📔 Weekly Journal: EU Crypto Regulation

Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats plus a feature on how EU & US differ in approach to digital asset regulation

The Weekly Journal 📔 is your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 17 of the 520 weeks of writing I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

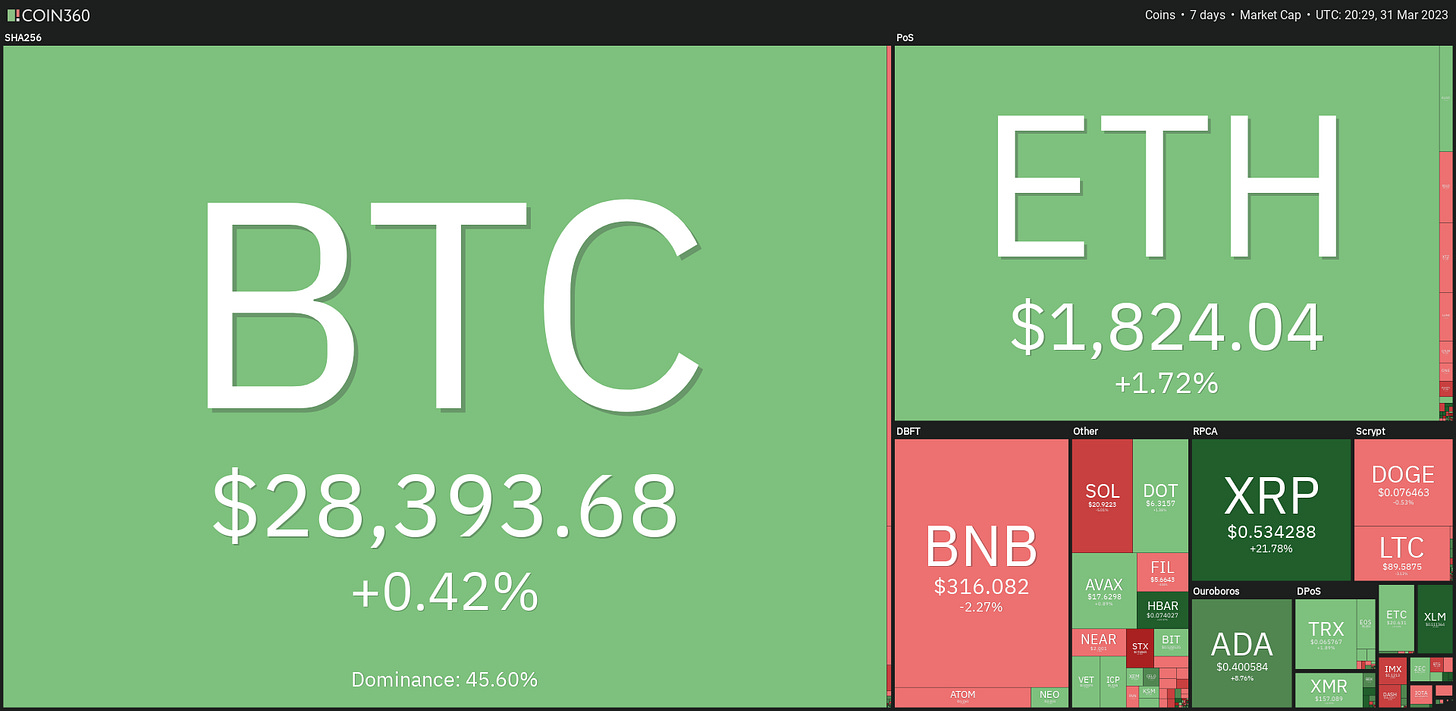

Market update: Overall Crypto market flat, XRP surging on rumours of legal win

Interesting news: EU and US’s contrasting approaches to digital asset regulation

Video of the week: How to make your own Avatar using AI

This week’s AI showcase: Results from above and why it’s a step towards the Metaverse adoption

This week’s Poll: Chose the topic for next weeks Wednesday W.O.W

Market update 📈

🦘🥝 On April 4th, the Reserve Bank of Australia will decide if they want to raise their cash rate target by 0.25%, this would be the highest rate since 2012. The next day, on April 5th, the Reserve Bank of New Zealand will also decide if they want to raise their OCR rate by 0.25% which would be the highest rate since 2008. The fight against inflation continues, buckle up because it is going to be a rough 2023 for household expenses.

In other Aussie news, ANZ (one of Australia's "Big Four" banks) will no longer facilitate cash withdrawals and deposits from some of its branches as more Australians move away from using cash and bank branches. This has caused concerns that the end of cash is near. ANZ's decision has received criticism, with some suggesting that it could disproportionately affect older people who are less capable of going digital and that it could make fiat users more susceptible to technical issues. The move has also reignited fears that cash could soon be fully replaced by central bank digital currencies (CBDCs).

