📔 Weekly Journal: Banks fighting 🥊

[7 min read] In your inbox every Saturday afternoon, a perfect start to your weekend. This week is about the banking system turmoil and how alternatives like Bitcoin start to look more appealing.

This week’s Weekly Journal 📔 showcases the banking system fighting to stabilise, times are tough. Other solutions start to look more appealing, we discuss this today.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

Market update: NZ Chief Economist advises on our path back to low inflation, crypto market stays strong

Interesting news: More cracks in the banking system reveal the value offering of Bitcoin

Poll of the week: Inflation temp check

Video of the week: Microsoft offers bite-sized AI tools to the masses

This week’s AI showcase: How these AI tools will affect the future of your work

Market update 📈

🥝 On Thursday, Chief Economist Paul Conway presented “The path back to low inflation in New Zealand”. Here are his 4 key points:

Inflation is high and widespread. Because strong demand outstripped supply. Businesses passed on higher costs and workers sought higher pay to compensate for higher prices. Fiscal and monetary responses to the pandemic supported demand while health measures and other shocks reduced the supply of labour and products.

We are worse off because of the pandemic, the war and floods. Monetary policy cannot do anything about the loss of real income stemming from these events.

Monetary policy is lowering inflation by lifting interest rates to ensure persistence in inflation above our inflation target is squeezed out of the economy. We are incredibly determined to get inflation and inflation expectations back to target.

Returning inflation to target could be made more difficult if businesses and workers try to push up their real profit margins and real wages to make up for the inflationary impact of the pandemic, the war, and the storms. In this case, monetary policy would need to be more contractionary for longer, resulting in a deeper recession.

🌐 Global markets have spent the week dissection Monday’s news that UBS has agreed to buy Credit Suisse for CHF3 billion and will take up to $5.4 billion in losses in a merger driven by Swiss authorities. Credit Suisse has been plagued with problems, ranging from drug money in Bulgaria to spying by former executives, which have caused the bank to hemorrhage clients. Despite Credit Suisse's well-capitalized position, investor confidence has waned due to the bank's lack of hedging and unrealized losses on bonds. The Swiss bank's bond portfolio plummeted, which indicates investors have lost faith in the bank's ability to survive. This confidence game is one that NZ banks also need to play, reassuring depositors and investors of their resilience. With concerns over the high-interest rate exposure of NZ banks' mortgage portfolios, the Reserve Bank may need to pause on its plans for further rate hikes.

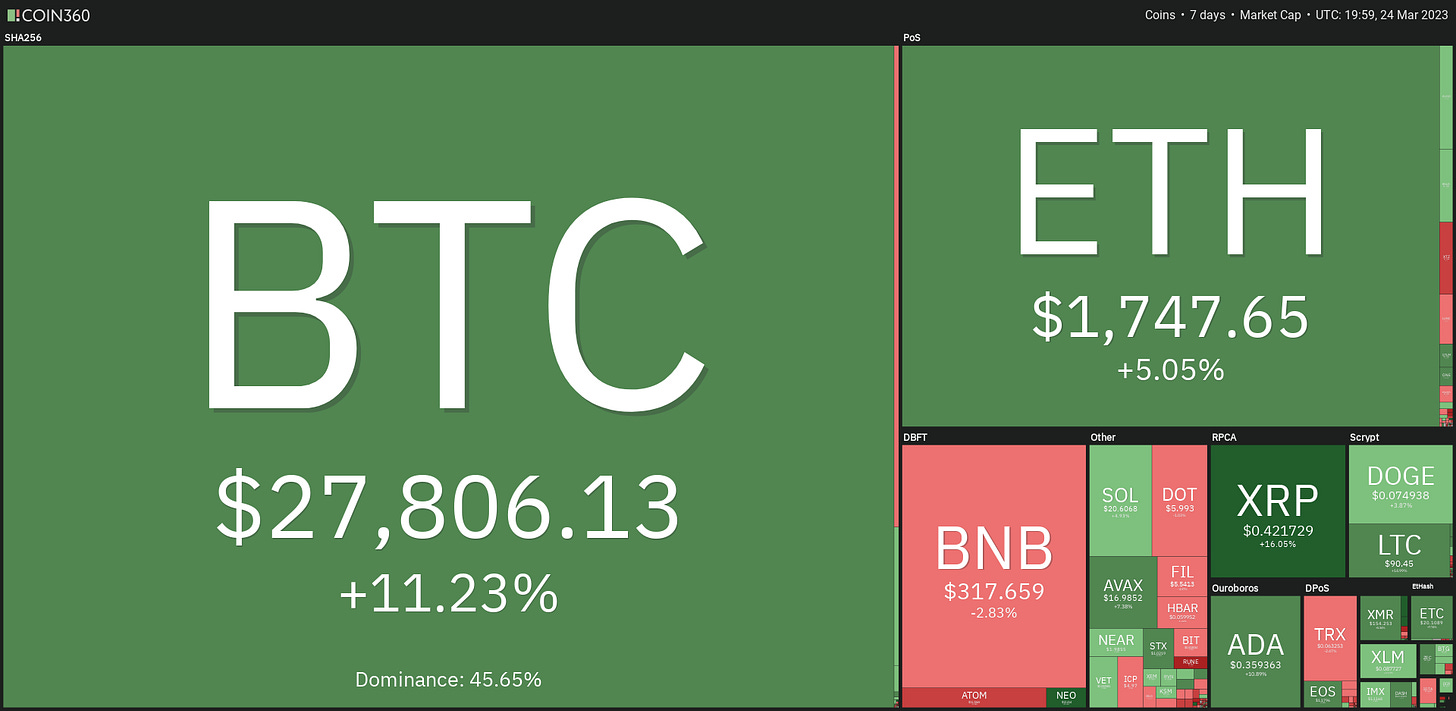

🗺️ Crypto Market Heatmap shows a strong week, let by Bitcoin (size of the blocks are market share, colour & % show the change over the last week)

🤔 Sentiment levels are still in the greed zone, typical after a solid pump in price.

