📔 Weekly Journal: The Path Is Cleared 🪓🪵🛣️

[7min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats as well how the big institutions are clearing a path to dominate digital assets

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 30 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: 2 big events that have been a catalyst for a 20% boost to Bitcoin this week, Ethereum hits new staking milestones

🗞️ Interesting news: A crypto exchange launches backed by Fidelity Digital Assets, Charles Schwab, and Citadel Securities. Positive UK regulation.

👓 Read of the week: A scathing Forbes piece on SEC Chair Gary Gensler and his “attack against crypto” 🍿

🎥 Video of the week: Trailer for "The Rise of Blus: A Nouns Movie” by the Nouns DAO, first-ever feature-length film project by a DAO

🤖 This week’s AI showcase: Mercedes-Benz and its plan to integrate OpenAI's ChatGPT chatbot into its vehicles

✅ Weekly poll: Help chose the emerging tech topic for Wednesday’s showcase

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🦅 2 big events have been a catalyst for a 20% boost to Bitcoin this week:

Fed Chair Jerome Powell said on Wednesday on Capitol Hill during a semiannual hearing on monetary policy that the U.S. central bank should play a “robust federal role” in overseeing stablecoins, and remarked that cryptocurrencies, like Bitcoin, have "staying power” as an Asset Class.

A new crypto exchange launched, backed by Fidelity Digital Assets, Charles Schwab, and Citadel Securities. Lots more about this below.

🥝 As a counterbalance to my usual bullish thesis here is a local satirical opinion piece on why bitcoin is more like gambling than investing. To be fair, there are some good points, but clearly written by someone who doesn’t see the big picture.

🔷🦾 Over 23.5 million ETH has been staked, reaching a milestone of $38 billion in value. Staking allows holders to earn passive income and secure the network. With growing interest and a net inflow of 3.6 million ETH, staked ETH represents about 19.4% of the total circulating supply and is nearing the amount held on exchanges. This trend signals a shift towards decentralization and is a positive sign for the Ethereum network.

