📔 Weekly Journal: It’s Game Time 🎲🏀♟️

[8min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats as well as a deep dive into gaming, Web3 & the emerging Metaverse

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 32 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: NZ economy slowing, Ether facing resistance at $1,970, Larry Fink sings Bitcoin’s praises.

🗞️ Interesting news: Sega enters Web3 gaming, India's $172 billion bank merger, more drama for Binance.

👓 Read of the week: A deep dive into Roblox, a $24B company that blurs the boundaries between social media and gaming.

🎥 Video of the week: A discussion on the future of the metaverse, Web3 gaming, and NFTs. Explore the limitless potential it holds for economic freedom.

🤖 This week’s AI showcase: A text-based fantasy simulation powered by OpenAI's GPT-3, and the questions raised about ownership and authorship.

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🥝 The NZ economy is showing visible signs of slowing down as the Reserve Bank's efforts to control inflation take effect. Interest rates have risen, impacting mortgage loans and business operations. Despite this, inflation remains a concern, and the economy's slowdown may have wider implications. The unemployment rate and mortgage stress are key factors to monitor as the slowdown progresses.

🔷 Ether price facing resistance at $1,970 due to several factors (Read more: 4 reasons why the Ether price can’t break $1,970)

₿ BlackRock CEO Larry Fink has shown increased enthusiasm this week for bitcoin as his firm and others seek approval for a spot bitcoin exchange-traded fund (ETF). Fink, who was previously skeptical of the cryptocurrency due to its association with illicit activities, now sees it as a “digital equivalent of gold”. He believes that investing in bitcoin can serve as a hedge against inflation and currency devaluation. Fink also highlighted the need for a spot bitcoin ETF to reduce the high costs associated with trading and to make cryptocurrency more accessible to a broader audience.

Remember to take a step back and zoom out, the chart below gives good perspective from Mark Harvey:

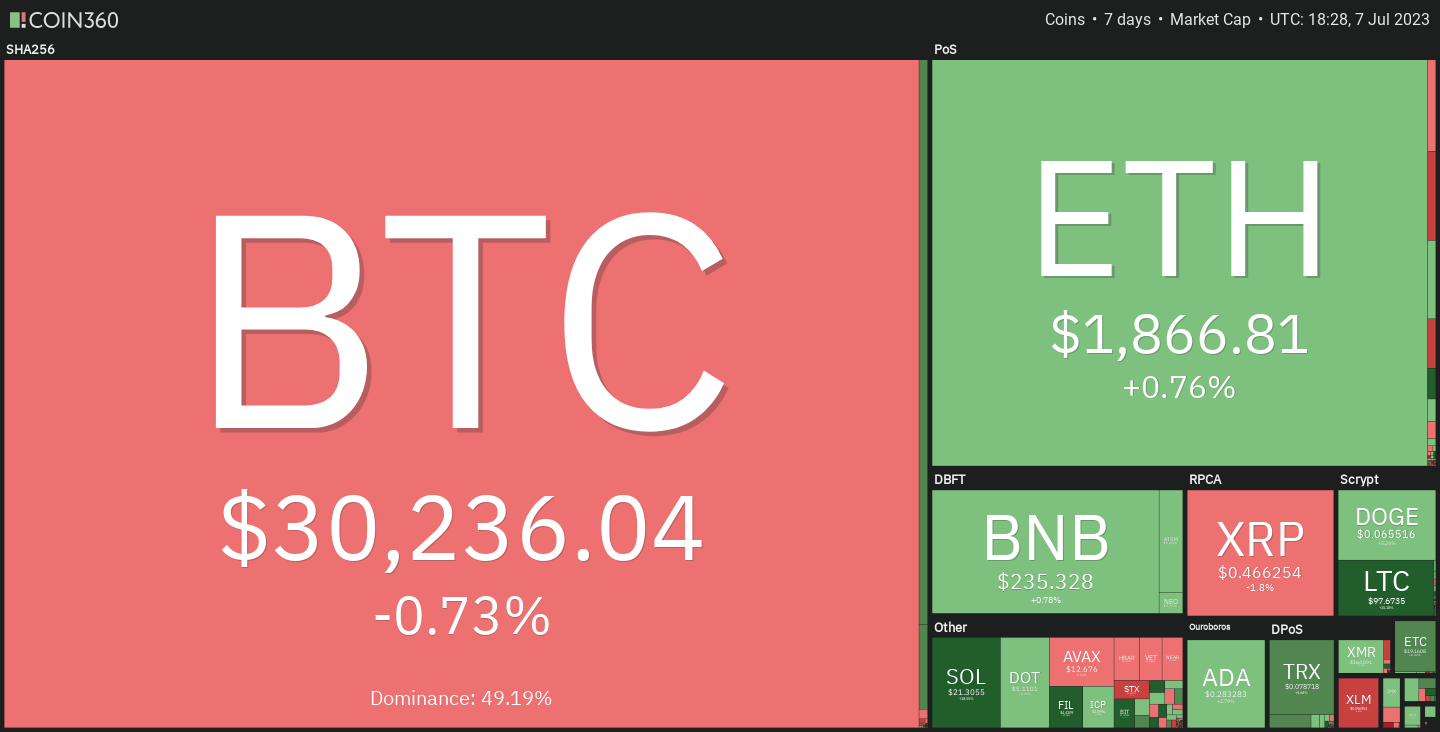

🔥🗺️ The 7-day heatmap shows a relatively flat week (size of the blocks are market share, colour & % show the change over the last week)

