📔 Weekly Journal: Australia Regulation 🦘⚖️

[6 min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news and Australia's cryptocurrency reforms to safeguard the ~25% of Aussies who own Crypto.

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in emerging technology, digital assets, and our exciting path to the Metaverse. This is week 49 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: The reasons for Bitcoin’s week-long rally

🗞️ Interesting news: Australia's new cryptocurrency reforms, soaring U.S. national debt, and an incoming Digital Euro.

👓 Read of the week: Marc Andreessen’s recently published techno-optimism manifesto.

🎥 Video of the week: Jason Lowery's "Softwar" thesis, the shifting global power landscape, and the strategic use of technology and information warfare.

🤖 AI: The 21yr old computer science student that used a machine-learning algorithm to read for the first time a scroll buried by Mount Vesuvius 🌋

✅ Weekly poll: Help choose the emerging tech topic for Wednesday’s showcase.

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market Update

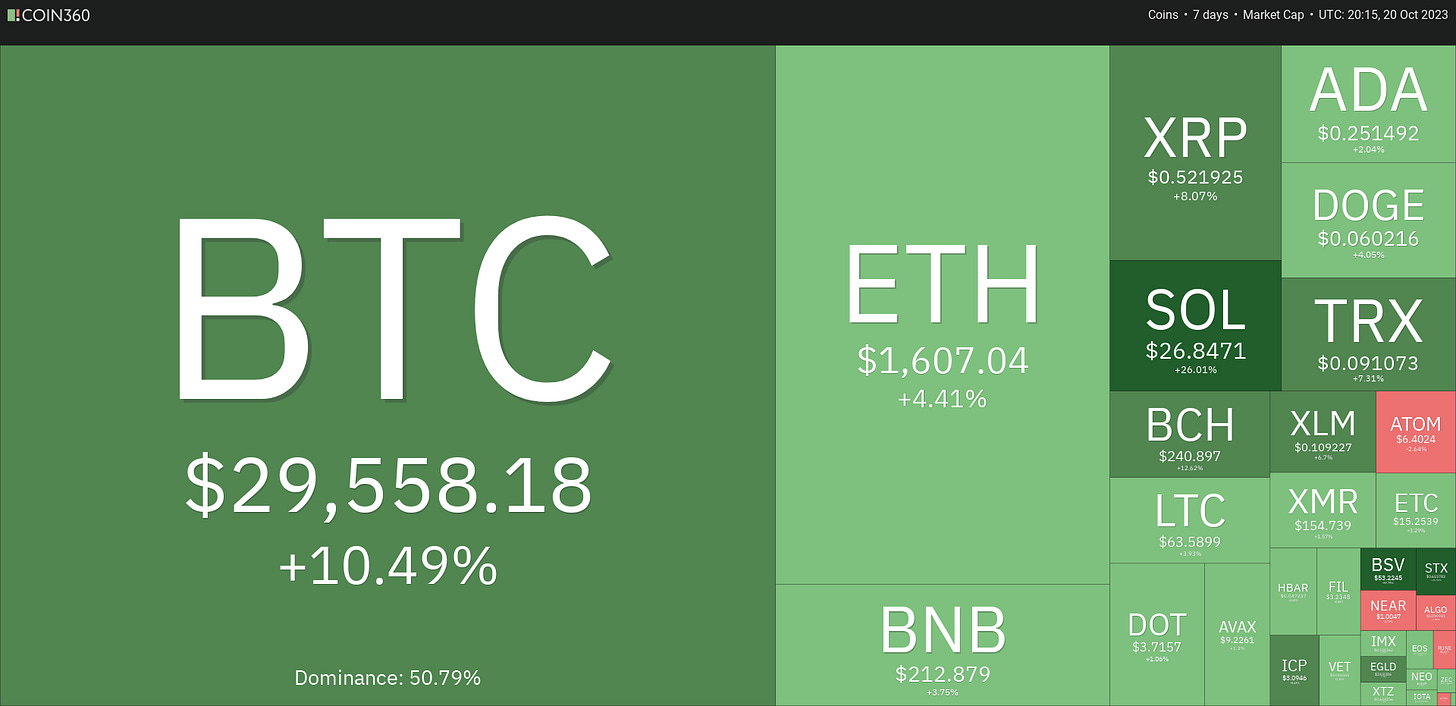

📈 Bitcoin had a week-long rally, gaining 10%+. It briefly exceeded $30,000, with a 5% rise in 24 hours, pushing the global cryptocurrency market cap to $1.18 trillion. A false report about a BlackRock ETF approval initially triggered the spike, but institutional figures like Larry Fink endorsed the rally's legitimacy, attributing it to investor demand for a "flight to quality." Larry Fink also said “It’s an example of the pent-up interest in crypto,” he said. “We are hearing from clients around the world about the need for crypto.”

🔥🗺️ 7-day heatmap below shows a very strong week, with BTC breaking over 50% dominance (its value is half of the entire crypto market).

🎭 Crypto Fear and Greed Index is based on volatility, social media sentiments, surveys, market momentum, and a few other bits and pieces. Given the sustained rally, this has popped back into the greed zone.

Interesting news from this week🗞️

🦘 Australia's government is introducing cryptocurrency reforms to safeguard the approximate 25% of Australians who own some kind of digital assets. Proposed changes subject crypto exchanges and platforms to existing financial service laws, requiring them to obtain an Australian financial services license. Platforms holding over $1,500 of an individual's assets or $5 million in total will be affected. The reforms aim to enhance operational standards and oversight to mitigate the risk of platform collapses, this is a good thing. Feedback on the proposal closes on December 1, with draft legislation consultations continuing into the next year.

