📔 Weekly Journal: Get Ready for CBDCs 💸🔒🌐

[8min read] Your guide to getting ahead on the digital frontier (& the weekend!). Today, the usual market news & treats as well as the 130 countries exploring CBDCs 🤯

Welcome to this week’s Weekly Journal 📔, your guide to the latest news & innovation in digital assets, emerging technology, and our exciting path to the Metaverse. This is week 31 of the 520 weeks of newsletters I have committed to, a decade of documenting our physical and digital lives converge.

New subscribers are encouraged to check out the history & purpose of this newsletter as well as the archive.

Enjoy your weekend! 😎

Ryan

Here’s what you’re getting today:

📈 Market update: Another strong week for Crypto, and institutions are loading up.

🗞️ Interesting news: The 130 countries (98% of the global economy) that are exploring digital currencies, Singapore tests asset tokenisation, and Dior jumps into Web3.

👓 Read of the week: The Bank for International Settlements unveils its blueprint for central bank digital currencies (CBDCs), along with a

biasedtake on decentralised alternatives.🎥 Video of the week: A well-balanced take on CBDC projects across different countries.

🤖 This week’s AI showcase: New AI technology revolutionising cancer radiotherapy treatment in the UK's NHS

✅ Weekly poll: Help chose the emerging tech topic for Wednesday’s showcase

🤑 DCA with me: Follow my regular $50 weekly investing in an emerging asset class.

Market update 📈

🥝 The NZ Reserve Bank is monitoring stablecoins and cryptoassets and believes there could be benefits in harmonising with global cryptoasset regulations. While the bank acknowledges the risks and opportunities in this sector, it emphasises the need for caution and refrains from proposing immediate regulation. The bank plans to enhance its monitoring capability and stay updated on global regulatory developments to inform future regulatory designs. Thumbs up from me 👍🏻

🔷 Ethereum is back to being deflationary after a being inflationary few days with less transactions than usual.

