📔 Weekly Journal: Glass Half Full 🍷☯⚖

[7 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well the 50% tipping points reached on some exciting digital assets adoption stats.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 44 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

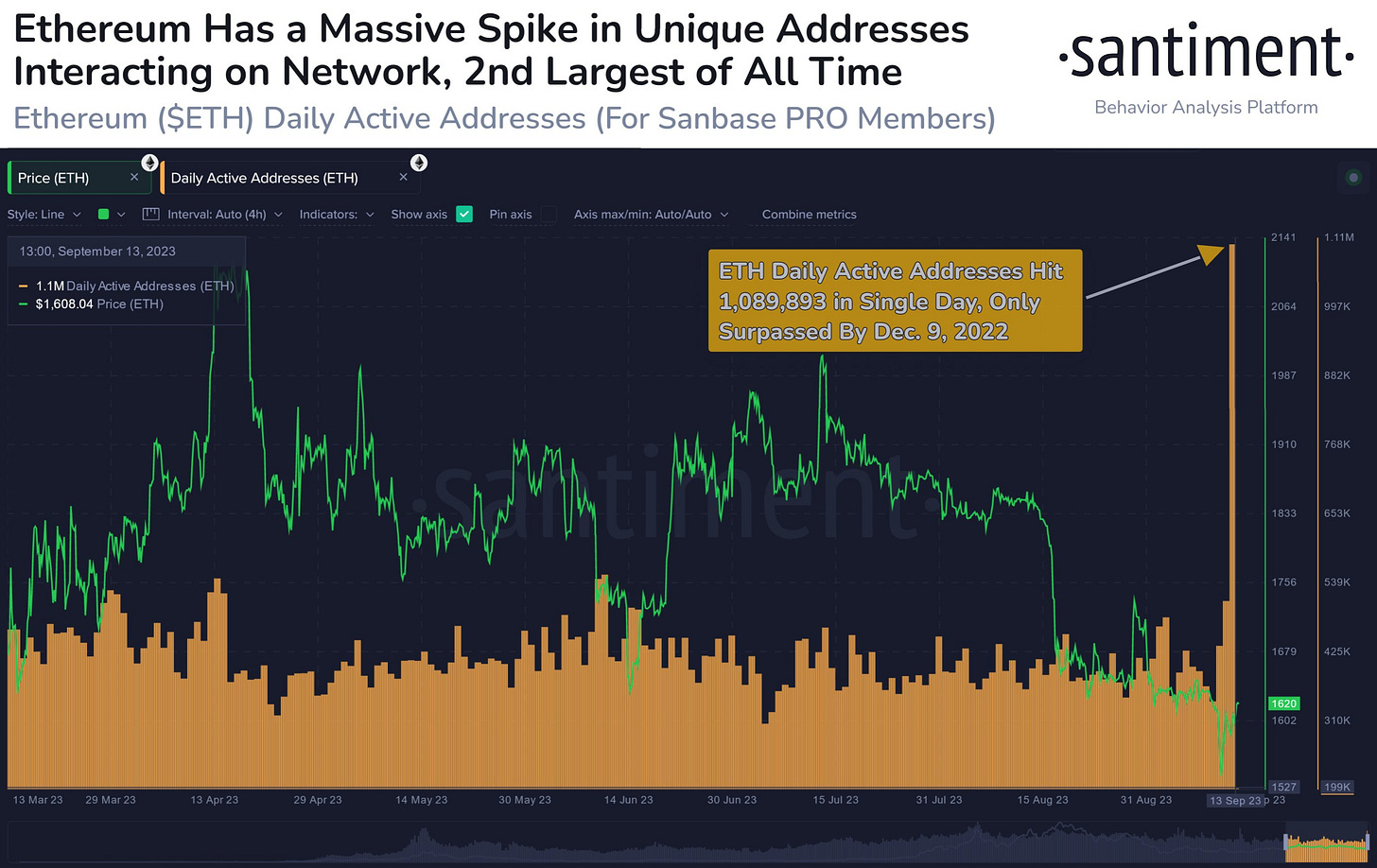

📈 Market update: The Ethereum network saw over 1m unique wallets on Wednesday, the 2nd highest amount in the asset's 8+ year history!

🗞️ Interesting news: >50% digital asset adoption in Turkey, >50% surveyed Asset Managers in the US, Europe, and the U.K. are managing digital assets for clients, ANZ x Chainlink used the A$DC stablecoin for a tokenised asset transaction.

