📔 Weekly Journal: Merry Christmas 🎄

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well as a few of the many reasons for a promising 2024 in emerging technologies.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 55 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: 2023 finishing strong and 2024 tailwinds such as Bitcoin ETFs, the April halving, and likely reduced interest rates and Quantitative Easing in the US.

🗞️ Interesting news: Starbucks & Polygon issuing NFT incentives for reusable cups, China aggressively pursuing Web3 and blockchain technologies despite its crypto ban, Solana's decentralized exchanges surpassed Ethereum in weekly volume.

👓 Read of the week: A case for why Ethereum is positioned as a key blockchain for tokenised real-world assets in 2024

🎥 Video of the week: Lamborghini uses Roblox to allow fans to test drive the Ultra GT car, slated for release in 2028.

🤖 AI: Deep learning AI has identified a new class of antibiotic candidates against drug-resistant bacterium MRSA

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market Update

Bitcoin's 2023 recovery has showcased the cryptocurrency's resilience amid challenges. From a market top near $69,000 in late 2021 to a low of $17,600 in June 2022, Bitcoin faced setbacks like the Terra Luna collapse and FTX's fraud breakdown.

However, 2023 saw a revival, reaching $45,000 a few weeks ago. 2024 looks to be strong with tailwinds such as Bitcoin ETF approvals, the April halving, and likely reduced interest rates and Quantitative Easing in the US.

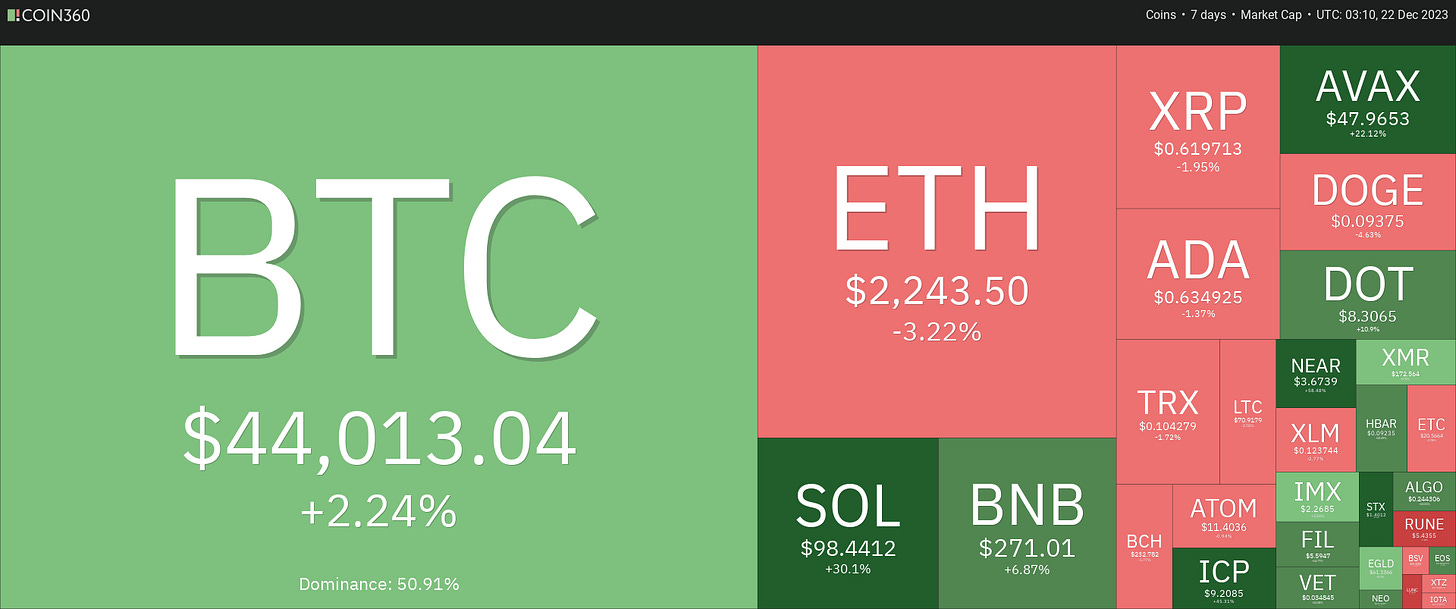

🔥🗺️ 7-day heatmap below

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Still in the Greed zone, no real change this week.

Interesting news from this week🗞️

Starbucks, in collaboration with Polygon, aims to boost sustainability by issuing NFTs through its app, encouraging customers to use reusable cups. Starting mid-January 2024, users can earn "eco-stamps" for ordering drinks with reusable cups, exchanging them for NFTs in a dedicated wallet. The NFTs, developed with South Korea's Print Bakery and NFT artist DADAZ, showcase eco-friendly themes. Starbucks plans an in-store exhibition at its Seoul location to highlight sustainability achievements. The initiative complements Starbucks' broader eco-friendly efforts, signaling diverse use cases for NFTs in a major global coffee business.

China is aggressively pursuing Web3 and blockchain technologies despite its crypto ban. The Ministry of Industry and Information Technology aims to position China as a leader in decentralised tech, proposing initiatives to advance research, establish global standards, and integrate Web3 in sectors like healthcare and tourism. This contrasts with China's strict stance on cryptocurrency, signalling a paradoxical approach to emerging technologies. The Ministry's broader initiative includes a 3-year plan for the Metaverse, aiming to incubate globally significant startups by 2025.

