📔 Weekly Journal: Happy New Year! 🎆📅

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as wrapping up 2023 and looking forward to 2024

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 56 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: A wrapup of key 2023 metrics.

🗞️ Interesting news: Binance’s impressive 2023 KPIs, the startup that will help by purchasing worthless NFTs for a 1 cent to harvest tax losses, and the B2 quadruped robot.

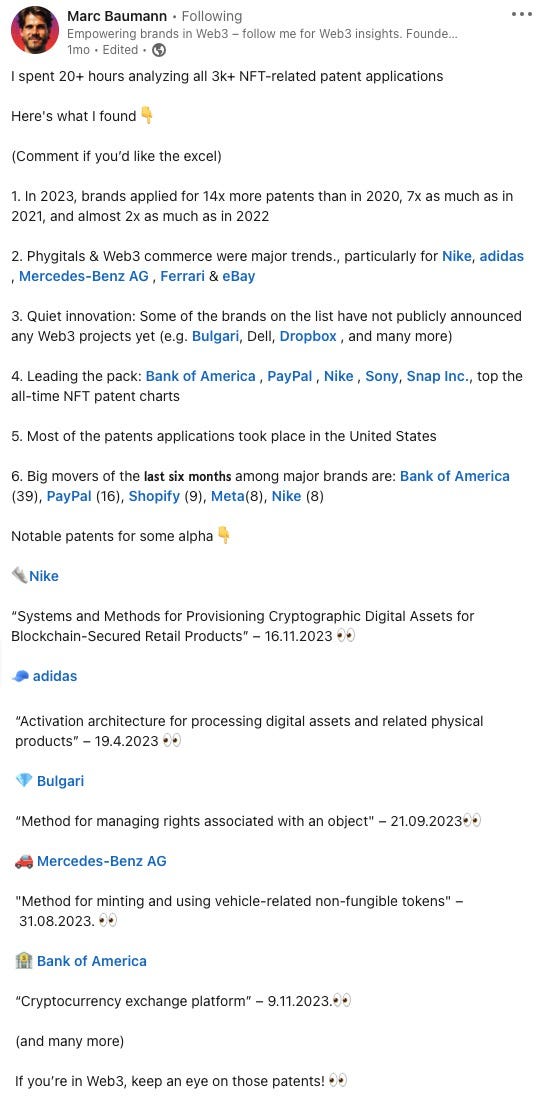

👓 Read of the week: Marc Baumann’s great wrap-up of 2023 highlights of brands making Web3 moves

🎥 Video of the week: Moore's Law, debates on its validity, and the future of technology beyond traditional paradigms.

🤖 AI: Learn about the huge lawsuit is unfolding, New York Times v. OpenAI

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market Update

2023 wrapup:

Digital assets experienced remarkable growth, with Bitcoin surging over 172% and maintaining a correction of less than 20%.

Net capital inflows into BTC, ETH, and Stablecoins were significant.

Institutional capital flows shifted notably in October, and Long-Term Holders now hold a near all-time-high of Bitcoin supply, with a majority of coins in profit.

Market structure shifts include Tether regaining dominance among stablecoins, CME futures surpassing Binance, and substantial growth in Options markets.