👓 Read of the week: A report capturing the >50% asset managers and hedge funds express bullish sentiments toward digital assets.

🎥 Video of the week: Watch how to use new MidJourney features to achieve ultra-realistic images

🤖 This week’s AI showcase: An article in NZ Lawyer “Should copyright protect AI-generated work?” gives an NZ legal perspective on generative AI tools

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market Update

Expect more volatility according to Santiment, as the Ethereum network just saw 1,089,893 unique wallets acting as a sender or receiver of Eth on Wednesday, the 2nd highest amount in the asset's 8+ year history 🤯. As we know, volatility can be in either direction and liquidation cascades can magnify this. Personally, I chose to interpret this as a glass-half-full situation.

🔥🗺️ 7-day heatmap below shows a fairly flat week to be honest, a bit boring:

🎭 Sentiment levels are stable and seem to be slowly rising from a low of 39 the week before last, but they are still in the Fear zone

Interesting news 🗞️

Digital Assets News 🌐💱

🦘Australian bank ANZ successfully used its A$DC stablecoin and Chainlink's Cross-Chain Interoperability Protocol (CCIP) for a tokenized asset transaction. “The bank’s work with its A$DC stablecoin and the tokenization of real-world assets has already provided us with valuable lessons as we continue to investigate enterprise-grade use cases.” This highlights ANZ's ability to foster collaboration between traditional finance and digital assets.

☪ Digital assets adoption in Turkey has surged from 40% to 52% over the past 18 months, according to a survey by KuCoin, the world's fifth-largest crypto exchange. This growth is attributed to increasing interest in cryptocurrency as a hedge against high inflation, with the Turkish lira depreciating by more than 50% against the US dollar. Similar trends have been observed in countries like Brazil and Nigeria, where inflation is also a major concern, as reported in previous KuCoin studies.

🏦 A recent report reveals that 48% of surveyed Asset Managers in the U.S., Europe, and the U.K. are managing digital assets for clients. While concerns about regulation persist, 85% believe regulatory bodies will support digital asset adoption. Institutions prioritize crypto despite the bear market. Asset managers surveyed were not small fish either, about a third reported >$5B in AUM across all asset classes, with around another third declaring $1-5B AUM.

🇹🇭 Thailand's KBank has launched a $100 million fund aimed at AI, Web3, and fintech startups globally. The Bank of Thailand has approved KBank's fund initiative, operated under the name KXVC (Kasikorn X Venture Capital), the fund seeks to facilitate financial innovation in the Asia-Pacific region. It will target traditional financial stakeholders, with a focus on consumer-oriented AI, cybersecurity, blockchain node validators, zero-knowledge proofs (ZKP), wallets, and non-fungible tokens (NFTs). KBank plans to invest in more than 30 startups and funds across the U.S., EU, Israel, and APAC.

👓Read of the Week

This week’s read is the report in the update above, highlighting the remarkable resilience and expansion of the U.S. and U.K./European digital asset markets despite rigorous regulatory scrutiny. My take-home message was that asset managers and hedge funds express bullish sentiments toward digital assets, viewing it as both a growth opportunity and a means to introduce diverse investment vehicles, including ETFs and innovative digital asset securities. While some focus on traditional crypto applications like trading and investment, others are intrigued by decentralized finance (DeFi). Infrastructure development and data analytics are the forthcoming industry focal points, with increased investments anticipated in the next 6 to 12 months.

Watch of the week

Midjourney just keeps getting better and better. This video explores how to use MidJourney to achieve of ultra-realistic images. Inspired by a Reddit thread, the Matt takes viewers on a captivating journey into the world of crafting the most lifelike images possible. If I were Getty or Shutterstock I would be sweating so hard.

This week’s AI showcase🎨🤖🎵✍🏼

AI is disruptive, challenging industries and driving innovation. Each week I showcase something amazing generated by AI-based tools. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

This week I wanted to feature an article in NZ Lawyer, another perspective on the generative AI tools I have talked about in previous weeks. The article is titled: “Should copyright protect AI-generated work?” and discusses the complex challenges arising from AI-generated content and copyright. As AI technologies like ChatGPT advance rapidly, there is a pressing need to address issues such as the use of copyrighted material to train AI, ownership of AI-generated work, and the suitability of current copyright laws for protecting these creations. The discussion also emphasizes the importance of copyright in incentivising human creativity and suggests that existing laws may need updates to account for the emergence of generative AI.

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.