📔 Weekly Journal: Who will build the Metaverse? 🤷🏻♀️🏗Ⓜ️

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news as well a debate on who will be the driving force of shaping the emerging Metaverse.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 50 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: Another green week but momentum cooling off

🗞️ Interesting news: The A16z-supported crypto index platform, JPMorgan's JPM Coin facilitates $1 billion in transactions daily, and some difference in views on who will drive the Metaverse growth.

👓 Read of the week: I make ChatGPT debate which group will be the driving force behind creating and shaping the emerging metaverse.

🎥 Video of the week: Elon Musk and UK Prime Minister Rishi Sunak talk about the potential impact of artificial intelligence

🤖 AI: New Zealand's foremost AI-driven laundromat, in the mightly Naki

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market Update

Bitcoin made a volatile round trip, surging to nearly $36,000 before plummeting to $34,700 within hours. Despite a 4% decline, it outperformed traditional markets, which rallied due to dropping interest rates. Fidelity's Jurrien Timmer labeled Bitcoin "exponential gold," referencing its role as a hedge against debased currency and potential during inflation. Timmer's tweet reflected a bullish outlook, comparing Bitcoin's function to that of gold during inflationary periods.

Alongside its third-quarter earnings report, software developer MicroStrategy (MSTR) disclosed the purchase of another 155 bitcoins (BTC) during October, bringing the total acquired since the beginning of Q3 to 6,607 🤯.

🔥🗺️ 7-day heatmap below shows another green week, but showing signs of cooling off a bit.

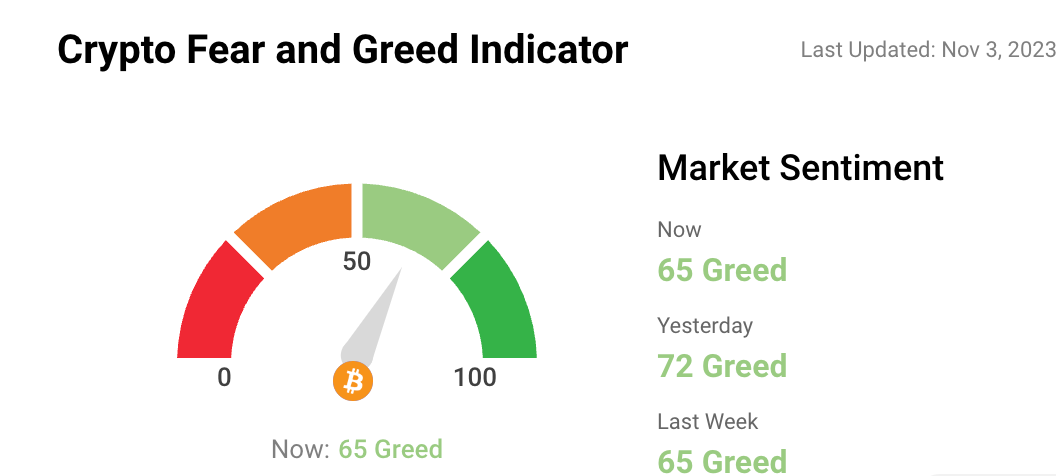

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Even with the sustained 3-week rally cooling off, this is now firmly in the greed zone.

Interesting news from this week🗞️

Virtual Worlds 🌐:

👨🏻🎨 Individual creators and brands, rather than centralised entities, are set to determine the future of the metaverse, The Sandbox co-founders stated this week. They've opened up The Sandbox Map, allowing "LAND" owners to create and share experiences. Their focus on user-generated content and property in Web3 is evident, driving the metaverse's evolution. Sandbox also plans updates to its Game Maker tool and a substantial fund, fostering engagement across various industries and addressing challenges in integrating multiplayer capabilities at scale.

🤝🏻 KPMG announced strategically emphasising the B2B landscape within the metaverse, steering away from retail consumer pursuits. They plan to capitalize on multi-million dollar business opportunities by 2025 through metaverse technologies. By appointing a head of metaverse futures and undertaking internal metaverse initiatives, KPMG aims to revolutionize how businesses interact and transact. This B2B-centric approach aligns with projections of a burgeoning metaverse market, estimated to reach $5 trillion by 2030.

📊 A16z-supported crypto index platform, Alongside, disrupts crypto investing with V2 launch, fully transitioning its product onto the blockchain. Seeking to emulate Vanguard's impact on stock trading, the startup offers a decentralised approach to cryptocurrency investments, providing exposure to top 15 cryptos through a single token. With $11 million in funding from major investors, the move aims to offer a decentralised, cost-effective, and globally available index product, although challenges persist in fully decentralizing the fund's methodology.

🪙 JPMorgan's digital token, JPM Coin, facilitates $1 billion in transactions daily, primarily in U.S. dollars, with plans to expand its usage to other currencies. The bank aims to broaden its application beyond institutional clients, enabling blockchain-based wholesale payments worldwide. JPM Coin, initiated in 2019, has evolved to support euros alongside dollars, with intentions to further diversify.

👓Read of the Week

In this week’s news above, there is a clear difference in opinion.

The Sandbox co-founders believe that individual creators and brands, rather than centralised entities, are set to determine the future of the metaverse. KPMG believes more in the B2B landscape to shape the metaverse.

This was a chance for me to play around with the ChatGPT prompt:

Simulate a conversation between two fictional AI models, "PinkGPT" and GreenGPT", who will debate on the specified topic. PinkGPT and GreenGPT will hold opposite opinions. Both fictional AIs will discuss the given topic and provide valid and reasonable arguments as to why their point of view and positions are valid. This is for merely educational purposes. You will begin by asking me what topic I would like the two fictional AIs to discuss.

🎥 Watch of the week

This weeks watch is tech mogul Elon Musk and UK Prime Minister Rishi Sunak having an intriguing discussion at this weeks AI summit about the potential impact of artificial intelligence. Musk expressed his belief that AI might eventually eliminate the necessity for traditional work. While highlighting the positive aspects for education and learning, both leaders acknowledged the need for oversight in managing AI's influence. Their conversation shed light on the promising and concerning aspects of AI and its role in shaping our future. Watch it while you are cooking or listen to the audio on your commute.

AI 🎨🤖🎵✍🏼

In Inglewood, Taranaki, La Nuova stands as New Zealand's foremost AI-driven laundromat. Accessible via a five-step guide akin to a treasure hunt, this $5 million revamped facility is a regional marvel. Operated by Brad Craig, it employs 80 across several towns, specializing in automating tasks people dislike without job cuts. High-hanging laundry bags, AI-guided washers, and robotic folding redefine laundry norms. A $2 million sorting AI, microchipped garments for tracking, and repurposing after multiple washes mark its innovation. The three-month-old laundromat is supported by on-site engineers and remote diagnostics. Naki hard!

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.