Solana's decentralized exchanges (DEXs) have surpassed Ethereum in weekly transaction volume, reaching $9.03 billion compared to Ethereum's $8.836 billion. Meme coins like BONK and Dogwifhat drove Solana's surge, benefitting from Solana’s much lower gas fees. Although Ethereum reclaimed the lead in the last 24 hours, Solana's achievement highlights growing competition. SOL, Solana's native token, surged to over $89, contributing to positive sentiment despite its smaller market cap of $37 billion, still dwarfed by Ethereum's $268 billion.

Speaking of Solana, a surge in BONK token prices, a dog-themed meme token, has revitalised sales of Solana's Saga phone, previously considered a failure. Some phones are now fetching over $5,000 on eBay, primarily from U.S. sellers. The boost in sales is attributed to a 30 million BONK token airdrop, making the $599 phone profitable amid earlier uncertainties about its success. The Saga phone, initially priced at $1,000, had faced sluggish sales before the unexpected turnaround.

👓Read of the Week

This week’s read is an opinion piece by Moody's Cristiano Ventricelli. He makes a strong case that Ethereum is positioned as a key blockchain for tokenised real-world assets, with a rising trend in asset tokenisation expected in 2024 👀. Ethereum's scalable strategy and extensive ecosystem attract institutions for pilot studies and transactions. Despite challenges like interoperability and digital cash reliability, Ethereum hosts the majority of the $2 billion tokenised real-world assets. Moody's predicts legal clarity improvement in 2024, expecting progress in digital asset frameworks, particularly in the EU, Singapore, and the UAE. The US may rely on regulatory enforcement for establishing legal precedent in the digital asset marketplace.

Read it all here: Ethereum Emerges as a Key Blockchain for Tokenised Real-World Assets

🎥 Watch of the week

How does a brand build an affinity for a product that’s not available to consumers until 2028?

Lamborghini has launched the Lamborghini Lanzador Lab experience on Roblox, offering users a virtual exploration, customisation, and test drive of the brand's forthcoming Ultra GT car, slated for release in 2028. The immersive encounter features a digital replica of the Lamborghini Museum, customisation choices, and virtual time trials. Enthusiasts can also purchase a rare avatar accessory for an exclusive in-person experience at Lamborghini's headquarters in Sant'Agata Bolognese.

AI 🎨🤖🎵✍🏼

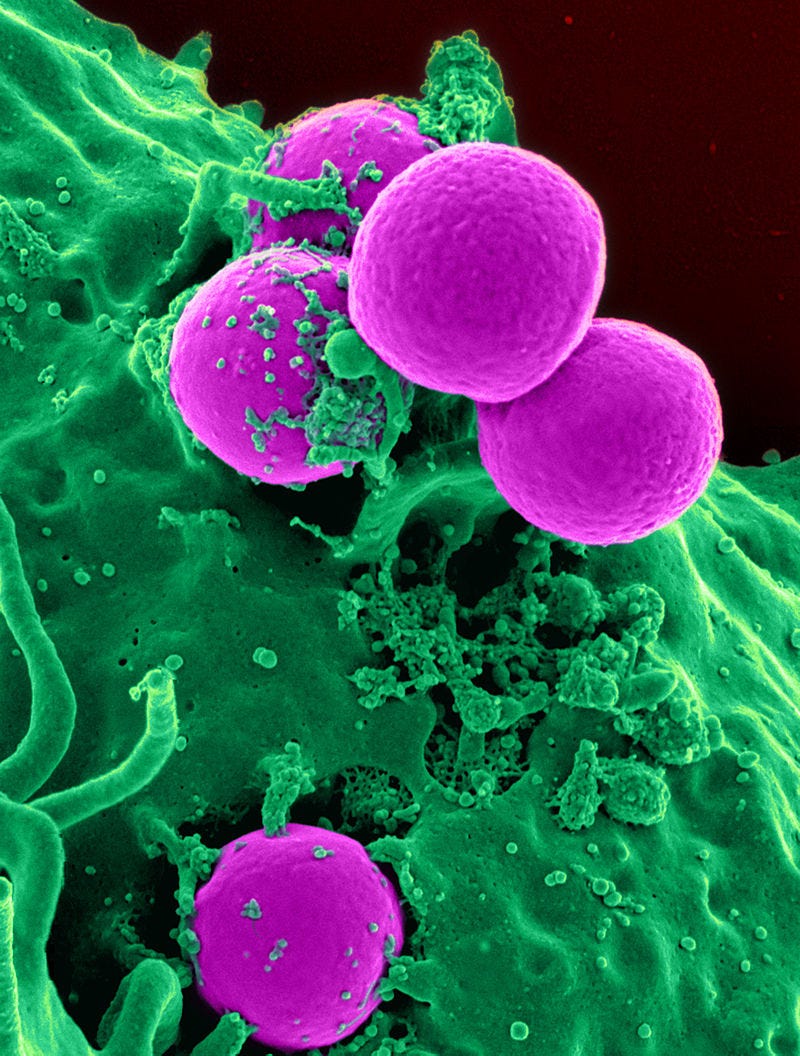

MIT researchers, utilising deep learning AI, have identified a new class of antibiotic candidates effective against drug-resistant bacterium MRSA, which causes over 10,000 deaths annually in the US.

Published in Nature, the study demonstrated the compounds' efficacy in lab and mouse models with low toxicity to human cells, making them promising drug candidates. Notably, the researchers decoded the deep-learning model's antibiotic potency predictions, offering insights for designing better drugs. The Antibiotics-AI Project at MIT aims to discover antibiotics against deadly bacteria. The compounds are being further analysed by Phare Bio, a non-profit linked to the project, for potential clinical use.

If you like this story, make sure you check out my recent piece on Alphafold:

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market cycle. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.