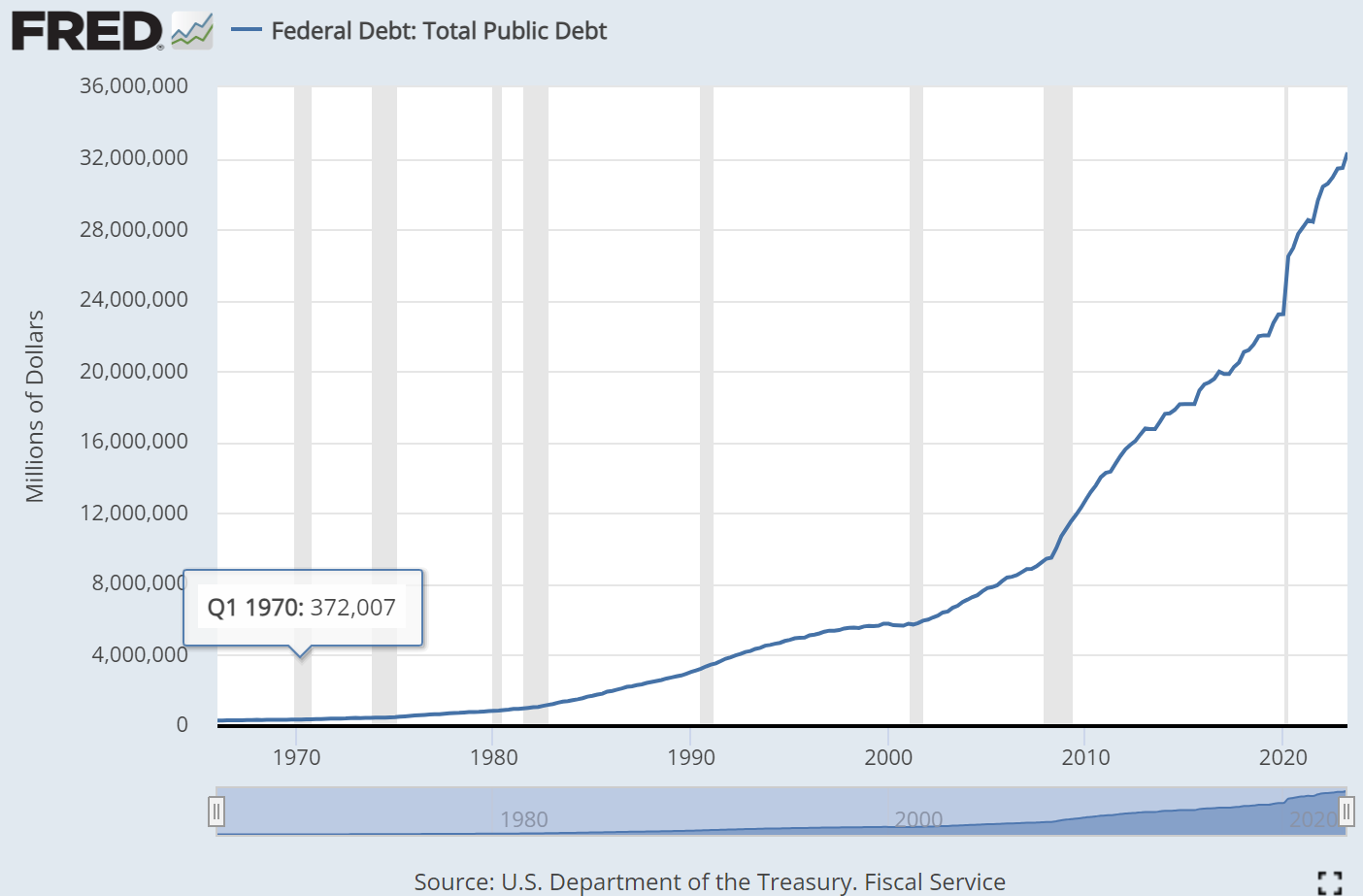

😞 There are lots of concerns about the soaring U.S. national debt which is now over $33 trillion, and is projected to reach over $50 trillion by the decade's end. Efforts to cut spending and raise revenue have faced challenges, exacerbating worries of a looming fiscal crisis because USD is (for now) the world’s reserve currency. For reference, here are some reference points:

Rising US debt may undermine trust in conventional currencies, leading individuals to turn