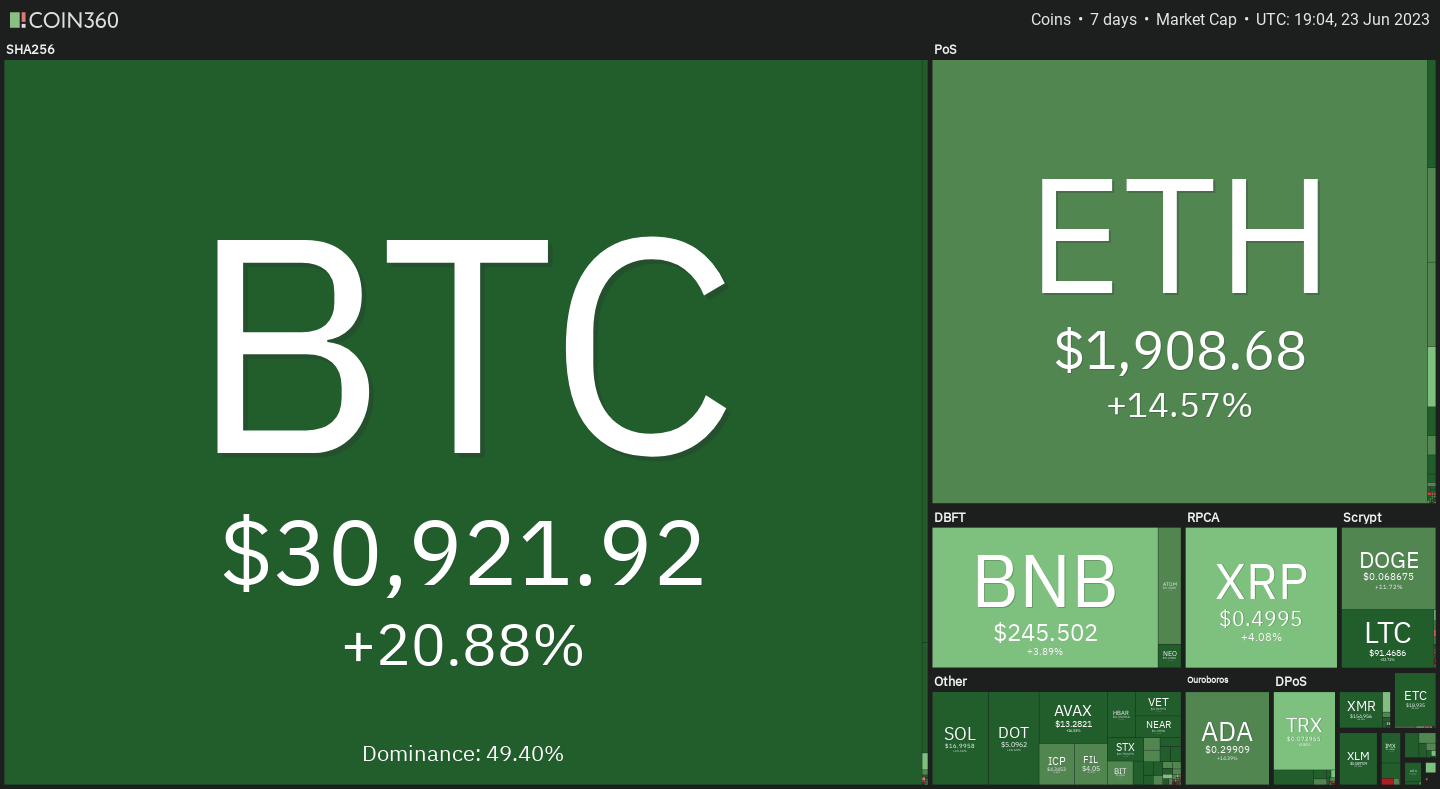

🔥🗺️ The 7-day heatmap shows a great week for Crypto! With all the news of institutional adoption and positive sentiment, its a sea of green (size of the blocks are market share, colour & % show the change over the last week)

🎭 Sentiment levels have swung back to mild greed with this recent market pump.

Interesting news

This weeks news, and the corresponding 20% price surge, can be summed up in this tweet:

Let’s dig in ⛏️:

🇺🇸 EDX Markets, a crypto exchange backed by Fidelity Digital Assets, Charles Schwab, and Citadel Securities, has officially launched in the U.S. The exchange has a unique business model where customers' digital assets are not held in custody. Instead, users must go through financial intermediaries to buy and sell crypto assets, similar to traditional stock exchanges. This approach has gained regulatory approval as it separates the exchange function from the broker-dealer function. EDX Markets currently offers only Bitcoin, Ethereum, Litecoin and Bitcoin Cash – partly because of the unclear regulatory landscape in the U.S. and plans to launch EDX Clearing for trade settlement. The exchange prioritizes regulatory compliance and investor trust.

🇬🇧 The UK Government has published new proposals for marketing and promoting crypto investments, aiming to protect consumers while fostering innovation. Starting from October 8, 2023, a new regime will be implemented, allowing registered crypto asset firms to communicate their financial promotions to UK customers. However, strict regulations will be in place, including risk warnings, banning incentives to invest, cooling-off periods, personalised risk warnings, and appropriateness assessments. The promotions must also meet fairness, clarity, and non-misleading requirements. Additionally, specific guidelines apply to stablecoins, commodity-backed coins, and promotions involving complex yield models. All firms marketing crypto assets to UK consumers must comply with these regulations.

🇫🇷 Two years ago, the Managing Director of Credit Agricole (one of the largest banks in Europe) Phillippe Brassac said that Bitcoin would be worth less than a dollar by 2025. Days ago his bank received approval to custody Bitcoin for their clients.

It’s hard to know how much is a years-long co-ordinated plan to accumulate and dominate a new asset class, and how much is a last-minute scramble to catch up. Maybe a bit of both? 🤔

👓Read of the Week

Forbes ran a piece on the “attack against crypto” led in part by SEC Chair Gary Gensler. Here are the key points:

His evolving stance on digital assets, particularly cryptocurrencies, has raised questions about his motivations and strategies.

Gensler has asserted that crypto platforms are securities exchanges falling under the SEC's purview. However, newly surfaced videos from 2018 show Gensler stating that bitcoin, ether, litecoin, and bitcoin cash are "not securities."

Congress' attempts to legislate crypto have been met with SEC enforcement actions, while Gensler garners attention through high-profile cases and media tactics.

My Fav quote: “Gensler’s attack on digital assets poses an existential threat to the industry. But for him, it may well be just a stepping stone on the path to higher office.”

Gensler's actions have drawn both support and criticism, with some suggesting they serve his political ambitions (word on the street is that he is vying to be Secretary of the Treasury).

Read the full article here: Forbes Digital Assets - The Story Behind Gary Gensler’s SEC Strategy

Video of the week 🎥

In the first-ever feature-length film project by a DAO, Nouns DAO has funded an animated film called "The Rise of Blus: A Nouns Movie," featuring characters from the Nouns NFT community. Produced by Atrium, an animation studio with connections to Pixar and Marvel, the film follows a 13-year-old Noun in a cloud city as they uncover a sinister plot by the city's elites. The project, operating on a $2.75 million budget, aims to swiftly produce high-quality animation with an agile decision-making process. The pilot for episode one is below, as well as a short behind-the-scenes on sound production. Fascinating!

This week’s AI showcase🎨🤖🎵✍🏼

AI is disruptive, challenging industries and driving innovation. Each week I showcase something amazing generated by AI-based tool. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

Mercedes-Benz has announced its plans to integrate OpenAI's ChatGPT chatbot into its vehicles through the Mercedes-Benz User Experience. This integration will allow drivers to use AI-driven voice commands and access additional functionalities. Drivers in the United States can join the beta by simply asking their car about it, the Beta will run for three months, and started on June 16. Mercedes-Benz emphasizes that data protection is a priority and that ChatGPT will operate within a controlled cloud environment to address potential risks and enhance the system.

How do you feel about your car using ChatGPT?

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.