📔 Weekly Journal: The Fed Pauses Rate Hikes ⏸️

[7min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats as well as signals from the Fed that affect the future of asset prices 👀

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 29 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: The US pauses rate hikes, while NZ climbs the Mistery Index as kiwis suffer inflation and high interest rates

🗞️ Interesting news: Louis Vuitton tokenises physical products and Norway partners with Arbitrum to expand their Digital Krone

👓 Read of the week: A study conducted by Nokia and Ernst & Young (EY) on the expanding industrial metaverse opportunities

🎥 Video of the week: Analysis of the recenty CFTC lawsuit victory against Ooki DAO

🤖 This week’s AI showcase: TVNZ's Breakfast hosts experiment with AI-generated music

✅ Weekly poll: Help chose the emerging tech topic for Wednesday’s showcase

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🥝 Recent polling in NZ shows a significant decline in the belief that the country is heading in the right direction, with a growing majority feeling that New Zealand is on the wrong track. This downward trend has persisted for over a year, accompanied by a rise in the global Annual Misery Index, where New Zealand has climbed to 104th place from its previous ranking of 151st. The index measures misery based on factors such as unemployment, inflation, economic growth, and lending rates. Its tough out there guys, but we will get through it.

🦅 The Fed are holding interest rates steady at 5% to 5.25% while posturing about potential rate increases later in the year. Market expectations had previously suggested a pause or even cuts in interest rates, then his doe happen asset prices are likely to increase. Bitcoin experienced a sharp decline to around $25,000 then bounced back, continuing to show that investors are happy to snap up more when prices dip. Bitcoin has gone up 50% in 2023, for surpassing the 15% rise of the S&P 500. Ethereum, the second-largest cryptocurrency, also saw a decline of 6.4% and hasn’t yet bounced back.

₿ BlackRock, the world's largest asset manager, has filed for a bitcoin exchange-traded fund (ETF) amid increased regulatory scrutiny. The proposed iShares Bitcoin Trust would enable investors to gain exposure to the cryptocurrency, with Coinbase Custody serving as the custodian for the ETF. The U.S. Securities and Exchange Commission (SEC) has not approved any spot bitcoin ETFs applications. The move by BlackRock comes at a time when the crypto industry is facing regulatory challenges, including recent lawsuits against major exchanges Coinbase and Binance. The announcement led to a 2% increase in bitcoin prices.