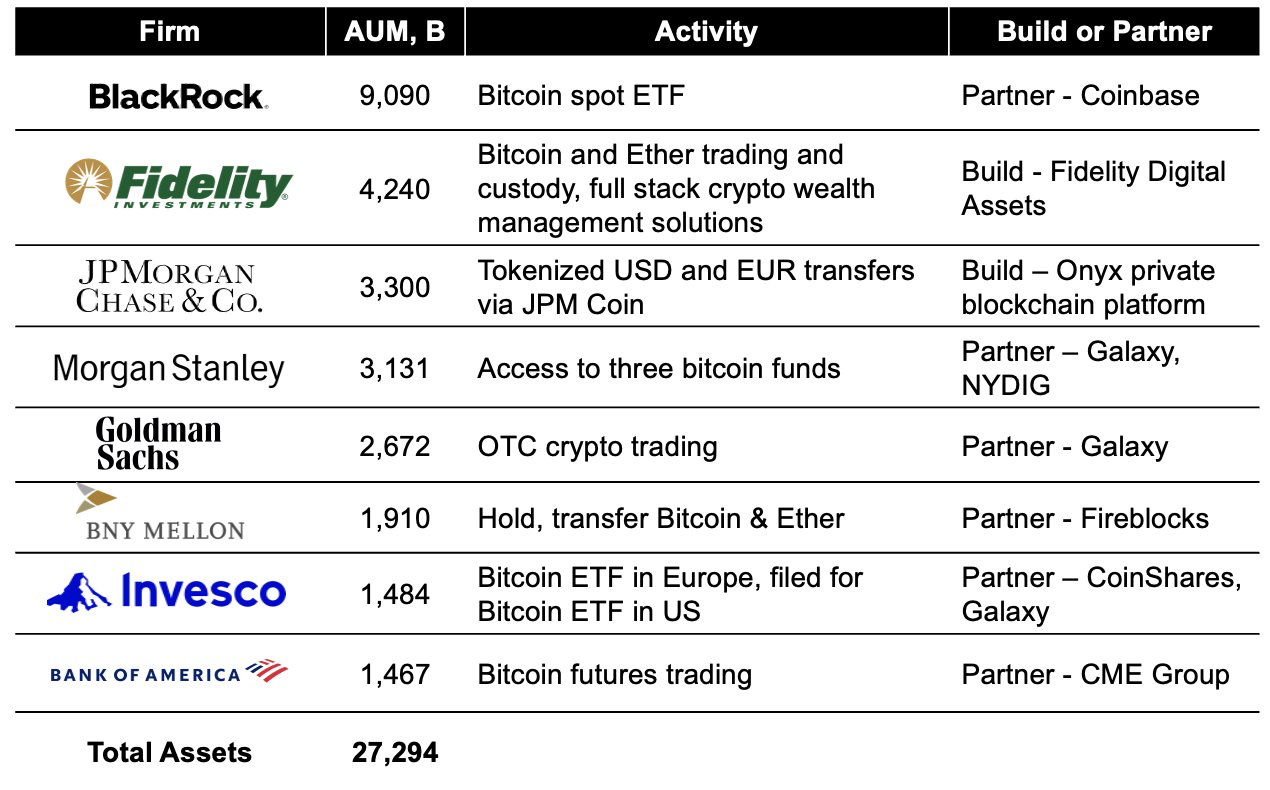

₿ Institutional holdings of Crypto (esp Bitcoin) are increasing, they have been buying the dip. The 8 institutions below have over $27 Trillion worth of such assets under management (source)

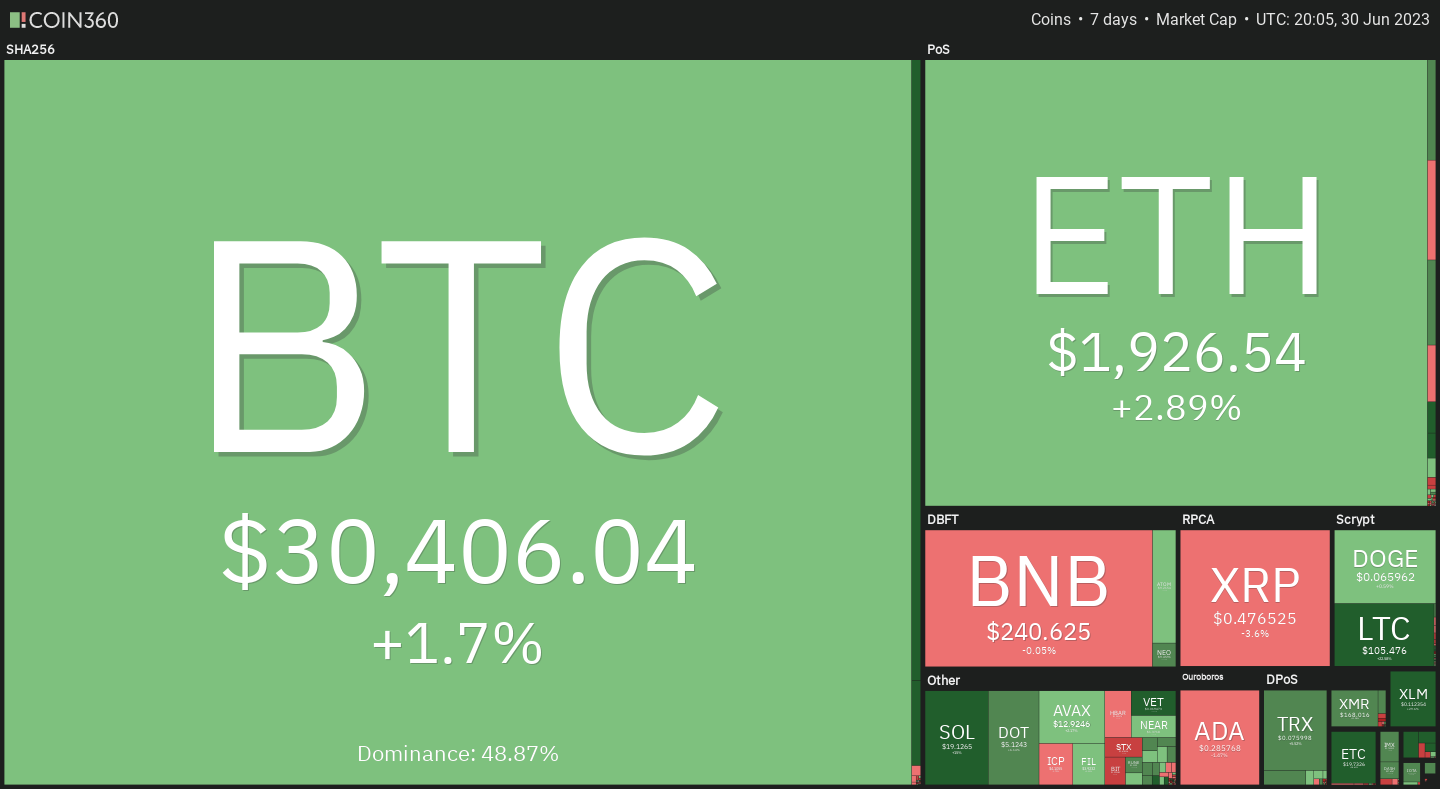

🔥🗺️ The 7-day heatmap shows another strong week, I was half expecting a dip after last weeks surge (size of the blocks are market share, colour & % show the change over the last week)

🎭 Sentiment levels still in mild greed with this recent market pump.