🌐 Goldman Sachs has recognized bitcoin as the best performer in 2023, surpassing IT stocks, Nasdaq 100, S&P 500, and gold, among other investment assets. Its price has risen 70% since January 1st, leading some to believe that the bear market could be over and BTC has entered a new bull run. CEO of One River Digital Asset Management, Eric Peters, claims that the next phase will be "very powerful" as major institutions dive in. The CEO of the crypto intelligence firm Messari, Ryan Selkis, predicts BTC will reach $100,000 in the next year, acting as a "life raft and peaceful exit option" to potential financial instability.

The most bullish prediction came from Coinbase's former CTO, Balaji Srinivasan, who bet $2 million against Twitter user James Medlock that bitcoin will be worth $1 million in 90 days, believing that the price expansion will happen due to a possible collapse of the US banking system and consecutive hyperinflation.

🗺️ Crypto Market Heatmap shows a flat week, with XRP ripping on rumours of a upcoming legal win against SEC (size of the blocks are market share, colour & % show the change over the last week)

🤔 Sentiment levels are still in the greed zone, does this mean the end of the bear market is coming?

Interesting News 🗞️

European Parliament passing crypto regulation

The European Parliament is expected to approve the new MiCA (Markets in Crypto-Assets) AML regulation in the coming weeks. AML stands for Anti-Money Laundering, and it means that certain crypto-related entities will have to comply with new rules to prevent money laundering.

However, uncertainties remain around the application of the regulation to non-fungible tokens (NFTs). The MiCA regulation divides crypto-assets into three categories: e-money tokens, utility tokens, and asset-referenced tokens. While Bitcoin and Ethereum fall under e-money tokens, the status of NFTs is still unclear.

The exact scope of the regulation is also unclear, with debates about its application to decentralized services, software houses, and DeFi protocol operators. Protesters have claimed that the regulation is overly rigid, lacks innovation, and will lead to higher costs for crypto operators. While the EU is not currently a favorable place for crypto operators, Switzerland, one of the world's leading crypto hubs, has already adapted to these innovations and could benefit from the uncertainty surrounding the MiCA regulation. If you are interested, read more here.

The new anti-money laundering regulation set to be discussed by the European Parliament will not block crypto payments, according to Damien Carême, one of the two lawmakers responsible for negotiating the law on behalf of the parliament. The legislation will impose a limit of €1,000 for payments made from self-hosted wallets where the payer cannot be identified, but Carême clarified that this was not intended to prevent crypto transactions entirely. He also noted that dirty money should not simply flow into other sectors due to banking controls. The vote passing will lead to negotiations between the European Parliament and the EU's Council, representing the bloc's member states, to frame a consistent version of the law. The Council had previously sought to prevent banks or crypto providers from handling cryptocurrencies that guarantee anonymity, but Carême said a ban was unnecessary as Dash, Monero, and Zcash were already outlawed by the EU's Markets in Crypto Assets regulation

In contrast, is the US Govt targeting Crypto with Operation Choke Point 2.0?

The US government, including the White House, Federal Reserve, OCC, FDIC, DOJ, and influential members of Congress, may be conspiring to cut off cryptocurrency's access to fiat, according to venture capitalist Nic Carter.

Operation Choke Point 2.0 appears to be a concerted effort to discourage traditional financial institutions from servicing the crypto industry, starting with fiat on- and off-ramps. The name follows Operation Choke Point, a Department of Justice initiative that ran from 2013 to 2017, aimed at preventing fraud by targeting high-risk businesses like payday lenders and money transfer services. The initiative was criticized for unfairly cutting off legitimate businesses from banking services and was eventually discontinued.

The FDIC, OCC, and Federal Reserve's joint statement in January "strongly discouraged" banks from supporting crypto, which resulted in Metropolitan Commercial Bank completely shutting down its crypto-related business lines. Carter believes that the US government's move to label crypto-facing banks "high risk" to stifle innovation and the competition that crypto-related financial services provide.

Given the current situation with increased government scrutiny and regulatory measures, what would need to happen in order to improve the banking status of crypto in the US and address the challenges posed by Operation Choke Point 2.0, whether it is a coordinated effort or not? That is the $1.2 trillion dollar question.

Optional deep dive: Cooper & Kirk Lawyers Operation Choke Point 2.0 Report.

Video of the week 🎥

The tutorial video showcases a simple step-by-step using Midjourney V5 to create photorealistic or highly stylized avatars. Read more in the AI showcase below.

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by an AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

The tutorial video above shows how to use Midjourney V5 to create photorealistic or highly stylized avatars, with over 150 different cartoon avatar styles available. It demonstrates finding an image, copying the link, and accessing different styles from illustrators, cartoonists, and caricaturists.

Avatars are digital representations of individuals that can interact with others in virtual environments. In the emerging metaverse, avatars are likely to play a crucial role in driving adoption. They allow individuals to immerse themselves in a virtual world, enabling them to engage with others and experience new forms of social interaction. Avatars can also enhance personalization, providing individuals with a unique digital identity that they can customize and use across different platforms.

For now, these are usually simple 2D images. As the metaverse continues to evolve, avatars will likely become increasingly sophisticated, enabling more realistic and immersive experiences. This, in turn, is likely to drive adoption as people seek new and engaging ways to interact and connect with others.

Have a go yourself, it’s a lot of fun!

Poll of the week ✅

That’s all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.