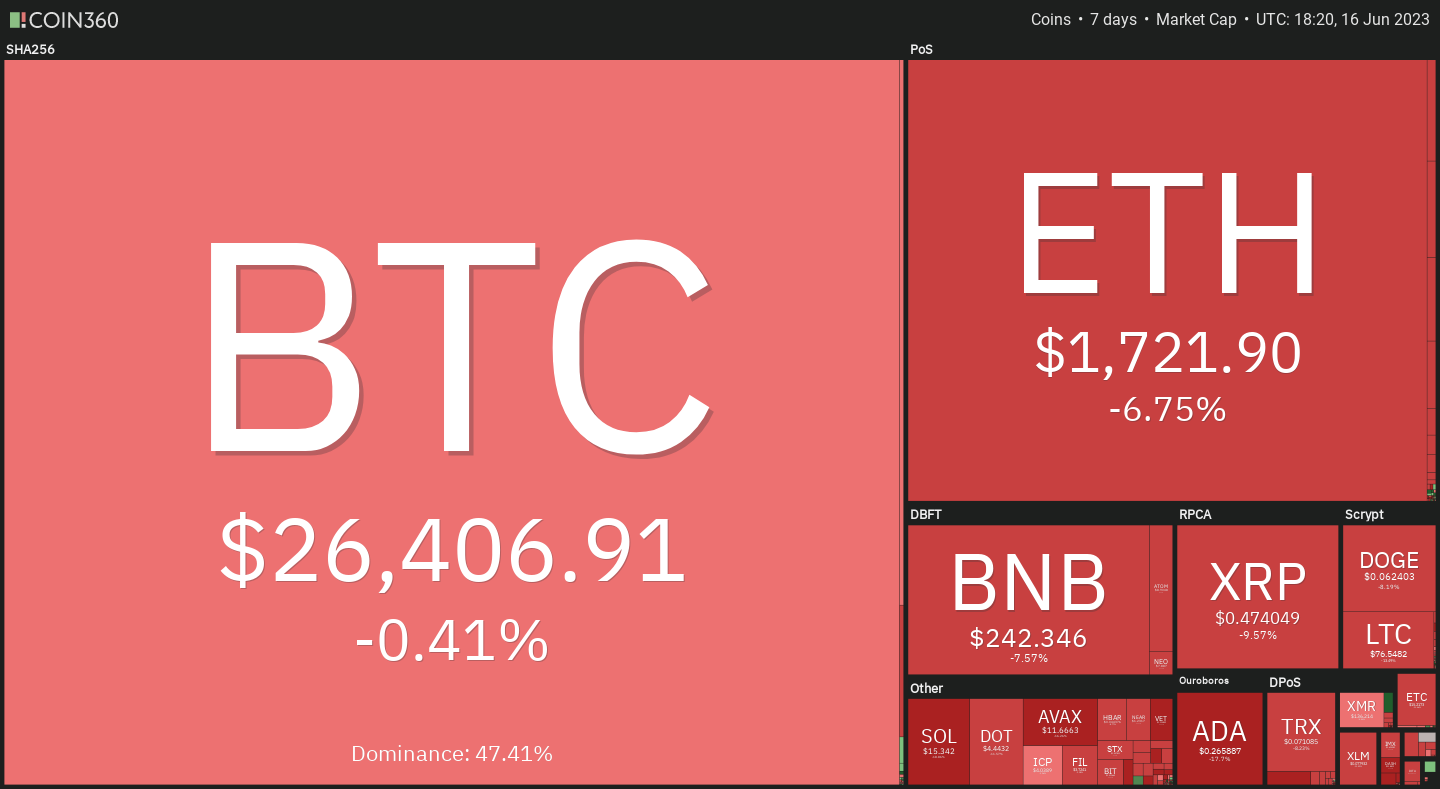

In the last 24 hrs BTC price has bounced back 4.5%. The 7-day Crypto Heatmap below reflects this recovery but Eth is still down (size of the blocks are market share, colour & % show the change over the last week)

🎭 Sentiment levels are back in Fear, so much uncertainly. No conclusive signs that the bear market is over.

Interesting news

Luxury brand Louis Vuitton has made a significant announcement, stating that they will be tokenizing their physical products! They will start with their iconic trunk and enable a "connect wallet" directly on their website. This move is significant because the global fashion industry is valued at $1.53 trillion in 2022. Louis Vuitton is blending tradition and innovation by introducing their first-ever "phygital" or "connect product" called VIA, which acts as a gateway to the Louis Vuitton insider community. This initiative redefines online identity and ownership, paving the way for a new era in the fashion industry. Lots more in this great twitter thread by @Megan_Kaspar

🇳🇴 Arbitrum, a Layer 2 scaling solution for Ethereum I discussed a month ago, is making moves! A bridge has been announced between Norway's central bank digital currency (CBDC) the Digital Krone and BRØK, an Arbitrum-based platform for managing shareholder data. This development allows for stock trading using the digital Krone. Additionally, Arbitrum has added native support for Circle's USDC stablecoin. Arbitrum is striving to maintain its position as Ethereum's top Layer 2 network amidst competition from other rivals like Polygon and Optimism.

👓Read of the Week

This weeks read is a study conducted by Nokia and Ernst & Young (EY) with Nokia's belief that the industrial metaverse is an extension of Industry 4.0. The study surveyed 860 business leaders in six countries, revealing that the U.S., the U.K., and Brazil lead in deploying or piloting industrial or enterprise metaverse use cases. Companies already implementing metaverse solutions reported benefits in capital expenditure reduction, sustainability, and safety improvement. The report defines the metaverse as the fusion of digital and physical worlds, with the industrial metaverse focusing on physical-digital fusion and human augmentation in industrial applications. Cloud computing, AI/ML, and network connectivity are key technical enablers for metaverse use cases. Exciting stuff!

Video of the week 🎥

Big news this week in the world of DAOs (Decentralised Autonomous Organisations) with the CFTC wining a big lawsuit against Ooki DAO. The video is a good watch, here are my key takeaways:

The CFTC (Commodity Futures Trading Commission) has won a lawsuit against Ooki DAO, the lawsuit alleged that Ooki DAO offered unregistered commodities.

Ooki DAO did not show up or defend itself, resulting in a default judgment in favor of the CFTC.

This case signifies that the federal government can pursue decentraliSed entities in the crypto industry and that federal agencies may bring cases against token holders who participate in DAOs accused of violating laws.

The regulator's victory serves as proof that decentralised entities can be treated as a “person” not a “company” and therefore its members can face legal consequences for their dealings (Court ruling documentation)

Let me know what you think in the comments below.

This week’s AI showcase🎨🤖🎵✍🏼

Each week I showcase something amazing generated by AI-based tool. AI is disruptive, challenging industries and driving innovation. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

TVNZ's Breakfast hosts, Chris Chang and Anna Burns-Francis, recently experimented with AI-generated music, showcasing the increasing accessibility of this technology. Their voices were used as inputs for an artificial intelligence tool, resulting in the creation of new "music."

Fabio Morreale, a music technology lecturer at the University of Auckland, who used the AI software to make the music, talks about the utilisation of AI in music production gaining significant traction in the last six months, raising questions about copyright and its implications for creative industries. Morreale highlighted unresolved concerns regarding the technology's usage, emphasising the need for regulations in this unregulated AI space.

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.