Interesting news

Almost half of them are in advanced stages of development, pilot testing, or launching their central bank digital currencies. The global push for digital currencies is driven by declining cash use, the need to counter bitcoin and tech giants, and the desire for alternative payment networks.

China's pilot testing reaches 260 million people, while India, Brazil, and the European Central Bank plan to launch digital currencies. The United States is progressing on a wholesale digital dollar, but the retail version has stalled. Sweden and the Bank of England are making strides, and several other countries, including Australia, Thailand, South Korea, and Russia, continue pilot testing.

Some countries that have launched digital currencies, like Nigeria, have seen disappointing adoption rates, and others, such as Senegal and Ecuador, have cancelled development work.

🇸🇬 Singapore's central bank, the Monetary Authority of Singapore (MAS), is collaborating with various financial institutions, including Standard Chartered, HSBC, and Citi, to test asset tokenisation across wealth management, fixed income, and foreign exchange. MAS has proposed a design framework for open and interoperable networks for tokenised digital assets. Additionally, Standard Chartered is working on an initial token offering platform in partnership with Linklogis to issue asset-backed security tokens on the Singapore Exchange. MAS aims to promote technological advancements in the digital asset ecosystem while discouraging speculation in cryptocurrencies.

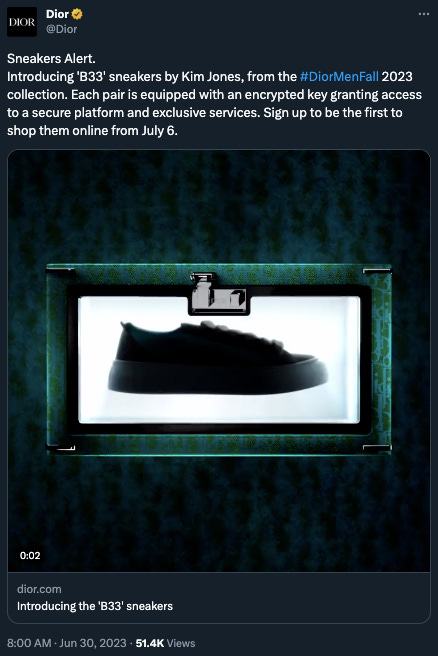

👟 Dior jumped into Web3 with a line of sneakers that come with NFTs that unlock online services and experiences. They don’t refer to them as NFTs of course, which is totally fine (the term still has confusing connotations).

June has been a hell of a month! Here is a great summary of the rollercoaster ride:

👓Read of the Week

The Bank for International Settlements (BIS) is basically the Central Bank of all the Central Banks. The final boss in the system of global monetary control.

It has just unveiled its blueprint for central bank digital currencies (CBDCs), touting the potential of tokenising fiat currency. However, the report heavily criticises decentralised systems, stating that they lack real-world connections and the trust provided by central banks. No surprise, they don’t like what threatens their power and control of money globally.

This BIS report discusses a unified ledger system that allows seamless value transfer among banks globally. They believe this "game-changing" CBDC blueprint, incorporating tokenised deposits and claims, can enhance the monetary and financial system through settlement finality and leveraging trust in central banks.

You can expect these narratives to be cascaded down as CBDCS are rolled out globally, although we need to be careful and understand the pros and cons of CBDCs.

Video of the week 🎥

This was a well-balanced take on CBDC projects across different countries. The high-level notes:

In the United States, there is significant opposition to CBDCs due to concerns about increased government control and reduced financial privacy.

The European Central Bank is actively involved in developing a digital Euro, and EU citizens are more focused on achieving an acceptable design rather than opposing it entirely.

China has already launched its digital Yuan, but adoption has been limited due to the lack of incentives and the popularity of existing payment apps.

Russia is expediting the development of its digital Ruble as an alternative to the Western-controlled Swift system, but adoption challenges and potential losses for commercial banks may hinder its success.

India has a pilot program for its digital rupee, showing a willingness to embrace government-controlled digital currencies while opposing decentralised cryptocurrencies.