Banks also have Bitcoin to fight against 🥊

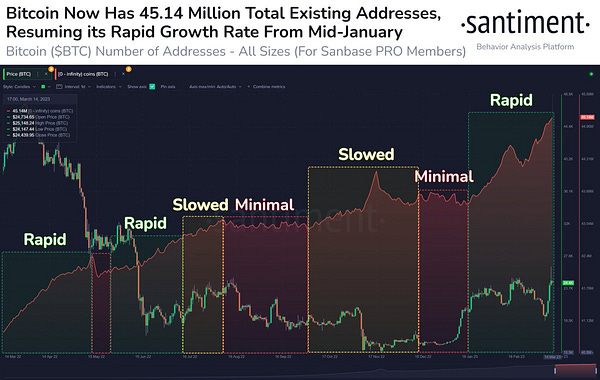

Bitcoin's popularity is on the rise, and the numbers don't lie. Take a look at the graph from Santiment, which shows how bitcoin's growth is thriving despite the current market volatility and unpredictability. It's incredible to see that in just the past two months, the number of bitcoin addresses has soared by nearly 2 million. That's a 4% increase in an unbelievably short amount of time!

But why is this happening? What's driving this surge in bitcoin adoption? Perhaps it's because people are starting to realize the potential of this revolutionary digital currency. Like a phoenix rising from the ashes, bitcoin has emerged as a powerful alternative to traditional banking systems. It's decentralized, secure, and efficient, and it puts the power back in the hands of the people.

Think about it: with bitcoin, you don't need to rely on a bank to store your money. You are your own bank, with complete control over your funds. And that's not all. Bitcoin transactions are fast and cheap through the Lightning Network, making it a perfect solution for anyone looking to send money around the world. No more waiting for days for your transfer to go through or paying exorbitant fees just to move your own money.

It's no wonder that bitcoin is taking the world by storm. People are tired of being at the mercy of big banks and governments. They want a currency that's transparent, accessible, and independent. And that's exactly what bitcoin provides. I’m not naive, I know that banks are not going anywhere, but they will have to evolve against options like Bitcoin, especially in developing economies.

Despite concerns about crypto troubles fueling a banking crisis, the recent collapse of two California-based banks was not caused by their involvement in the crypto industry. Silvergate Bank, a bank focused on crypto, avoided federal assistance, while Silicon Valley Bank, with weaker ties to digital assets, required FDIC receivership. Both banks suffered from a flood of withdrawals and had to liquidate securities, taking big write-downs due to rising interest rates. Silvergate Bank had enough liquidity to satisfy depositors and repay loans, making its collapse the ideal scenario for a bank, with shareholders taking the hit instead of depositors or the government.

In other News 🗞️

🏦 Microsoft is reportedly working on a new Web3 wallet that integrates crypto and NFTs into its Edge browser. The wallet will enable users to buy and sell crypto assets on Coinbase and MoonPay, browse NFT marketplaces, and buy and sell NFTs using the digital wallet. This move by Microsoft follows the trend of tech companies encroaching into the financial space. As the adoption of cryptocurrency trading and digital wallets continues to grow, more companies are expected to enter the space, from established financial institutions to tech giants and fintech startups. Fintech startups are leveraging the latest technology to create more efficient, cost-effective, and user-friendly financial products, prompting established financial institutions and tech companies to invest heavily in fintech to stay competitive and retain customers.

Poll of the week ✅

Inflation is continuing to grind down consumers and the economy is slowing down.

Video of the week 🎥

There is always a challenge getting emerging technology into the hands of everyday users, in a way that is simple and has a gentle learning curve. Microsoft are winning, putting their $10 billion dollar investment into OpenAI to good use.

Watch the video and read below and you will see why:

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by an AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

Microsoft just announced a major upgrade to its 365 suite, introducing a powerful AI Copilot for Word, Powerpoint, Outlook, Excel and Teams. With over 400 million paid users, the impact of this upgrade is going to be massive!

Imagine being able to say "prepare me for my meeting," and Copilot generates a list of bullets for you to focus on during the meeting. Or, generating a new product announcement in Word by typing in a prompt and letting Copilot read and analyze an existing document to generate the new content with perfect context.

The Copilot is a game-changer for enterprises, allowing them to use AI tools to customize everything to each business, with no more context blockers. It can even automatically capture meeting notes, transcripts, summaries, action items, and tasks.

Google also announced generative AI in their office suite, which means virtually every office worker will soon have access to AI in their most-used tools. This could accelerate AI adoption more than anything we've seen so far. Are you ready for the future of work?

Thats all for this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.