For more see the Glassnode 2023 Yearly On-chain Review

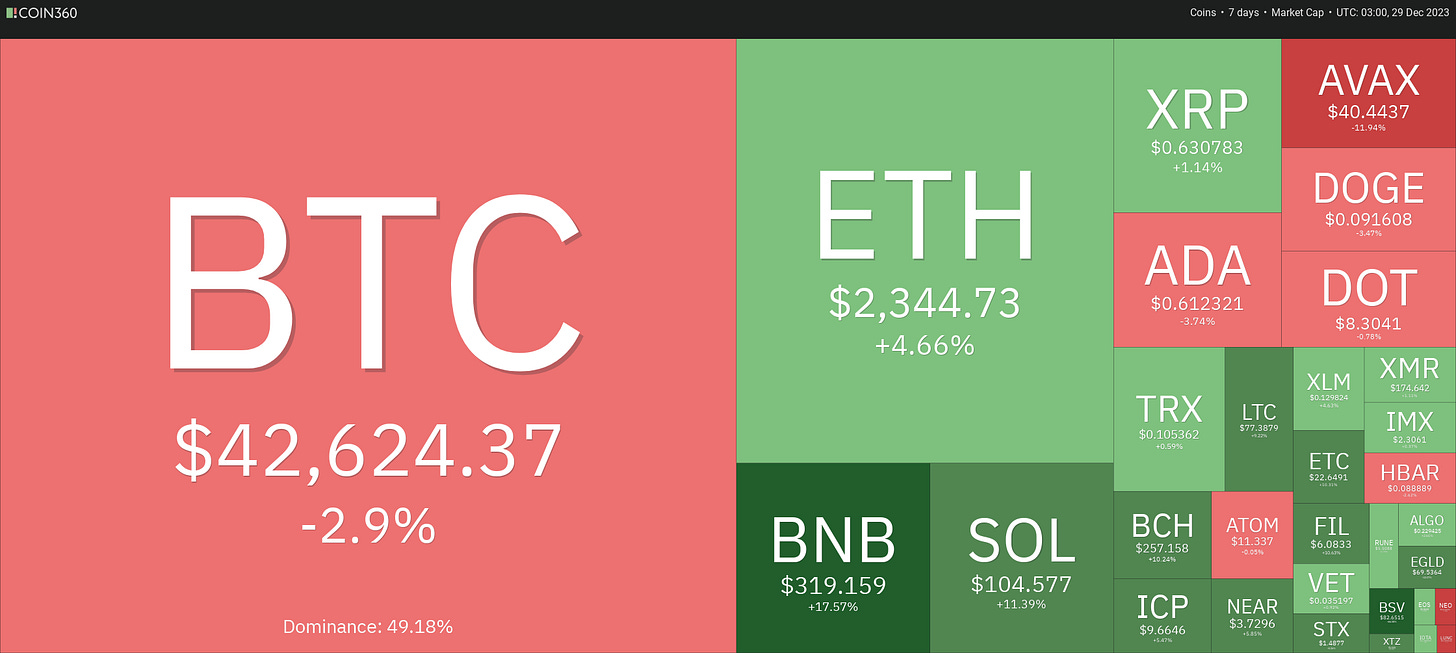

🔥🗺️ 7-day heatmap below, slight pullback this week with BTC but ETH doing well

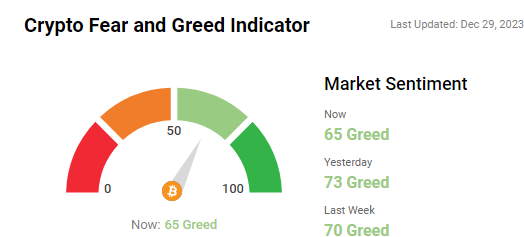

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Still in the Greed zone, no real change this week.

Interesting news from this week🗞️

📈 Despite all the negative media exposure and legal challenges, including a $7 billion settlement and the CEO's guilty plea, Binance, the world's largest cryptocurrency exchange, reported a 30% growth in users, reaching 170 million in 2023. The end-of-year report highlighted increased trading on its peer-to-peer platform and expanded crypto reserves. Remember not to get distracted by the noise, digital assets are part of a huge global societal shift, it’s not going to stop or even slow down for a long time. Buckle up for 2024!

💡 Unsellable, a startup, will purchase your worthless NFTs for a 1 cent each, helping owners declare $4.2 million in tax write-offs for realised losses. With the NFT market down over 90%, Unsellable targets worthless projects, amassing 26,000 NFTs. It charges a $2 fee for each NFT transfer and aims to create the world's largest NFT collection. The founders envision selling the platform to a crypto tax firm, while some express interest in owning the collection as a museum piece reflecting past speculative excess.

🤖 Unitree's B2 quadruped robot outshines its predecessor with improved speed, boasting 6 m/s, making it the fastest industrial-grade quadruped. With enhanced payload capacity at 40 kg, increased battery life (5 hours unloaded), and improved leg joint actuators for greater stability, the B2 excels in industrial applications such as automation, inspection, and emergency rescue, offering superior performance and efficiency.

👓Read of the Week

I highly recommend Marc Baumann’s great wrap-up of 2023 highlights of brands making Web3 moves:

🎥 Watch of the week

Sometimes it’s helpful to pause and look back to see how far tech has come just in the last 20 years.

This video delves into Moore's Law, highlighting its historical context with Gordon Moore's founding of Intel and the inception of Moore's Law in 1965. It traces the evolution of the law, addressing debates on its validity, challenges in determining transistor size, and the future of technology beyond traditional paradigms, encompassing AI and novel transistor designs.

AI 🎨🤖🎵✍🏼

This week in AI, a huge lawsuit is unfolding, New York Times v. OpenAI. A gripping analysis below is a good way to get up to speed. IP & AI Lawyer Cecilia Ziniti picks apart copyright infringement claims, visual evidence, and the clash between AI innovation and creative content protection. This insightful piece explores the potential watershed moment for the future of artificial intelligence.

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.