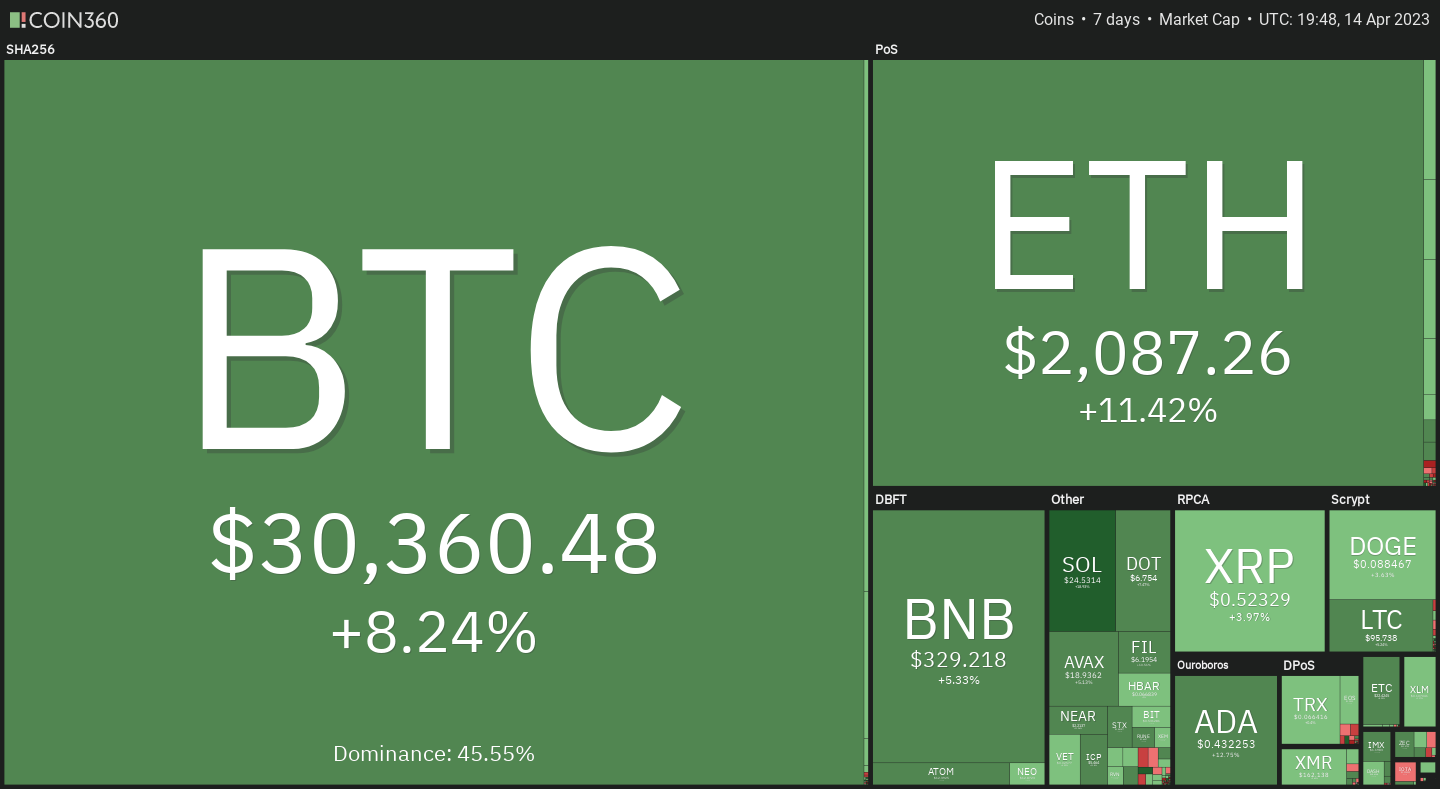

Heatmap below - so much green! (size of the blocks are market share, colour & % show the change over the last week)

🤔 Sentiment levels are steady in the greed zone, with Market Cap steady and crypto volume up with the Ethereum update success.

A reminder of sentiment (colour bars) relationship to Bitcoin price (blue line) in the past

👓Read of the Week

My favourite read this week was Citibank’s report titled "Money Tokens and Games Blockchain's Next Billion Users and Trillions in Value" recently, co-authored by key figures in the crypto industry. Here are a few of my favourites takeaways:

The report highlights asset tokenization as the killer use case of blockchain technology.

Kathleen Boyle, the managing editor at Citibank, explains in the report that blockchain's true adoption will be achieved when it has a billion-plus users who do not even realize they are using the technology. She believes this will come from Central Bank digital currencies (CBDCs) that use private and permissioned blockchains.

Boyle notes that regulatory considerations are necessary to allow adoption and scalability without hindering innovation, estimating that the mass adoption of blockchain, not crypto, is six to eight years away.

The report projects that between 2-4 billion people will voluntarily adopt CBDCs, and that as much as 20% of all currency in circulation will be converted into CBDCs by 2030. This will allow governments and central banks to micromanage monetary and fiscal policy.

Concerning thought: If these blockchains are controlled by governments, then having all assets tokenized means people won't truly own them; they will be owned/controlled by the government 😟

The value of the assets tokenized on cryptocurrency blockchains is projected to exceed the four trillion dollars that the authors are projecting for CBDCs and asset tokenization on private blockchains.

The authors of the report include Algorand founder Silvio Mikali, Ava founder Stani Kolechov, Ava Labs President John Wu, Polygon Labs President Ryan Watt, and Zuko Wilcox, the founder of Zcash.

The full report can be accessed for free (here)

Video of the week 🎥

This video describes the Ethereum upgrade called Shanghai in a way that is really simple and informative. The video came out just before the update, which was a success and increased the price of Ether.

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by an AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

The video below covers three major AI projects that have a big impact on many industries:

The first project is from a company called Blockade Labs, which offers a platform for creating 360-degree images that can be used for video games or virtual reality. The platform is easy to use, and users can generate unique 360-degree images by entering prompts.

The second project is from a company called Spline, which offers a platform for building 3D shapes, animating objects, and adding physics to those objects. The platform has many examples of projects people have built, including games and product mock-ups.

The third project is a video technology called deepfake, which can create videos that look and sound like real people. The video cautions about the potential risks of deepfake technology and encourages people to use it responsibly.

Enjoy!

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.