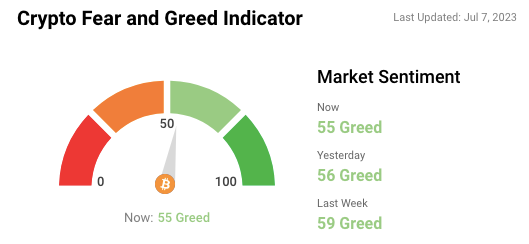

🎭 Sentiment levels are still in mild greed, no real change this week.

Interesting news

🦔 Sega, known for iconic game franchises like Sonic the Hedgehog and Yakuza, has entered the web3 gaming world. They're developing Sangokushi Taisen, a web3 version of a popular web2 game, featuring innovative gameplay and graphics. The trading card game will be available on PCs in late 2023, with more languages added in 2024. Sega's partnership with Oasys blockchain and their previous NFT launch demonstrate their commitment to the web3 space. This move marks a significant win for web3 gaming, which is poised to shape the future of the industry.

HDFC Bank and HDFC, India's largest private sector bank and housing finance company respectively, have merged, creating a combined entity valued at $172 billion. This makes HDFC Bank one of the world's most valuable banks, surpassing giants like HSBC and Citigroup. The merger aims to boost credit flow, underwrite larger loans, and address the country's infrastructure needs. The new HDFC Bank entity will have 120 million customers, 8,300 branches, and 177,000 employees. It also presents an opportunity to tap into HDFC's mortgage customers for in-house home loan products.

Several senior officials, including Binance's General Counsel, Chief Strategy Officer, and Senior Vice President for Compliance, have resigned amid the crypto exchange's ongoing legal battles. The departures come as Binance faces investigations by the US Department of Justice for alleged attempts to deceive regulators and violations of money laundering and sanctions. The exodus of executives is expected to complicate Binance's defense efforts, as the company is already under scrutiny from multiple regulators worldwide. The situation has impacted Binance's operations, leading to the loss of a European banking partner and the suspension of trading in US dollars by Binance US. The price of Binance's native token, BNB, has dropped approximately 2% since the news broke.

👓Read of the Week

“How Roblox Grows: From Virtual Playground to Global Empire” offers a comprehensive exploration of Roblox, a company that blurs the boundaries between social media and gaming. I categorise it as a “proto-metaverse experience”, a stepping stone to a true open metaverse.

The article deep dives delves into:

The company's origins, its current position (market cap of $24B!), and its future trajectory.

Roblox can be likened to YouTube for online games, serving as an ecosystem for game creation and hosting rather than a standalone game.

With elements of YouTube, LEGO, Facebook, and Epic Games, Roblox has emerged as a fascinating player in the race to build the largest virtual economy.

Since its establishment in 2004, Roblox has aimed to provide a global online space where individuals can engage in various activities together, such as building, running businesses, battling enemies, participating in sports, and attending concerts.

Video of the week 🎥

I really enjoyed the discussion on the future of the metaverse, Web3 gaming, and NFTs in this interview with Yat Siu. He is a visionary entrepreneur and gaming pioneer. My highlights:

The profound impact of Web3 beyond its surface appeal and explores the limitless potential it holds for economic freedom.

How Web3 gaming transparently unlocks the financial ecosystem of the gaming world.

His take on the importance of understanding the underlying purpose behind your work and how it can lead to a more fulfilling life.

This week’s AI showcase🎨🤖🎵✍🏼

AI is disruptive, challenging industries and driving innovation. Each week I showcase something amazing generated by AI-based tool. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

AI is playing a pivotal role in shaping the future of gaming by enabling dynamic and immersive experiences, enhancing gameplay mechanics, and introducing new possibilities for content generation and intelligent game design. A recent article by Wired Magazine discusses the potential copyright crisis arising from the use of generative artificial intelligence (AI) in games.

AI Dungeon, a text-based fantasy simulation powered by OpenAI's GPT-3, allows players to create unique narratives with the assistance of AI. However, this raises questions about ownership and authorship. The article highlights the ambiguity surrounding who owns the content generated using AI tools and whether the AI developers or the users hold the rights.

The article also mentions the cautious approach taken by platforms like Roblox, which use generative AI trained on released community assets rather than user-created games. The need for clear permissions and management of user data for AI training is emphasised, as the industry moves towards a future where these issues cannot be ignored. Interesting stuff!

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. Nothing I say is financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.