to hard assets such as Bitcoin. Bitcoin's limited supply and decentralised structure make it an attractive hedge against inflation and economic instability, presenting a compelling option for preserving value amid increasing fiscal pressures.

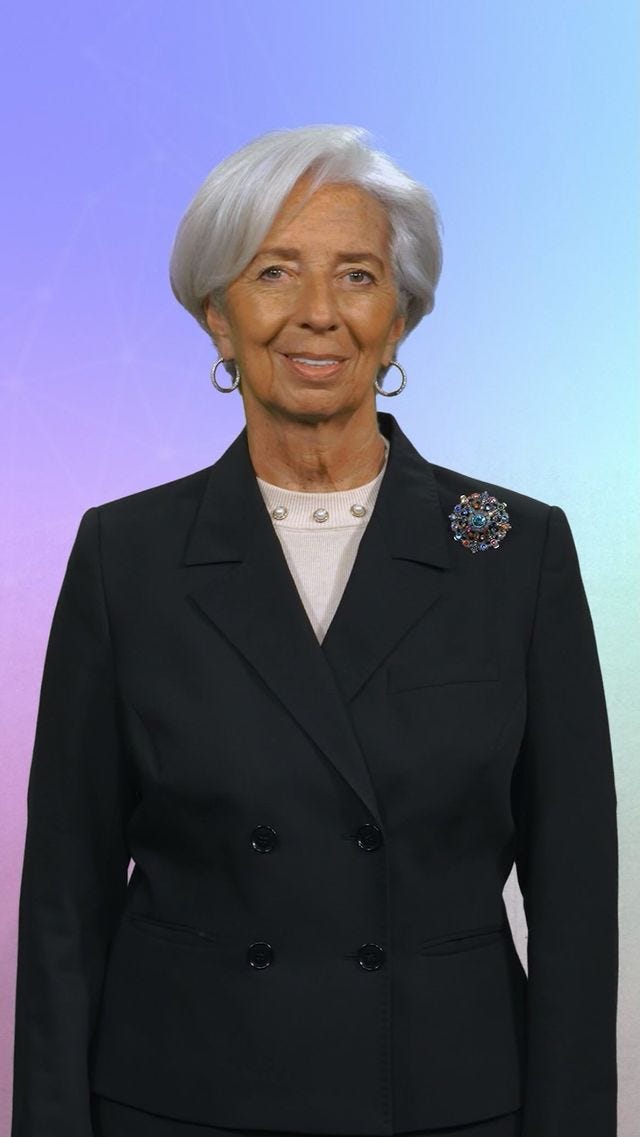

💶 Christine Lagarde, the President of the European Central Bank announced the preparation of a digital euro, existing alongside cash, to “future-proof the Euro”. She claimed it would be safe, easy to use, and free of charge.