The Bahamas and Nigeria have both launched their CBDCs, but adoption has been low in both countries, with citizens showing a preference for cash transactions.

South Korea's advanced banking system may limit the need for a CBDC, making widespread adoption unlikely.

Summary: CBDCs are not harmless, but the “imminent threat” of CBDCs has been exaggerated, the truth is in the middle and the likelihood of their success varies among different countries.

This week’s AI showcase🎨🤖🎵✍🏼

AI is disruptive, challenging industries and driving innovation. Each week I showcase something amazing generated by AI-based tool. My vision of the emerging Metaverse predicts the use of many AI tools to enhance how we work, learn, play and socialise.

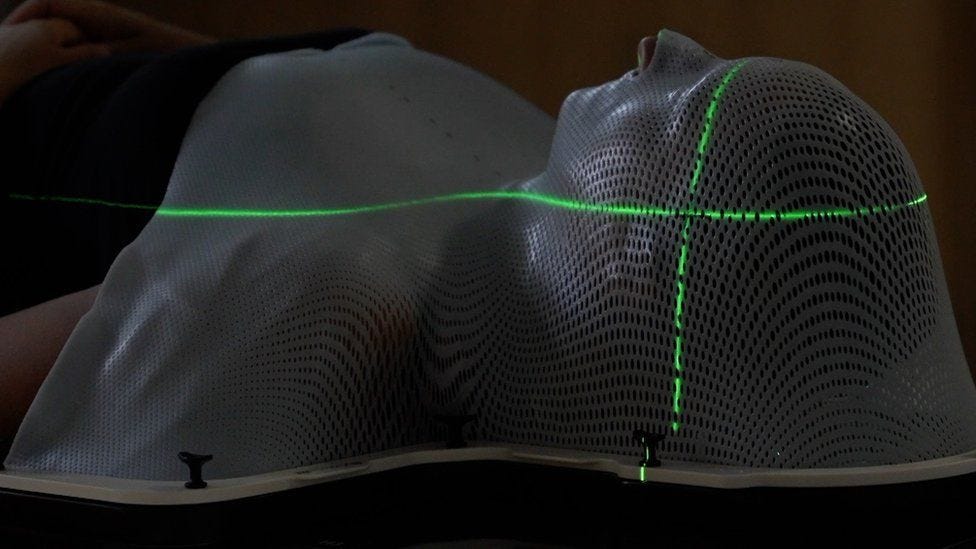

A new AI technology a decade in the making developed in collaboration with Microsoft is set to revolutionise cancer radiotherapy treatment in the UK's National Health Service (NHS). The AI program helps doctors determine the precise location for directing therapeutic radiation beams, maximizing the destruction of cancer cells while minimizing harm to healthy tissues. By training the AI program with patient data, doctors at Addenbrooke's Hospital achieved a significant time reduction of two and a half times the usual duration for contouring scans. The NHS is now making this AI technology available to all NHS trusts in England at cost price.

Although the AI program is approximately 90% accurate, clinicians still review and verify its contours, acknowledging the AI's valuable assistance in their work. This development showcases the potential of AI to accelerate diagnosis, improve patient outcomes, and support healthcare professionals. While AI can enhance efficiency and alleviate the strain on healthcare workers, it cannot replace the expertise of highly skilled professionals.

Read all about it here: BBC Article

Weekly Poll ✅

Help choose what you would like to learn about on Wednesday for my weekly emerging tech showcase:

That’s all for the free version this week! If you have any organisations in mind that could benefit from learning about emerging technology, be sure to reach out. Educational workshops are one of many consulting services I offer.

DCA With Me 🤑

Dollar Cost Averaging is an investment strategy in which an investor regularly invests a fixed amount of money into a particular asset/asset class at regular intervals, regardless of its current market price. By doing so, the investor can reduce the impact of market volatility and potentially earn a better return over time. An investor can buy more of the asset when prices are low and fewer when prices are high, which averages out the overall cost of investment (time IN the market beats trying to time the market).

To experiment with this, I invest $50 NZD into a Digital Asset every week. Each week I will choose an asset that seems underpriced in the short term and has positive long-term potential. My timeframe is 3-5 years. I don’t give financial advice but if you want to follow along with me you can use my easycrypto.co.nz referral link to support this newsletter. Let’s dive into this week’s pick:

Keep reading with a 7-day free trial

Subscribe to Metaverse Field Guide to keep reading this post and get 7 days of free access to the full post archives.