I have written a post on CBDCs and their risks. Others took the same view, very quickly people posted “notes” to her post on Twitter, giving readers more context:

“The EDPB argues that the digital euro faces several hurdles, such as shaky privacy and anonymity safeguards, possibly limiting choice, accelerating cash displacement, and allowing spending tracking. (source)

The digital euro doesn't offer clear benefits but has many risks. (source), (source),(source), (source)”

🇪🇺 Onthe top of the EU, Binance strengthened its European presence via EUR partnerships, focusing on Euro services like deposits and withdrawals. Binance.US ceased direct USD withdrawals, facing regulatory challenges in the U.S. Despite global opportunities and challenges, Binance adapts and advances in Europe.

👓Read of the Week

In a 5,200-word manifesto published by venture capitalist and billionaire Marc Andreessen this week, he passionately defends technology and its potential. The manifesto, broken into 15 parts with frequent line breaks, emphasises techno-optimism. Andreessen dismisses critics and labels them as enemies, advocating for minimal regulation. He believes that technology and free markets have historically improved living standards. He argues that AI can save lives and broaden job opportunities, opposing the idea of a universal basic income. Additionally, he challenges the notion of overpopulation and envisions settling other planets. I don’t agree with everything but certainly a good read.

🎥 Watch of the week

I enjoyed this video on Jason Lowery's "Softwar" thesis which examines the shifting global power landscape, highlighting the strategic use of technology and information warfare by nations and non-state entities. It emphasises the growing importance of cyber capabilities, intelligence operations, and information manipulation in shaping contemporary geopolitics, including the role of cryptocurrencies such as Bitcoin in this digital evolution.

AI 🎨🤖🎵✍🏼

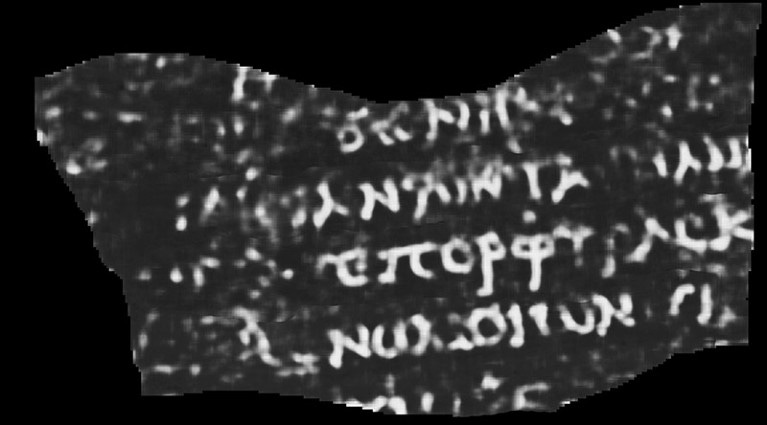

A 21-year-old computer science student, Luke Farritor, has used a machine-learning algorithm to read Greek letters in a carbonized scroll from Herculaneum, buried by Mount Vesuvius in AD 79. This remarkable breakthrough could reveal hundreds of texts from the ancient Roman city's intact library, revolutionizing our understanding of Greco-Roman antiquity. Farritor won a prize of $40,000 for reading more than 10 characters in a small section of the scroll. Researchers had previously struggled to open the scrolls, but advances in X-ray scanning and machine learning are shedding light on their hidden contents. The Vesuvius Challenge continues with the hope of revealing more text from these preserved scrolls.

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. Motto = time IN the market beats trying to time the market

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.